February 28th, 2024 | Posted in Data & Insights

Note: This post was last updated on February 28th, 2024 to include refreshed U.S. stock market returns up until the end of 2023. The U.S. stock market returned +22.1% in 2023 💸

From Canada to Chile, Barcelona to Bali — investors around the globe pay close attention to the U.S. stock market. With the U.S. generating ~25% of global GDP, and U.S. companies weighing in at ~60% of global stock markets, the long-term performance of all of our investments is heavily influenced by the performance of the U.S. market.

This post will cover a few facts and figures on the history of U.S. stock market returns:

- What is the average return of the stock market?

- How often does the stock market go down?

- Gauging the impact of short / long time horizons and the likelihood of losing money in the market

- The best months and worst months in stock market history

Understanding historical stock market returns can help to inform your financial plans, from planning for retirement, or figuring out whether it makes more sense to rent or buy your home. Plus, it’s plenty of fun for data geeks 🧐

Throughout this post we’ll be relying on a fantastic data set released and maintained by Professor Robert Shiller, giving us data on U.S. stock market returns all the way back to the 1870s — a data set covering more than 150 years.

Onto the good stuff!

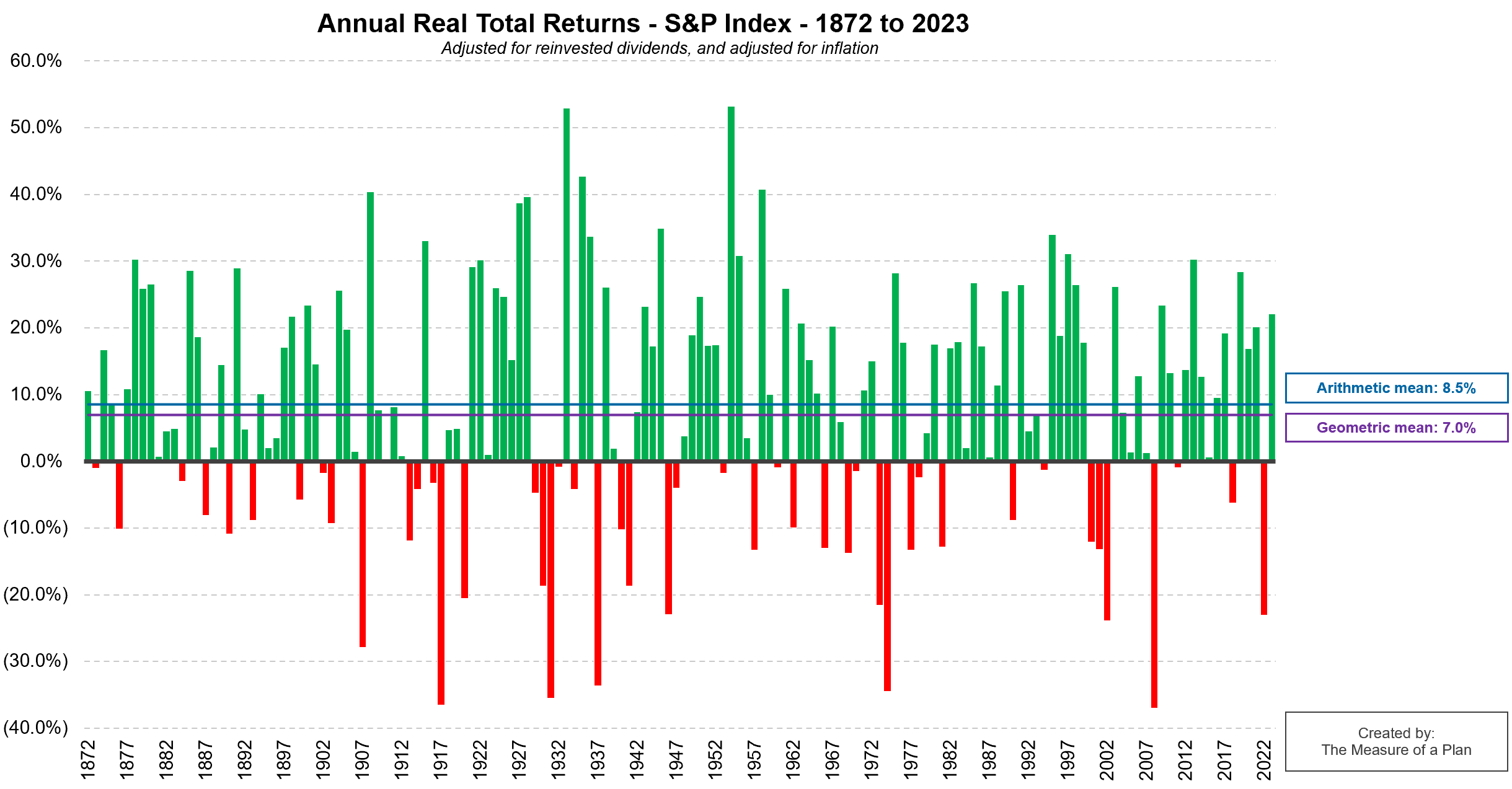

U.S. Stock Market Returns by Year

What is the average annual return of the U.S. stock market?

- The average return of the U.S. stock market has been 8.5% per year over the past 152 years (1871 to 2023); note that this is the “simple” average across all years (also known as the “arithmetic” average)

- The annualized return (also known as the “geometric” average) of the U.S. stock market from start to finish has been 7.0% per year. This represents the compounded annual return that you would have earned if you’d invested over this whole period

This showcases why many financial planners tend to assume returns of 5% to 8% per year in the stock market.

Note: these figures are “real total returns”, meaning that they’ve been adjusted to include the re-investment of dividends, and have also been adjusted for inflation.

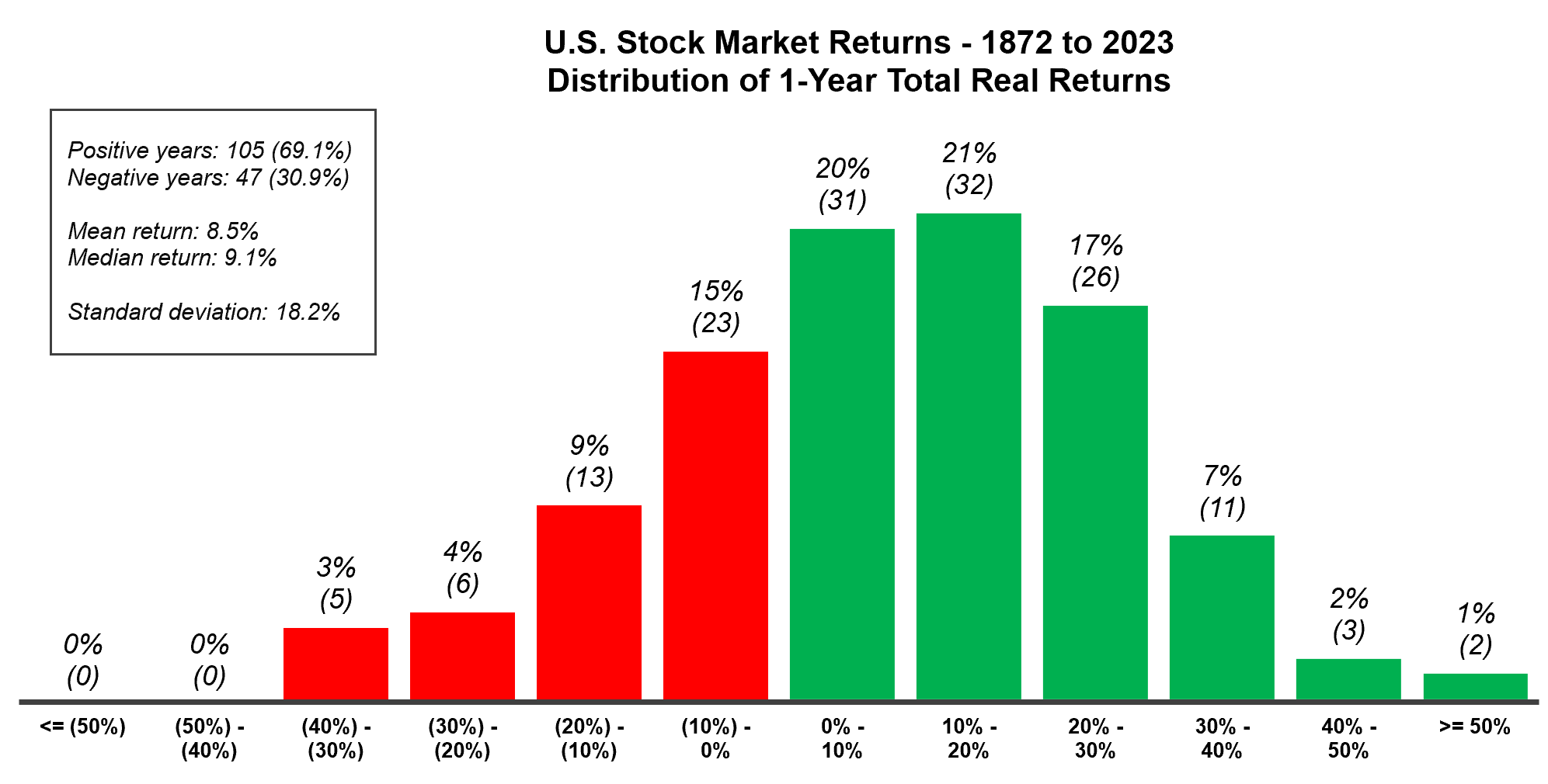

Distribution of Annual Returns

How often does the stock market go down?

- While the U.S. stock market has generally trended upwards over time, it isn’t always rainbows and unicorns. The market has grown in 69% of all years on record, and declined in 31% of years on record

- U.S. stock market returns in any single year can be extremely volatile. There have been 5 cases where the market declined by 30 to 40% in a single year (1917, 1931, 1937, 1974, and 2008)

- You don’t need to go back too far for evidence of losses in the stock market losses — in 2022, the U.S. stock market dropped by 23.3% (real total return of the S&P 500 index)

Buy, Hold… Profit?

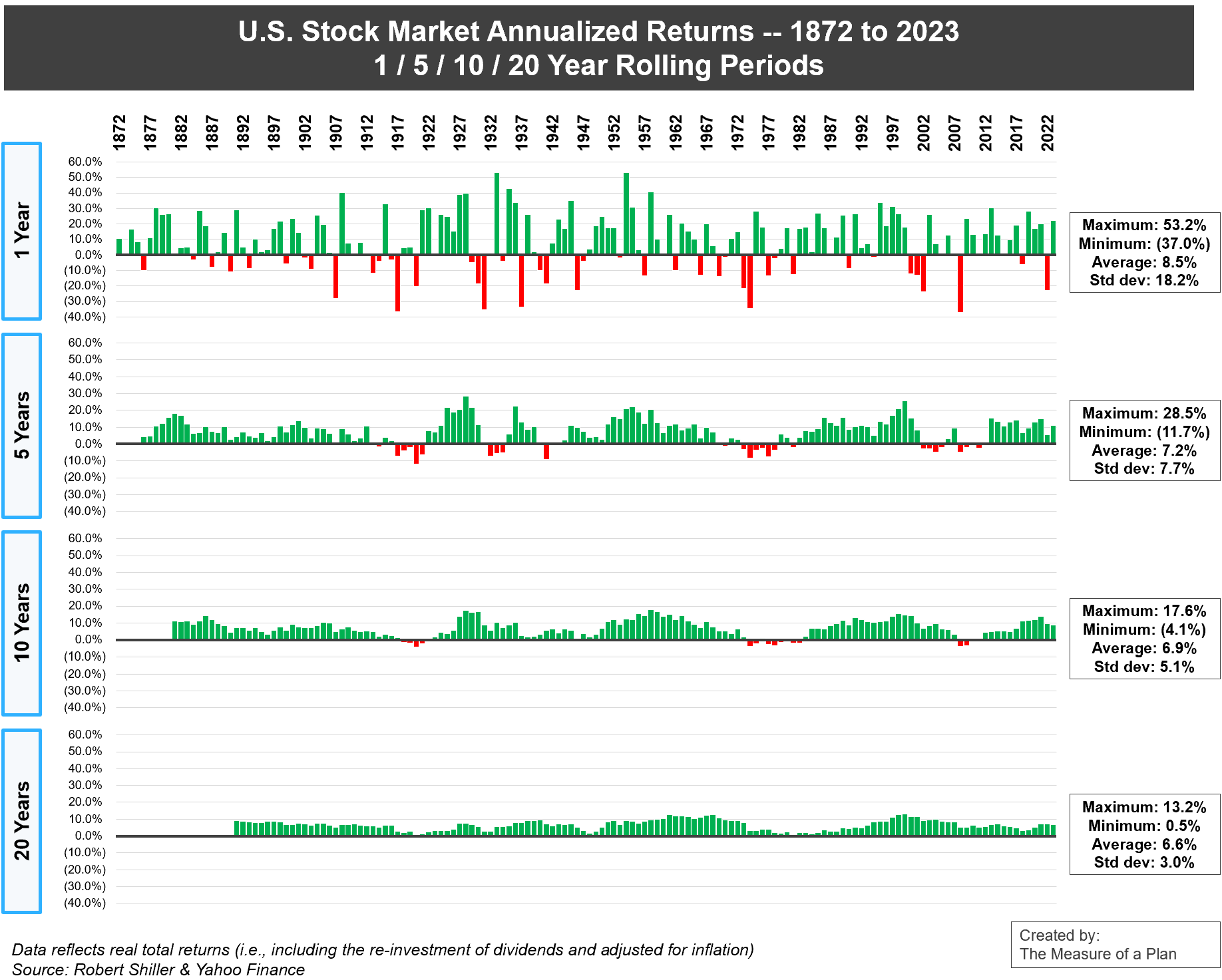

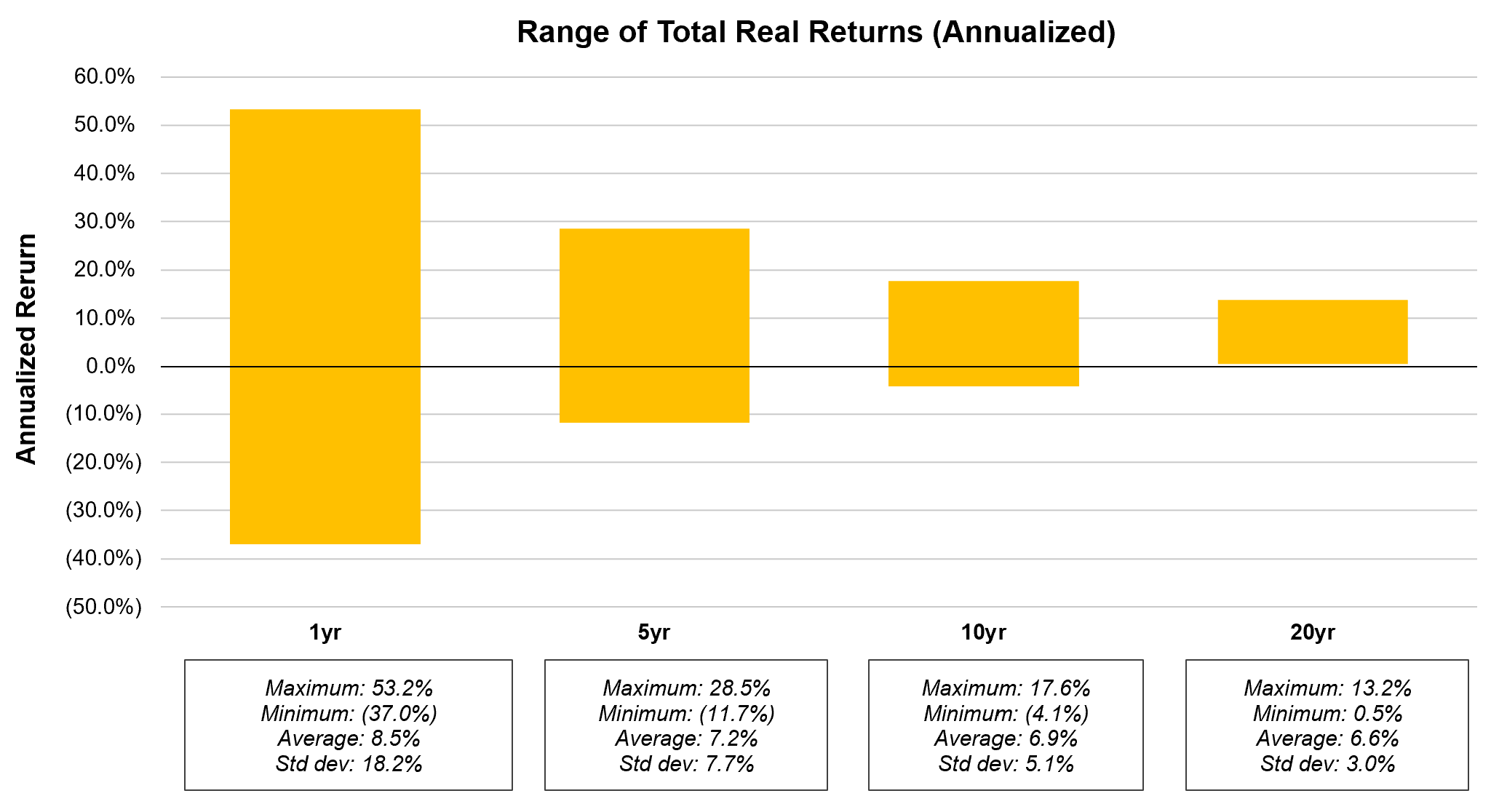

The wild swings of the market are reduced if we start to look at time horizons that are longer than a single year.

In the animation below, you can see how U.S. stock market returns have fared when we look at 1 / 5 / 10 / 20 year rolling periods.

- Taking a 1-year view, we see lots of red — there were plenty of years in which the market was down, and sometimes down significantly.

- As we consider longer and longer time periods (stretching our view out to 5 years, then 10 years, and finally 20 years), the range of possibilities narrows, and the chance of losing money diminishes.

- Once we zoom it out to look at 20-year periods, you won’t see any more flashes of red. In other words, The U.S. stock market has never declined over any 20-year period.

And down below you’ll find the same chart, but this time shown as a static picture.

To summarize: while the range of returns across 1-year periods has varied significantly (from negative 37.0% to +53.2%), the annualized returns across 20-year periods have a much tighter range (from +0.5% to +13.2%).

In the long run, U.S. stocks have delivered strong returns. However, if your investment horizon is short (0-5 years), your savings are likely better suited towards less volatile assets such as bonds, GICs, or high interest savings accounts.

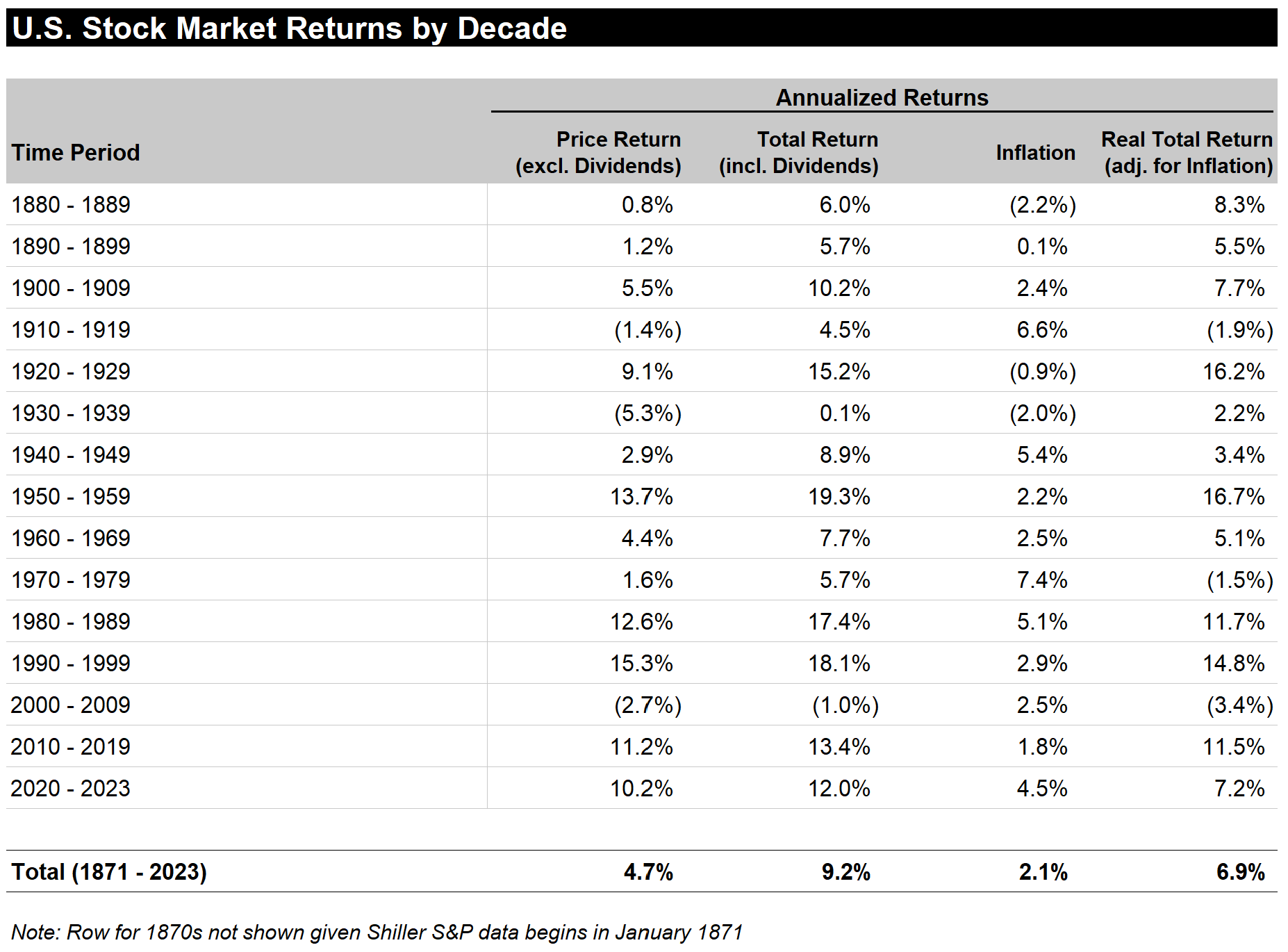

U.S. Stock Market Returns by Decade

Across the entire period spanning 1871 until 2023, U.S. stocks have increased at +4.7% per year excluding dividends, +9.2% per year including dividends, and +6.9% per year including dividends and also adjusting for inflation.

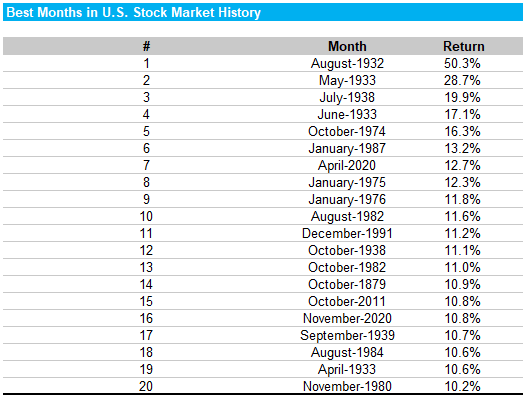

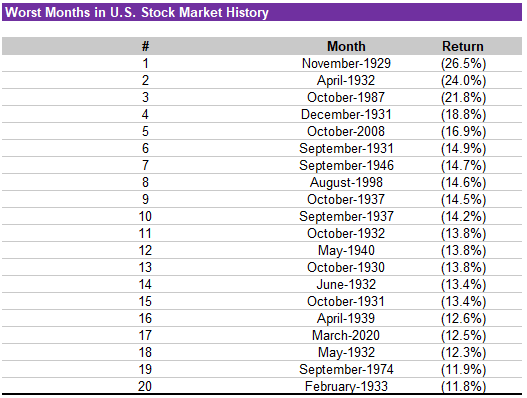

The Best and Worst Months in Stock Market History

The table below lists the 20 months on record with the highest returns, and the 20 months with the lowest returns (without adjusting for dividends or inflation).

A familiar story: in the short-term, the stock market is far from predictable.

The best month in stock market history was August 1932, when the market gained 50.3% in a single month!

On the other hand, the worst month in stock market history was November 1929, with a decline of 26.5%. The worst month in recent memory was October 2008 (during the depths of the Great Recession), when the stock market dropped by 16.9%.

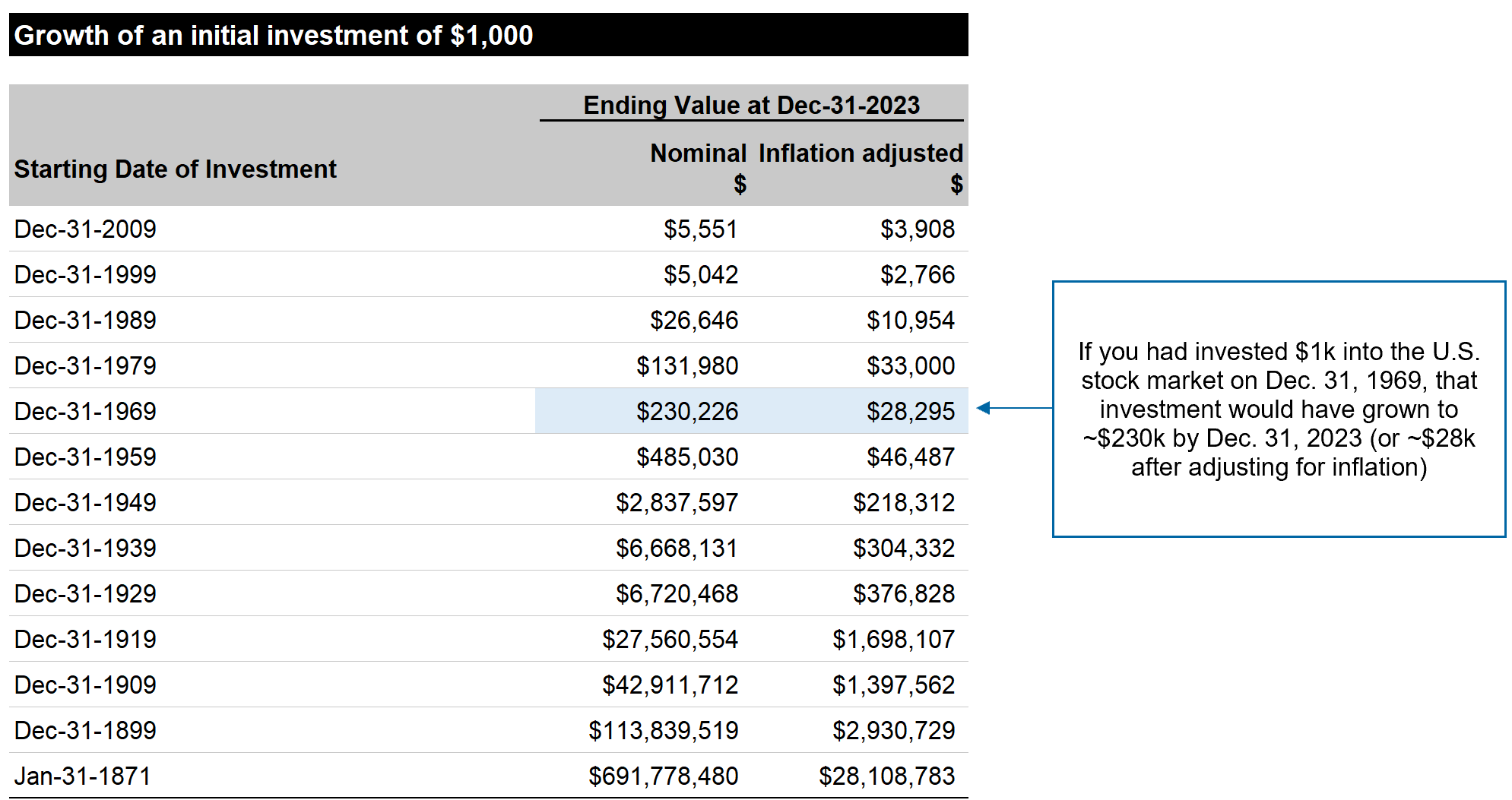

$1,000 — Then and Now

If you had invested $1,000 in the U.S. stock market on Dec. 31st, 1969 and held the investment until Dec. 31, 2023 (without buying or selling during that 54-year period), your investment would have grown to ~$230k before inflation, or ~$28k after adjusting for inflation.

Historically, buying and holding (and potentially forgeting about the investment entirely) has been a simple and straightforward way to build wealth.

Final Thoughts

If you’re looking to make a quick buck by jumping in and out of the market, quite often you’ll find yourself on the losing end of things. Over short time periods, there’s no telling if the market will go up, down, or sideways.

However, if you have the patience and fortitude to hold onto your investments for 10 or 20+ years, your prospects become much brighter. You’ll ride out the short-term noise and benefit from the long-term upwards trend 🚀.

As always, Warren Buffet put it best: “the stock market is a device for transferring money from the impatient to the patient”.

That being said! If you’d like to try your hand at beating the performance of a simple buy-and-hold strategy, I invite you to play this simple market timing simulator game.

***

For the data-heads, click here to download an excel file which contains all of the underlying data on U.S. stock market returns, along with the charts shown in this post.

Data sources:

Robert Shiller U.S. stock market data

Yahoo finance S&P 500 historical data

FRED U.S. CPI (inflation) data

Note: for the purposes of this post, the “U.S. stock market” refers to the S&P Composite index from 1871 to 1957, and the S&P 500 index from 1957 until today, which is aligned with the definition used by Professor Shiller.

Clearly shows the power of buying and holding high quality assets for decades.

Thanks for sharing.

Absolutely.

1-year holding periods in the market can be scary. Over 10 or 20 years, the long-term upwards pattern really shines through.

[…] The Measure of a Plan […]

[…] The article in question here is U.S. Stock Market Returns – 1870s to Present […]

Wonderful website. I stumbled across it looking for a baby budgeting tool but found a wealth of information. Thank you.

In the article you mentioned that a rolling period of 20 years has never lost money. Is it safe to assume that if you increase this rolling period to 25 or 30 years, they would not lose money either?

Is it possible to know what the ranges of returns would be for 25 and 30 years?

Hey Vizzy,

You are very welcome. Thank you for the kind words.

Your assumption would be safe! I just did the calculations for 25 / 30 year rolling periods. The trend continues — as the time horizon lengthens, the range of returns gets tighter and tighter.

25 years: min of 2.6%; mean of 6.7%; max of 11.7%

30 years: min of 3.3%; mean of 6.6%; max of 10.4%

[…] No reference is given and I know that to be untrue not only for inflation-adjusted returns, but also for nominal (strictly numerical) returns. The graphs on pages 122 and 123 bear that out, using the Dow Jones Industrial Average as a guide, but the same is true of other indices like the S&P 500. There have definitely been 10-year periods where the markets have been down. […]

[…] animation comes to us from The Measure of a Plan, and it shows the performance of the U.S. market over different rolling time horizons using […]

A few years ago one of the major investment firms, Fidelity I believe, went back and analyzed their most successful portfolios under their management. The most successful portfolio was identified as those who had been forgotten. In other words the investment had not had a buy or sell for decades and they had highest percentage of growth. A behavior to duplicate was identified.

Thanks Clint. I’ve heard the same story: https://www.businessinsider.com/forgetful-investors-performed-best-2014-9

It’s a critical point to keep in mind — the average investor simply isn’t very good at timing the market.

Another great way I’ve heard it put: “Your portfolio is like a bar of soap; the more you touch it, the less you have!”

Thanks for the info. Great insight. Quick question though. $1000 now and then chart… does $1000 account for the inflation? For example, $1000 in 1939 would be worth around $18,200 now. Still a great plot

Thanks Bobby.

The “$1000 then and now” chart has a column which is in nominal dollars (i.e., not inflation adjusted), and another column which is in real dollars (i.e., adjusting for inflation).

So if you had invested $1,000 in 1939 (in actual 1939 dollars), you’d have ~$3.6M today (in 2019 dollars). Adjusted for inflation, you’d have ~$200K today (in 1939 dollars).

[…] The Measure of a Plan created this fantastic visual that details the range of return the U.S. stock market has delivered over one-, five-, ten-, and twenty-year rolling time periods. […]

[…] Invierte a largo plazo!! Esa es la conclusión que se podría inferir de la animación publicada por The Measure of a Plan. […]

[…] market has provided generous returns for those willing to stay invested. As this cool chart from Measure of a Plan shows, the longer an investor’s time horizon, the strongest a chance of positive stock market […]

[…] few years ago I came across an article that showed the return of the stock market by holding period. As you might expect, for any given […]

[…] tends to rise (though of course past performance is no guarantee of future results). For example, the U.S. stock market has never lost money over any 20 year period. However, along the way, there is a lot of volatility. For that reason, I and others do not […]

[…] animation comes to us from The Measure of a Plan, and it shows the performance of the U.S. market over different rolling time horizons using […]

[…] animation comes to us from The Measure of a Plan, and it shows the performance of the U.S. market over different rolling time horizons using […]

[…] U.S. Stock Market Returns – 1870s to Present (themeasureofaplan.com) […]

[…] maar op lange termijn rekent men op een gemiddelde opbrengst van 7-8 % per jaar. In de VS was het gemiddelde reële rendement (na inflatie) tussen 1872 en 2018 8,4%. Dit gemiddelde verbergt uitschieters naar boven en naar beneden (bv. 30% winst in 2013 en 38% […]

[…] heutige Animation stammt von The Measure of a Plan und zeigt die Performance des US-Marktes über verschiedene Rolling-Time-Horizonte unter Verwendung […]

[…] courtesy of Measure of a Plan. Check them out […]

[…] heutige Animation stammt von The Measure of a Plan und zeigt die Leistung des US-Marktes über verschiedene rollierende Zeithorizonte anhand der […]

[…] us-stock-market-returns-1870s-to-present […]

[…] 根據過去146年的歷史統計,長期下來市場單年出現上漲的機率是70%,下跌則是30%。 […]

[…] animation comes to us from The Measure of a Plan, and it shows the performance of the U.S. market over different rolling time horizons using […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] négatifs au cours de 31 % des années de son histoire, selon les données recueillies par Mesure d’un plan, un site de finances personnelles. Mais il n’y a pas eu une seule période de 20 ans au cours […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] négatifs au cours de 31 % des années de son histoire, selon les données recueillies par Mesure d’un plan, un site de finances personnelles. Mais il n’y a pas eu une seule période de 20 ans au cours […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has […]

[…] returns in 31% of the several years in its record, in accordance to knowledge gathered by Evaluate of a System, a personal finance web-site. But there hasn’t been a solitary 20-calendar year period of time in […]

[…] has delivered negative returns in 31% of the years in its history, according to data gathered by Measure of a Plan, a personal finance website. But there hasn’t been a single 20-year period in which it has lost […]

[…] adverse returns in 31% of the years in its historical past, in accordance to details gathered by Evaluate of a System, a particular finance internet site. But there hasn’t been a single 20-yr period of time in which […]

[…] As an example, look at the Vanguard 500 Index Fund (VFIAX), which tracks the performance of the S&P 500. In 2018, the fund actually had a negative return of -4.38%. And during the recession in 2008, it had a negative return of -37%. But over long periods of time, the index has gone steadily up. There hasn’t been a single 20-year period in its history in which the S&P 500 posted negative returns, according to data compiled by Measure of a Plan. […]

[…] As an example, look at the Vanguard 500 Index Fund (VFIAX), which tracks the performance of the S&P 500. In 2018, the fund actually had a negative return of -4.38%. And during the recession in 2008, it had a negative return of -37%. But over long periods of time, the index has gone steadily up. There hasn’t been a single 20-year period in its history in which the S&P 500 posted negative returns, according to data compiled by Measure of a Plan. […]

[…] As an example, look at the Vanguard 500 Index Fund (VFIAX), which tracks the performance of the S&P 500. In 2018, the fund actually had a negative return of -4.38%. And during the recession in 2008, it had a negative return of -37%. But over long periods of time, the index has gone steadily up. There hasn’t been a single 20-year period in its history in which the S&P 500 posted negative returns, according to data compiled by Measure of a Plan. […]