April 12th, 2018 | Posted in Tools

First up — download the Budget Tracking Tool as an Excel spreadsheet, or as a Google Sheets spreadsheet (both have the same features, but the google version sometimes runs a bit slower). These spreadsheets — like everything else on this site — are completely free, and will always remain so.

[These spreadsheets were originally published in 2018, and were last updated on March 7, 2024. A new “Historical Comparison” tab has been added to compare one time period against another, and there’s also a new and improved layout for the “Dashboard” tab!]

Table of Contents

- The Merits of Budgeting

- Why Should I Use This Tool For My Budgeting?

- Getting Started with the Spreadsheet

- Setting Your Budget Targets

- The Dashboard

- Historical Comparison Analysis

- Comparison to Budget Targets Analysis

- Frequently Asked Questions (FAQs)

- Troubleshooting

- How to Migrate from Mint to this Spreadsheet

- Final Thoughts

The Merits of Budgeting [back to top]

Keeping track of your budget is the single most important step towards taking control of your financial well-being.

Before you can draw up a plan for a home down payment, debt pay-down, or retirement, you’ll need to understand how much money comes in, and how much money goes out.

Many of us keep track of our budgets in our heads, often using a mix of precision, guesstimates, and “voodoo math”.

While it’s easy to list off monthly rent, internet, or Netflix bills, it’s harder to keep tabs on the “one-off” items. Most of us have a laundry list of small or infrequent expenses that add up into a meaningful total — the lunches out, drinks with friends, new clothing, impromptu weekend trips, and the like…

If you only have a vague sense of how much you spend in an average month, chances are that you’re underestimating the actual figure.

I’d like to offer you a simple spreadsheet that you can use to track your budget, and visualize where your money is going each month. You can download the spreadsheet by clicking the links at the top of this post, or by clicking here for the Excel version or the Google Sheets version (both have the same features, but the google version sometimes runs a bit slower).

In my personal spreadsheet, I’ve got more than 10 years of data tracked down to the penny. It’s amazing to be able to quickly see how my income & expenses have trended over a long time period. This helps me to feel in control of my spending, and be more confident in my long-term plans.

Say hello to your new financial dashboard!

After inputting your expenses and income, you’ll be presented with your own version of this. Think of this as the new mission-control room for your financial life.

It might just be me (it can’t just be me, can it?), but I love scanning through these visuals every time I open up the file.

This dashboard will show:

- Your total income, expenses, and savings over any time period

- A month-by-month trending view of your finances

- Breakdowns into individual categories — i.e., how much of your total spending came from rent, eating out, groceries, car payment, etc.

- Comparisons of your spending and income against your personal budget targets

In other words, you’ll have a neat and tidy snapshot of your financial picture generated for you each time you update your spreadsheet.

Why Should I Use This Tool For My Budgeting? [back to top]

If the dashboard visuals didn’t convince you to jump in and start budgeting, here’s why I think this spreadsheet is the best tool for the job:

- It’s completely free and will always remain so

- Your data privacy is protected. The tool doesn’t require you to share any personal information (name, email, bank account passwords, etc.) — the same can’t be said of tools like Mint, Monarch, Empower, Simplifi, etc.

- Tracking your expenses and income on your own forces you to consider your financial picture on a regular basis. This breeds good habits and sets you up for long term success

- This tool lets you save your expense and income transaction data in one central place. Since most banks only let you access your transaction data from the past 12 months (or less), this means that you’ll never lose your financial data

Getting Started with the Spreadsheet [back to top]

The tabs of the spreadsheet are colour-coded — the blue tabs are where you need to enter manual inputs, whereas the Green tabs are outputs that will update automatically based on your data.

On the ‘Category Setup’ tab, you can modify the labels used to categorize your expense / income transactions. I’ve already included default category names which will hopefully work for most people, so there is no need to make changes here unless you’d like to.

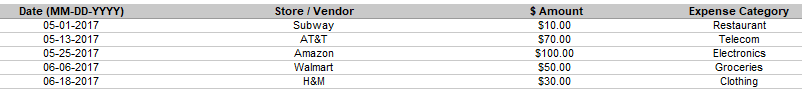

On the ‘Expenses’ tab, enter all of your expense transaction data. Enter each expense transaction as a separate row.

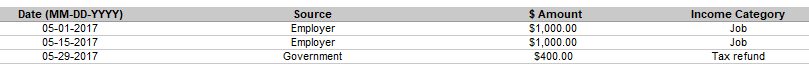

On the ‘Income’ tab, please enter all of your income transaction data (same process as the ‘Expenses’ tab)

A few tips for inputting your data into these tabs:

- Most banks will let you export / download your transaction data. Downloading these transactions in “spreadsheet” or “CSV” format and then copying/pasting into this spreadsheet will make your life much easier!

- Please ‘paste as values’ into the tool when possible, as regular pasting can sometimes bring in odd formatting into the tool which will mess up the dashboard tab

- Please note that the data that you enter needs to be in the correct format: dates must be written in the format mm-dd-yyyy; for example May 20, 2023 would be entered as 05-20-2023

My approach is to update my personal budgeting spreadsheet every month or two. This is normally a Sunday morning activity with a round-trip time of an hour to brew coffee, download my banking transactions to CSV, paste into the spreadsheet, and sip my coffee while poring over the newest results ☕😏.

I find this “batch” approach to be the easiest, but several users have mentioned that they prefer to manually input their transactions each day. Choose whichever method floats your boat!

Setting Your Budget Targets [back to top]

On the ‘Budget Targets’ tab, enter your monthly target amounts for your expenses and income by category (see yellow highlighted cells below). For example, a rent target of $1,300 per month is shown below.

The Dashboard [back to top]

Now, the spreadsheet will handle the heavy lifting! No more manual inputs are required from you — the charts will update automatically.

At a glance, you can see your total income / spending / savings, how your finances are trending on a month-by-month basis, and breakdowns by category.

By selecting an option from the menus, you can toggle between different time periods, and also drill down into a single expense category.

Historical Comparison Analysis [back to top]

For a deeper look into your finances, the ‘Historical Comparison’ tab allows you to compare your income, spending, and savings in one time period against another time period.

You can toggle the time period comparison easily at the top of the tab.

This tab gives quick answers to questions such as:

- How much money did I save in total in 2024 versus 2023?

- What was my combined income in the last 6 months, compared to the same 6 months last year?

- How has my spending changed as a result of a major life event such as moving to a new city, starting to live with a spouse, etc.?

Comparison to Budget Targets Analysis [back to top]

The ‘Comparison to Budget Targets’ tab will now be updated for you automatically as well. Here, you can see a summary of your expense / income / savings data, and the comparison of your actual figures versus your budget targets.

You can enter your own custom date range at the top of the tab, so you’ll be able to summarize any time period that you’d like.

This feature can be used to create an end-of-quarter or end-of-year summary of your finances, showing where each of your dollars went, and how this compared against your targeted goals.

Frequently Asked Questions (FAQs) [back to top]

1) Can I change the currency in the spreadsheet to be euros, pounds, or yen instead?

You’ll need to make manual updates to your spreadsheet to change the currency formatting.

To change the format of cells, here is a guide: https://www.howtogeek.com/240316/how-to-change-the-currency-symbol-for-certain-cells-in-excel/

All of the cells currently formatted as $ would need to be changed.

Otherwise, you can just use the default version and ignore the “$” symbols. It’s just visual formatting. For example, you could just consider $1,000 to be the same thing as €1,000 or £1,000.

In other words, ignore the currency symbol and only focus on the number itself.

2) I’m having trouble with the date formatting, the dashboard isn’t updating with any information, and/or how can I change the default MM-DD-YYYY date formatting?

The spreadsheet was built to accept dates in MM-DD-YYYY format (for example, May-20-2023 is written as 05-20-2023).

However, sometimes users will need to enter dates in YYYY-MM-DD or DD-MM-YYYY formatting instead. I’m guessing it has something to do with the excel version, operating system, or default system date settings that people have on their computer.

Please try entering dates in a different format instead to see if this helps.

Alternatively, please try using the google sheets version instead of the excel version. Google sheets tends to be a bit smarter in handling dates.

If you’d like to change the default date formatting, you can follow this guide: https://support.google.com/docs/answer/56470?co=GENIE.Platform%3DDesktop&hl=en

See the section about customizing a date / custom formats. The current format used in the file is MM-DD-YYYY. If you edit the custom formatting, you can change it instead to YYYY-MM-DD or DD-MM-YYYY.

You’d need to make this change in the date columns of the Expenses and Income tabs.

3) How should I input my savings into the tool?

The way I use the budgeting tool personally is that I input money that comes in (ie, from my job) and the money that goes out (my bills and spending), with the remainder being the leftover savings.

I don’t track any transfers of money from one account to another, since that’s just the “left hand paying the right hand” — for example, I don’t record an expense if I transfer $1,000 from my checking account into my savings account or into my retirement accounts (for Canadians: TFSA / RRSP accounts).

The savings number on the dashboard will then be the total of your income, minus the total of your expenses.

In other words, this budgeting spreadsheet isn’t used to track where your savings go — whether they go into your savings accounts or retirement accounts. It just tracks your cash inflows, cash outflows, and the remaining savings over the time period.

To track my account balances, I use a separate net worth tracking spreadsheet where I input my account balances at the end of each month. This is how I keep track of where my money is allocated and how my individual account balances are changing each month. If you’d like, you can copy that net worth tracking tab into your budgeting spreadsheet, in order to keep everything in one file.

4) How can I build another pie chart that shows my spending broken down by specific stores/merchants (Amazon, Walmart, Netflix, etc.)?

To build a new chart like that, you could try the following:

Create a table with a column for “merchant name”, and another column for “spending”.

For the second column, use the SUMIFS formula to sum the expenses on the Expenses tab accordingly — you will need to enter in criteria for the merchant name (text in the first column), and also date range if you’d like.

Tips on using the SUMIFS formula: https://exceljet.net/excel-functions/excel-sumifs-function

As an alternative solution, please read through the comment section below for tips from user “Fred T.” (you may need to go back to the older comment pages), a user who has mastered using “pivot tables” to do this kind of analysis and much more!

5) How do you record a payment to a credit card?

For my own personal budgeting, I use the following method:

- When I pay off my credit card (using cash from my checking account), I don’t add those transactions into the tool. I just delete those rows from my bank statement before I add them to the budgeting spreadsheet

- To track the credit card expenses correctly, I download my monthly statements from my credit card, and import those individual transaction rows into the budgeting spreadsheet

- For example, instead of having a generic $500 expense for “credit card”, I instead record the underlying transactions of “groceries $150, utilities $250, internet $100”

Troubleshooting [back to top]

If you’re having issues with the budget tracking tool, please follow the steps listed in this troubleshooting guide. If you continue to have issues, please let me know.

August 2019 update: An awesome reader of this site — a YouTuber going by the name of The Frugal Minimalist — has created a fantastic video tutorial on YouTube, showing us how to use this budget spreadsheet in Google Sheets. Highly recommended If you’re a visual learner who wants a step-by-step guide to this tool!

How to Migrate from Mint to this Spreadsheet

Mint is (was) the world’s most popular budgeting tool. The platform launched in 2006, grew like wildfire, and was acquired by Intuit in 2009 for $170 million. Mint subsequently grew to have ~20 million users worldwide.

Intuit announced that Mint will be permanently shut down in March 2024, leaving millions of users in the dark (think of the people! what will the people do without budget tracking!).

I am quite biased as the creator of a budgeting spreadsheet, but I do think this serves as a useful illustration of the benefit of using spreadsheets instead of apps.

A spreadsheet lasts forever (as long you don’t delete it from your computer), doesn’t require you to share personal / banking details, and is ad-free. The same can’t be said of apps like Mint (R.I.P.), Monarch, Simplifi, Empower, Nerd Wallet, and the like.

If you’re a former user of Mint who is hoping to migrate to this spreadsheet instead, you can export your transactions from Mint into a “CSV” (Comma Separated Values) format which you can then paste into the Expenses and Income tabs of this budget tracking spreadsheet.

Follow these steps to export your Mint transaction data history:

- Sign in to Mint.com (use the web version on your computer, as this does not work on mobile)

- From the menu, select the “Transactions” tab

- (Optional) If you want to export on a subset of your data — for example, a specific time period — you can add filters by clicking on the “Filters” button. If you want to export everything, ignore this step

- Go to the bottom of the page and click “Export X transactions”. This will download your transaction data in spreadsheet format

- You can now paste this CSV data into the Expenses and Income tabs of the budget tracking spreadsheet, as appropriate

Final Thoughts [back to top]

Once you start tracking your budget, you’ll be able to identify areas of improvement. You can also set targets for yourself (such as cutting down your spending on eating out, or saving a certain amount each month), and be able to track your progress towards those goals.

With a solid grasp on your budget, you’ll be able to start investing, keep tabs on your (growing!) portfolio, and plan for your retirement.

Thank you for taking the time to check out this tool. I hope that you find it useful, and that it helps you meet your goals.

For any questions, feedback, or random thoughts, please let me know either through the comments below or by email at themeasureofaplan@gmail.com.

—

Header image credit: Keiffer Buckles

—

P.S., if you’d like to show your appreciation for this spreadsheet, you can buy me a coffee or beer by clicking the little blue button below 🙂

Re. last post refund

NVM, figured it out! The expense was on month of October and refund was on month of November. So the refund wouldn’t be seen on the chart since you don’t track/show the a negative value. Used your troubleshoot page too, which it in itself is also extremely informative.

Case closed, thank you so much!

Awesome, glad to hear it!

Thanks for making this! On the Google Sheets version I noticed the “Time Period” dropdown on the “Dashboard” page wasn’t updating correctly (always showing “na”). On the “Date Info” tab, cell C6 has the following formula:

=iferror(if(MAX(Expenses!$B$5000:$B)=0,”na”,MAX(Expenses!$B:$B)),”na”)

This results in a value of “0” which gets converted to “na”. I’m guessing the formula should actually be:

=iferror(if(MAX(Expenses!$B:$B)=0,”na”,MAX(Expenses!$B:$B)),”na”)

This change appeared to populate all my date fields correctly.

Thanks very much Kevin.

I did a test using a fresh copy of the spreadsheet, and the date menu did populate for me once I inputted my expense data.

However, you’re right that the “$5000” shouldn’t be there in cell C6. I’ve removed it in the template just now.

Thanks for your keen eye, and happy new year!

Hi,

please, could you make an euro version?

Thanks a lot! 🙂

Hi J,

You’d need to make manual updates to your spreadsheet to create a euro version.

To change the format of cells, here is a guide: https://www.howtogeek.com/240316/how-to-change-the-currency-symbol-for-certain-cells-in-excel/

Pretty much all the cells currently formatted as $ would need to be changed.

Otherwise, you can just use the default version and ignore the “$” symbols. It’s just a visual formatting. For example, you could just consider $1,000 to be the same thing as €1,000.

Just noticed. Your google spreadsheet doesn’t have the “Hide” column in the Expenses and Income sheets that is found in the Excel spreadsheet. Oversight?

Thank you once again!

re. last post, lol nvm. Found in your older comments.

TYVM

Hello there ! Amazing work, thank you !!!

Unfortunately, the date format quite annoy me (where i live it’s more like DD/MM/YY). Is there an easy way to change it ?

Hi Tom,

You can change the date formats by following this guide:

https://support.google.com/docs/answer/56470?co=GENIE.Platform%3DDesktop&hl=en

See the section about customizing a date / custom formats. The current format used in the file is MM-DD-YYYY. If you edit the custom formatting, you can change it instead to DD-MM-YYYY.

You’d need to make this change in the date column of the expenses / income tabs.

Thank ypu very muxh for your reply

This is incredibly useful. Thank you so, so much. Excited to dive deeper in. I have been adapting and adding to the Expense Categories in the ‘Category Setup’ tab but I must have done something incorrectly because they have not become an option in the drag downs in the ‘Expenses’ tab. I am a novice with Google sheets so apologies if I’m making a basic error but I’m keen to learn!

Hi Lloyd,

The spreadsheet is limited to having 40 expense categories maximum. In your spreadsheet, did you delete or add rows on the Category Setup tab?

I’d recommend starting fresh in a new copy of the spreadsheet.

I hope this helps!

Hi thank you for providing this tool! Really new to setting up a budget and I want to be more financially educated and working on this sheet you’ve provided is my first stab at it.

I’m curious – as I haven’t looked further into the other investment tracker you’ve created. What would be the best way to note a monthly TFSA investment in this budget tracking tool. Thanks!

Hi xfleur,

This afternoon I added a “Frequently Asked Questions” section to this page to help answer common questions about the spreadsheet.

Please see item 3 about savings. Let me know if any clarification is needed!

I’ve been using spreadsheets to budget for the past couple years. I’ve tried YNAB and Mint and a few other budget apps, but spreadsheets are just the easiest and most flexible. That said, I wish I would have found this one sooner. This is amazing.

I do want to know though: is there any way I can easily implement subcategories? I like to budget broadly so I’ll set a monthly “food” budget of $250, but that’ll consist of things like groceries, snacks, eating out, etc. Furthermore, I’d love to be able to have a report on categories that consisted of subcategories. Being able to group like that would really make this perfect.

I’m also confused by the Budget Targets. Is that just one budget for all months going forward? If I set a budget for Jan 2020 and change a few values on the 1st of Feb 2020, will it remember my Jan 2020 values? Or how does that work?

Thanks for the amount of work you put into this. I’m sharing this with everyone I know.

Hi Drew,

Thanks for your comment, and for sharing this with others. Much appreciated!

—

Unfortunately there isn’t a feature for sub-categories (perhaps in a future version though). To get the outputs that you want, you could try:

– Use your more detailed categories on the Category Setup tab (groceries, snacks, eating out, etc…)

– Go to the Historical Comparison tab where you can see your spending broken out by category — create a new table on this tab where you sum up the expense categories into broader groups. For example, the broader “Food” category would be the sum of groceries, snacks, eating out, etc.

– Create a pie chart from the resulting data table

—

For the budget targets, your understanding is correct. The inputted budget targets will apply to all months (historical and going forward).

When I do my personal budgeting, I’ve kept all of my data in a single spreadsheet. I’ve got over 6 years of data in that sheet and like having all of that info in one central place so I that can see the trends of total spending, evolution of spending by category, etc. My life situation has certainly changed over those years but I’ve kept going in that one sheet.

Unfortunately there isn’t any way to change the budget targets without having them applied to all months in the past.

If you want to have accurate reporting of your true budget targets in each month, you’d need to start a new spreadsheet. For example, save your existing spreadsheet as “2020 Budget History”, and begin a new file for your 2021 budgeting, with new monthly targets for income and expenses.

For me, I find it easiest to just have everything in one file, and love being able to look at my multi-year spending / income trends with just a few clicks.

Well, I’ll make sure to sign up for the newsletter to get the update if a sub-category version ever comes out. I do want to take advantage of the dashboard reports so I’ll just have to compromise!

Makes sense for the monthly budgeting too. I guess it’s not actually a huge deal. I don’t think I’ve ever checked previous budget amounts anyway — the spend is the important part. And the value certainly is in the historical data, and I’ll want to keep it in one place too. Combining this and the net worth spreadsheet is mega for my needs.

Anyway, thanks for the quick reply, your suggestions, and for the amazing spreadsheet. Cheers! ((:

Awesome — cheers and happy budget tracking!

Yeah. Thanks for the great spreadsheet. I would also love to have sub categories, or actually just “master” categories. A bit like how Mint does it. 5 or so master categories and then categories within those, so you can easily see all you house expenses (rent/mortgage, insurance, etc), or food (groceries, dining out, uber, coffee shop, etc)

[…] Do you love charts? How about graphs? Maybe you’re a fan of color-coded pie-charts? Then you might want to snag your copy of this budget template from Measure of a Plan. […]

Hi!

Thank you very much for this!

I’ve noticed in Dashboard, the section saying ‘Expense Drill Down’ is broken down as the same as ‘Time Period’ box! I’ve checked if it was me somehow and downloaded a new fresh sheet but it seems to be the same issue. I tried to fix it but goes far from my knowledge. Can you help me, please? I took a screenshot but isn’t possible to share here.

Thank you for your time!

Sorry, I know what seems to be the problem. I’m using LibreOffice. I just opened with Excel and is fine. Apparently the Macro for that box doesn’t show on LibreOffice.

Hi Francisco,

Good to hear! Yes, confirming that the spreadsheet won’t work if you open in LibreOffice.

And for anyone who doesn’t have the excel software, a google sheets version is available.

First off, I love your spreadsheet. It’s been going good so far <3

Under budget target, spending amount, the Total Spending(_ months) don't seem to refresh on my end. I have tried inputting data from January till now, Feb. Am I missing something?

Oh I realised that I need to input income from second month for that to be registered. Thank you again for the amazing work!

One more question/suggestion, I allocate $100 on Item A, but I did not spend on Item A in Jan. Would it be possible to add the $100 from Jan to cumulatively merged with Feb, so that in Feb, I will have $200 in that category to spend.

I am not good with excel/sheets would you happen to know the search term, or how to do it?

Hi Choo,

Try using the “Comparison to Budget Targets” tab. At the top of the tab, enter a start date of Jan-1-2021 and an end date of Feb-28-2021 (a 2 month period).

Then, the spreadsheet will show your actual spending in Item A in those 2 months, versus a budget target of $200 ($100 per month x 2 months).

I hope this helps!

Hi there! I’ve been using your spreadsheet to track our spending for the last few months and absolutely love it, however today when I went in to adjust our budget targets for the month of February, I noticed something strange. On the Variance to Budget Detail tab, I entered the start time and end time as 2-1-2021 to 2-28-2021, and it seems to think that the implied number of months is .9, instead of 1, so it’s throwing off my totals. Has anyone else had this issue, or is it something I’m making a mess of all on my own? Any thoughts on how to troubleshoot it? Thank you in advance for your help, and for this great spreadsheet. It’s been keeping us on track throughout the pandemic and has given us great peace of mind!

Hi Lindsey,

That’s my bad! Those pesky 28 day months…

I’ve adjusted the formula on that tab and have uploaded new versions. Please try out the new version — Feb 1 to Feb 28 should now show up as 1 full month.

FYI — this tab is now called “Comparison to Budget Targets” — thought it was a clearer name 🙂

Oh that is fantastic! Thank you so much for tweaking that, I really appreciate it. Love the new tab name, too!

Cheers!

You’re welcome! Happy budget tracking 🙂

Can i somehow change the currency ?

Hi Moe,

Please see the FAQ section of this page — there’s a tip about changing currency there.

[…] Measure of a Plan provides a money management spreadsheet designed to help you track income, spending, and expenses over time. The spreadsheet is built with […]

Hello, Thank you very much of making this. I would have suggestion of two expense categories fixed expense and variable. Or if there is a easy way to get a column like this that I don’t know?

Hi Simo,

There’s not a way to get that info by default, but I think you could get that output by using pivot tables or SUMIFS formulas.

Please see here in the comment section:

https://themeasureofaplan.com/budget-tracking-tool/comment-page-2/#comments

Search for comments from “Fred T”, and for comments with “SUMIFS” mentioned.

With a bit of a work you should be able to get these answers.

I hope this helps!

[…] Download it here […]

Hi,

Thank you so much for creating this amazing tool! I’m following you Moonshine Money course and I’m learning lots of important things. Thank you!

I’d like to have your opinion regarding how should I use this spreadsheet.

I’m a freelancer and I receive my gross income directly on my bank account.

Unfortunately, for me is not very simple to predict the exact amount of taxes that I’m going to pay in the future, since I have to pay taxes for the current year and also anticipate others for the next.

I came across two solutions:

1. Write in the “Income” page my gross incomes and then record taxes as expensives.

The problem is that I have to pay taxes in two big chunks (usually June and November) and as a consequence, those two months will be misleading.

Maybe, after taxes are paid, I can divide the whole amount by 12 and enter the result as an expensive at the end of every month, but since a big chunk of taxes falls in November, the spreadsheet will not be very correct and useful until the end of the year.

2. Try to approximate the amount of taxes. Let’s say 30% as an example.

In this case, if my gross income is 1000$, I write 700$ in the “Income” page.

The problem now is that the spreadsheet will not track my exact incomes, but only an approximation. This causes some problems, like difficulty in tracking my income budget.

What do you thing is the best way to use this tool? Maybe there are other alternatives that I have not considered?

Thank you for putting your time in reading this and in creating this fantastic website.

Keep up the good work!

Hi Federico,

Happy to hear that you like the Moonshine Money guide.

I don’t think there is a perfect solution in your scenario, since it relies on estimating taxes as you mention.

I would recommend doing the following:

– On the income page, enter your gross income (before paying taxes)

– On the Category setup, add an expense category for “Estimated taxes” and for “Tax adjustments”

– Each month, input an expense for your “estimated taxes” for the month — it could be as simple as assuming 30% of your income in that month

– When you file your taxes, add an expense entry in the “Tax Adjustments” category, where you reconcile to the actual amount of taxes that you owed — this could be a positive or negative adjustment amount

This way, you will be tracking your actual income earned, estimating your tax bill each month as an expense, and then “trueing it up” from time to time based on the actual taxes owed.

I hope this helps!

Your approach makes perfect sense. Thanks again for the help!

I’m setting up all your spreadsheets to guide me from now on. I really admire how you chose to make all of this for free.

I read a lot of finance blogs, but your approach and dedication are unbeatable.

Surely I will be more than happy to offer you a few cups of coffee 🙂

You’re welcome Federico. Thank you so much for the incredibly generous donation — this is really going to help me to continue building new tools, answering reader questions, and continuing to improve the site!

Much appreciated 🙂

This looks like a great tool – thanks so much for making it.

I’m experiencing issues with the date formatting that I hope you might be able to help me address. I’m using the excel version, and even if I put in the data exactly as typed in the example (i.e.: 02-2-2017), I get a warning message stating “please enter a valid date in MM-DD-YYYY format”.

I’ve tried editing the excel formatting in the input data sheets and deleting the data validation criteria, but with that, the input values don’t appear on the dashboard.

Any idea what could be the cause of this?

Nevermind actually, I didn’t see that I could view older comments and found the answer I was looking for. Thanks again!

OK great!

For other readers, there is a FAQ section of this page that has some tips if you experience any date formatting issues.

Hello.

I am fresh out of college, and almost entirely new to keeping a rigid budget of sorts. I find that this spreadsheet you have made is such a tremendous tool. I feel like I will be using this for the foreseeable future. Congratulations on such a helpful creation, and many thanks.

With that being said, I am basically starting fresh as today is the second day of April. I want to begin to get a feel for where my money is being allocated and where my spending goes.

Is there any way to add a “principal” income of sorts, that won’t heavily skew my data? To elaborate, I wish to add the amount that is already in my acct. for which I’ll be starting the month of April with. You can be honest with me too, if it means inputting all of my transactions of recent history in order to get an accurate snapshot of spending.

Thank you in advance.

Actually, nevermind! I found the “net worth” sheet that was included in the FAQ. This is exactly what I’m looking for. I understand, after further reading, that this is a tool simply to gauge cash flow. Thank you!!

Yes exactly! The budget tracking tool is for cash flow, and the Net worth sheet is for recording your account balances each month.

Cheers and thanks for replying to your original question.

I’m unable to add any information as the date column under expenses just keeps telling me “That value is not valid. Someone has restricted values that can be entered into this cell”. It shows that the whole column is just general under number format and I tried entering the order it shows I also tried changing it to what I wanted (dd/mm/yy) but that just ended up with the same error.

Im using excel on my Samsung phone as dont have access to a laptop at the moment and sheets just kept telling me it would have to change stuff.

Hi Tianna,

I suspect this error is caused by using excel on your phone. I’ve never tested this spreadsheet on a phone before!

Please try again when you have access to a laptop.

[…] Webseite […]

[…] The Measure of a Plan […]

Hi,

Love this sheet. How do I account for different months? Do I copy the budget targets sheet for new months? If so, will the dashboard reflect that information?

Thanks so much!

Sorry, to be more clear, how do I change months in the budget targets tab?

Thanks!

Hi Brett,

You can only set a single budget target amount.

Unfortunately there isn’t any way to change the budget targets without having them applied to all months in the past.

This sheet is for long term tracking of your finances, to see how your finances are changing from month to month, year to year.

When I do my personal budgeting, I’ve kept all of my data in a single spreadsheet. I’ve got over 6 years of data in that sheet and like having all of that info in one central place so I that can see the trends of total spending, evolution of spending by category, etc. My life situation has certainly changed over those years but I’ve kept going in that one sheet.

So, for me, I just input a budget target that reflects a rough average of monthly spending.

I hope this helps!

Thanks for this amazing tool, are there any simple steps I could follow to make a Google Form for input of expenses directly into the spreadsheet? (eg. date, amount, name, category)?

Hi Phil,

I haven’t tried that myself, but I believe others have done it!

You could try out this tutorial for linking a google sheets form to a google sheets spreadsheet: https://blog.sheetgo.com/google-sheets-features/how-to-connect-google-forms-to-google-sheets/

[…] Web Site […]

Hi, thanks for sharing this valuable spreadsheet with the rest of the world! It’s very useful.

I do have 2 questions however:

1) Is there a way to have subcategories? For example, Automotive Category with subcategories for a) Gas/Fuel, b) Insurance, c) Service/Parts for oil changes, maintenance, etc?

2) Is it possible to have the expenses and/or income record 1 transaction with split category? For example, one Walmart expense transaction that spent funds in difference categories like groceries, clothing, etc?

Thank you!

I’m currently using this spreadsheet and I think it’s great! Is it possible to add a stocks sheet inside?

[…] Webseite […]

Thanks for the great spreadsheet! I wish I discovered it several years ago…

Would it make sense to add a feature to input yearly inflation values for your country? And then the dashboard tab would give the option to allow the user to adjust the spending / incomes to current year dollars when looking at the dashboards for multi-year periods?

Just something for your consideration!

Cheers

Hi,

I switched from my excel version of budgeting file to yours, after almost 10 years of using my old file.

I have o little problem:

My Expenses table is now populated with hundreds of rows, and it is somehow harder to get to the next input row.

Is there a combination of keys to get to the next empty row?

Thanks in advance.

Found an answer:

Just use the combination keys CTRL + ↓ . While that gets you to the last row that has content, another ↓ gets you to the next blank cell in the column.

Another workaround was to use some script atached to a button – when you click on the button, the script will point to the next empty cell. I have tried this solution, but it needs some programming skills.

Thanks so much for this spreadsheet! Just wondering – do you know if adding extra columns in the Expense and Income Data Entry tables will mess with any of the formulas?

Cheers,

[…] Budget Tracking Tool […]

[…] https://themeasureofaplan.com/budget-tracking-tool/ […]

[…] Budget Tracking Tool […]

[…] https://themeasureofaplan.com/budget-tracking-tool/ […]

[…] how to use them, they won’t do you much good. That’s why we love that there’s a full suite of accessible instructions with this worksheet. You can get the most out of it even if you’re a spreadsheet […]

Hi there! I tried going back to see if this has been commented before, but no luck.

TLDR. I’m a freelancer who does a couple of different jobs. Is there any thought to create an “XX income by month” on the dashboard as there is for expenses? I’d love to see how much comes in from each category month to month. <3

Absolutely LOVE this spreadsheet and makes my type a finance parents sing praises

Hi!

Thank you so much for this course and all the tools you provide, so helpful and extremely generous!

I just started using the Budget Tool Spreadsheet and the expenses drop down does not load the expense categories. Any idea how I can get this to work?

Thanks