April 12th, 2018 | Posted in Tools

First up — download the Budget Tracking Tool as an Excel spreadsheet, or as a Google Sheets spreadsheet (both have the same features, but the google version sometimes runs a bit slower). These spreadsheet templates — like everything else on this site — are completely free, and will always remain so.

[These spreadsheets were originally published in 2018, and were last updated on October 15, 2024. The number of expense categories has been increased from 40 to 80 categories, a new “Historical Comparison” tab has been added to compare one time period against another, and there’s also a new and improved layout for the “Dashboard” tab!]

Table of Contents

- The Merits of Budgeting

- Why Should I Use This Tool For My Budgeting?

- Getting Started with the Spreadsheet

- Setting Your Budget Targets

- The Dashboard

- Historical Comparison Analysis

- Comparison to Budget Targets Analysis

- Frequently Asked Questions (FAQs)

- Troubleshooting

- How to Migrate from Mint to this Spreadsheet

- Final Thoughts

The Merits of Budgeting [back to top]

Keeping track of your budget is the single most important step towards taking control of your financial well-being.

Before you can draw up a plan for a home down payment, debt pay-down, or retirement, you’ll need to understand how much money comes in, and how much money goes out.

Many of us keep track of our budgets in our heads, often using a mix of precision, guesstimates, and “voodoo math”.

While it’s easy to list off monthly rent, internet, or Netflix bills, it’s harder to keep tabs on the “one-off” items. Most of us have a laundry list of small or infrequent expenses that add up into a meaningful total — the lunches out, drinks with friends, new clothing, impromptu weekend trips, and the like…

If you only have a vague sense of how much you spend in an average month, chances are that you’re underestimating the actual figure.

I’d like to offer you a simple spreadsheet that you can use to track your budget, and visualize where your money is going each month. You can download the spreadsheet by clicking the links at the top of this post, or by clicking here for the Excel version or the Google Sheets version (both have the same features, but the google version sometimes runs a bit slower).

In my personal spreadsheet, I’ve got more than 10 years of data tracked down to the penny. It’s amazing to be able to quickly see how my income & expenses have trended over a long time period. This helps me to feel in control of my spending, and be more confident in my long-term plans.

Say hello to your new financial dashboard!

After inputting your expenses and income, you’ll be presented with your own version of this. Think of this as the new mission-control room for your financial life.

It might just be me (it can’t just be me, can it?), but I love scanning through these visuals every time I open up the file.

This dashboard will show:

- Your total income, expenses, and savings over any time period

- A month-by-month trending view of your finances

- Breakdowns into individual categories — i.e., how much of your total spending came from rent, eating out, groceries, car payment, etc.

- Comparisons of your spending and income against your personal budget targets

In other words, you’ll have a neat and tidy snapshot of your financial picture generated for you each time you update your spreadsheet.

Why Should I Use This Tool For My Budgeting? [back to top]

If the dashboard visuals didn’t convince you to jump in and start budgeting, here’s why I think this spreadsheet is the best tool for the job:

- It’s completely free and will always remain so

- Your data privacy is protected. The tool doesn’t require you to share any personal information (name, email, bank account passwords, etc.) — the same can’t be said of tools like Mint, Monarch, Empower, Simplifi, etc.

- Tracking your expenses and income on your own forces you to consider your financial picture on a regular basis. This breeds good habits and sets you up for long term success

- This tool lets you save your expense and income transaction data in one central place. Since most banks only let you access your transaction data from the past 12 months (or less), this means that you’ll never lose your financial data

Getting Started with the Spreadsheet [back to top]

The tabs of the spreadsheet are colour-coded — the blue tabs are where you need to enter manual inputs, whereas the Green tabs are outputs that will update automatically based on your data.

On the ‘Category Setup’ tab, you can modify the labels used to categorize your expense / income transactions. I’ve already included default category names which will hopefully work for most people, so there is no need to make changes here unless you’d like to.

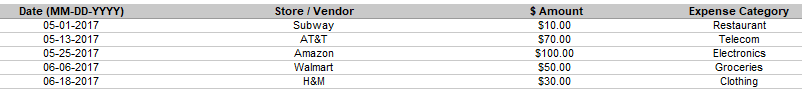

On the ‘Expenses’ tab, enter all of your expense transaction data. Enter each expense transaction as a separate row.

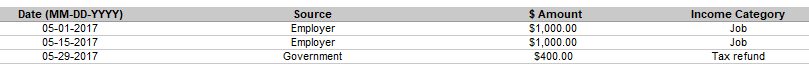

On the ‘Income’ tab, please enter all of your income transaction data (same process as the ‘Expenses’ tab)

A few tips for inputting your data into these tabs:

- Most banks will let you export / download your transaction data. Downloading these transactions in “spreadsheet” or “CSV” format and then copying/pasting into this spreadsheet will make your life much easier!

- Please ‘paste as values’ into the tool when possible, as regular pasting can sometimes bring in odd formatting into the tool which will mess up the dashboard tab

- Please note that the data that you enter needs to be in the correct format: dates must be written in the format mm-dd-yyyy; for example May 20, 2023 would be entered as 05-20-2023

My approach is to update my personal budgeting spreadsheet every month or two. This is normally a Sunday morning activity with a round-trip time of an hour to brew coffee, download my banking transactions to CSV, paste into the spreadsheet, and sip my coffee while poring over the newest results ☕😏.

I find this “batch” approach to be the easiest, but several users have mentioned that they prefer to manually input their transactions each day. Choose whichever method floats your boat!

Setting Your Budget Targets [back to top]

On the ‘Budget Targets’ tab, enter your monthly target amounts for your expenses and income by category (see yellow highlighted cells below). For example, a rent target of $1,300 per month is shown below.

The Dashboard [back to top]

Now, the spreadsheet will handle the heavy lifting! No more manual inputs are required from you — the charts will update automatically.

At a glance, you can see your total income / spending / savings, how your finances are trending on a month-by-month basis, and breakdowns by category.

By selecting an option from the menus, you can toggle between different time periods, and also drill down into a single expense category.

Historical Comparison Analysis [back to top]

For a deeper look into your finances, the ‘Historical Comparison’ tab allows you to compare your income, spending, and savings in one time period against another time period.

You can toggle the time period comparison easily at the top of the tab.

This tab gives quick answers to questions such as:

- How much money did I save in total in 2024 versus 2023?

- What was my combined income in the last 6 months, compared to the same 6 months last year?

- How has my spending changed as a result of a major life event such as moving to a new city, starting to live with a spouse, etc.?

Comparison to Budget Targets Analysis [back to top]

The ‘Comparison to Budget Targets’ tab will now be updated for you automatically as well. Here, you can see a summary of your expense / income / savings data, and the comparison of your actual figures versus your budget targets.

You can enter your own custom date range at the top of the tab, so you’ll be able to summarize any time period that you’d like.

This feature can be used to create an end-of-quarter or end-of-year summary of your finances, showing where each of your dollars went, and how this compared against your targeted goals.

Frequently Asked Questions (FAQs) [back to top]

To change the format of cells, here is a guide: https://www.howtogeek.com/240316/how-to-change-the-currency-symbol-for-certain-cells-in-excel/

All of the cells currently formatted as $ would need to be changed.

Otherwise, you can just use the default version and ignore the “$” symbols. It’s just visual formatting. For example, you could just consider $1,000 to be the same thing as €1,000 or £1,000.

In other words, ignore the currency symbol and only focus on the number itself.

However, sometimes users will need to enter dates in YYYY-MM-DD or DD-MM-YYYY formatting instead. I’m guessing it has something to do with the excel version, operating system, or default system date settings that people have on their computer.

Please try entering dates in a different format instead to see if this helps.

Alternatively, please try using the google sheets version instead of the excel version. Google sheets tends to be a bit smarter in handling dates.

If you’d like to change the default date formatting, you can follow this guide: https://support.google.com/docs/answer/56470?co=GENIE.Platform%3DDesktop&hl=en

See the section about customizing a date / custom formats. The current format used in the file is MM-DD-YYYY. If you edit the custom formatting, you can change it instead to YYYY-MM-DD or DD-MM-YYYY.

You’d need to make this change in the date columns of the Expenses and Income tabs.

I don’t track any transfers of money from one account to another, since that’s just the “left hand paying the right hand” — for example, I don’t record an expense if I transfer $1,000 from my checking account into my savings account or into my retirement accounts (for Canadians: TFSA / RRSP accounts).

The savings number on the dashboard will then be the total of your income, minus the total of your expenses.

In other words, this budgeting spreadsheet isn’t used to track where your savings go — whether they go into your savings accounts or retirement accounts. It just tracks your cash inflows, cash outflows, and the remaining savings over the time period.

To track my account balances, I use a separate net worth tracking spreadsheet where I input my account balances at the end of each month. This is how I keep track of where my money is allocated and how my individual account balances are changing each month. If you’d like, you can copy that net worth tracking tab into your budgeting spreadsheet, in order to keep everything in one file.

Create a table with a column for “merchant name”, and another column for “spending”.

For the second column, use the SUMIFS formula to sum the expenses on the Expenses tab accordingly — you will need to enter in criteria for the merchant name (text in the first column), and also date range if you’d like.

Tips on using the SUMIFS formula: https://exceljet.net/excel-functions/excel-sumifs-function

As an alternative solution, please read through the comment section below for tips from user “Fred T.” (you may need to go back to the older comment pages), a user who has mastered using “pivot tables” to do this kind of analysis and much more!

For my own personal budgeting, I use the following method:

- When I pay off my credit card (using cash from my checking account), I don’t add those transactions into the tool. I just delete those rows from my bank statement before I add them to the budgeting spreadsheet

- To track the credit card expenses correctly, I download my monthly statements from my credit card, and import those individual transaction rows into the budgeting spreadsheet

- For example, instead of having a generic $500 expense for “credit card”, I instead record the underlying transactions of “groceries $150, utilities $250, internet $100”

Troubleshooting [back to top]

If you’re having issues with the budget tracking tool, please follow the steps listed in this troubleshooting guide. If you continue to have issues, please let me know.

August 2019 update: An awesome reader of this site — a YouTuber going by the name of The Frugal Minimalist — has created a fantastic video tutorial on YouTube, showing us how to use this budget spreadsheet in Google Sheets. Highly recommended If you’re a visual learner who wants a step-by-step guide to this tool!

How to Migrate from Mint to this Spreadsheet [back to top]

Mint is (was) the world’s most popular budgeting tool. The platform launched in 2006, grew like wildfire, and was acquired by Intuit in 2009 for $170 million. Mint subsequently grew to have ~20 million users worldwide.

Intuit announced that Mint will be permanently shut down in March 2024, leaving millions of users in the dark (think of the people! what will the people do without budget tracking!).

I am quite biased as the creator of a budgeting spreadsheet, but I do think this serves as a useful illustration of the benefit of using spreadsheets instead of apps.

A spreadsheet lasts forever (as long you don’t delete it from your computer), doesn’t require you to share personal / banking details, and is ad-free. The same can’t be said of apps like Mint (R.I.P.), Monarch, Simplifi, Empower, Nerd Wallet, and the like.

If you’re a former user of Mint who is hoping to migrate to this spreadsheet instead, you can export your transactions from Mint into a “CSV” (Comma Separated Values) format which you can then paste into the Expenses and Income tabs of this budget tracking spreadsheet.

Follow these steps to export your Mint transaction data history:

- Sign in to Mint.com (use the web version on your computer, as this does not work on mobile)

- From the menu, select the “Transactions” tab

- (Optional) If you want to export on a subset of your data — for example, a specific time period — you can add filters by clicking on the “Filters” button. If you want to export everything, ignore this step

- Go to the bottom of the page and click “Export X transactions”. This will download your transaction data in spreadsheet format

- You can now paste this CSV data into the Expenses and Income tabs of the budget tracking spreadsheet, as appropriate

Final Thoughts [back to top]

Once you start tracking your budget, you’ll be able to identify areas of improvement. You can also set targets for yourself (such as cutting down your spending on eating out, or saving a certain amount each month), and be able to track your progress towards those goals.

With a solid grasp on your budget, you’ll be able to start investing, keep tabs on your (growing!) portfolio, and plan for your retirement.

Thank you for taking the time to check out this tool. I hope that you find it useful, and that it helps you meet your goals.

For any questions, feedback, or random thoughts, please let me know either through the comments below or by email at themeasureofaplan@gmail.com.

—

Header image credit: Keiffer Buckles

—

P.S., if you’d like to show your appreciation for this spreadsheet, you can buy me a coffee or beer by clicking the little blue button below 🙂

This is an excellent spreadsheet!

The only category that is missing is investments. I’d like to be able to see how my investments (TFSA/RRSP ..Canadian here, similar to the 401k and stuff) are growing and how much I’ve contriuted.

Also a way to categorize the time frame into 4 week segments instead of monthly, as alot of people are paid biweekly. As a result some monthly you get paid 3 times, so that month looks good. Or some months there are 3 weekends, so more eating out/bars happen.

Thank you for the feedback!

I plan to build another tool for tracking investments. Goal would be to let users input their ‘trade log’ (when they bought and sold shares, the dollar amounts) and then the tool would output net worth over time, returns, and a view of the current portfolio holdings / diversification. Stay tuned!

Great point on the time frames. The ability for the charts to use 4 week periods instead of months would be useful. I’ll have to give some thought on how to implement such a change given that I think it will take quite a bit of re-piping.

Thanks again for your comment, this was great feedback.

Hi,

Have you had the chance to make the investment tool yet? I’m really looking forward to it!

Yes! See here:

https://themeasureofaplan.com/investment-portfolio-tracker/

Great work! I’ve switched over from my own spreadsheet to using your tool. I love the dashboard.

Thanks so much!

I’m really happy to hear that! Please let me know if you have any questions or suggestions for improvement.

Neat tool — thanks for sharing! I have two suggestions.

First, is it possible to add a field where a user can add their budget for each category (perhaps allowing both per month and per year options) and then integrate that information into the dashboard views? It would be helpful to see where expenses and earnings line up as compared to what was planned.

Second, is it possible to create a Google Form to input expense and income data into the Sheets version? This would be a great shortcut to have — on mobile devices in particular.

This is great feedback – thank you.

In the next version, I will be adding in the ability for users to set their budget for each item, and will have that integrated into the dashboard for tracking purposes.

For the Google Form comment, this is an awesome idea. Do you mean allowing the user to input expenses through their phone, which would then sync to the Google sheets document?

I’m not familiar with Google Forms, and have never done an integration between Sheets and Forms. Are there any resources or tutorials you can point me towards so that I can learn how to do that? I would love to add this feature.

Thanks again!

I’m certainly no expert in Google Forms, but my understanding is that you can link a Form and a Sheet such that the data from submissions in a Form automatically populates the Sheet in a designated place.

On a phone, a user could create a shortcut to the Form (there might even be a widget – not sure) so that they can go straight there to input new data every time they have a new expense or new income.

Here’s a Google tutorial on Forms that might be a good place to start: https://gsuite.google.com/learning-center/products/forms/get-started/

Thanks! I’ll look into it.

Hey LG,

Thanks again for your feedback. I’ve added in the functionality for the user to enter their ‘budget targets’, and the dashboard now shows this info alongside the actual data.

I’ve also added a new tab ‘Variance to budget detail’ which shows each category’s actual and budgeted spend, with the $ and % variance. You can enter your own date ranges here so you can summarize whatever time period you’d like.

The post above / underlying file now reflects that change.

I am looking into the Google Forms integration next, but that change will likely take more time.

Cheers!

Hi thanks for creating this amazing spreadsheet!

I am an excel noob and have a maybe stupid question about the “Income by Category (Monthly)” section on the dashboard.

I split my income to: (1) pure cash (what I get in my account each month and what I use for all expenses – the remainder of which goes to my bank account) and (2) mandatory savings that go into my country’s pension plan (I’m not a US citizen) and which I can eventually utilize as downpayment to purchase property etc.

By default 100% of category (2) goes into the fund and I don’t touch, but the “Income by Category (Monthly)” section shows savings as split there. Is there any way that it can track deductions purely based on my job income, versus other types of income?

Or is the only option that this category (2) just need to be hidden?

Thank you!

Hi CP,

You’re very welcome!

To make sure I understand, I’ll use a made up example. Let’s say you have income of $4,000 per month (gross pay), with taxes of $1,000 per month, and contributions to your pension of $500 per month.

Your pay net of taxes and pension contributions would be $2,500 per month, which corresponds to the (1) in your example. This would be the amount actually going into your bank account each month.

Your contributions to your pension plan would be $500 per month, which is the (2) in your example.

If that is the case, the way I would record this in the budget tracking tool would be to input both (1) and (2) on the ‘income’ tab of the spreadsheet, for a total of $3,000 per month. I would input them separately in different categories (e.g., “job – $2,500” and “pension contribution – $500”). I would include the pension contribution in this tool because it is still income, regardless of it goes into your bank account or not. Not including it would understate your savings / savings rate.

I hope this answers your question. If you’d like to discuss in more detail, you can also send me an email. My email is at the bottom of this post.

Cheers!

Hi there – sorry, I had some issues keying in data and I’ve figured it out now. Your suggestion made perfect sense – thank you!

when i try to paste values only from my downloaded csv file into expenses or income column, the dates are not properly accepted by your spreadsheet. it pastes in a MM/DD/YYYY format and your spreadsheet only takes it in MM-DD-YYYY format. Any idea how to automate this so i dont have to go any manually input each row??

Hi Barry,

Sorry to hear that you are having issues.

If your CSV file data is formatted in MM/DD/YYYY format, it should paste in fine to my spreadsheet if you ‘paste as values’.

See this link for a guide on how to do that on the ‘How to Paste as Values or Text’ tab: https://docs.google.com/spreadsheets/d/1cT-MVaNSj5-TTubP6j7Df9y9wxdFckg-0kUrjdAhTnU/edit#gid=1337138691

Alternatively, if your CSV file data is formatted as DD/MM/YYY format (i.e., you need to switch day and month), you can see the same link, but on the ‘Troubleshooting Instructions’ tab there is a guide to swapping day and month. See the bottom on that tab.

Let me know if this solves the issue. If you’d like, you can send me an email (see my email at the bottom of the post), and I’ll try to resolve it for you.

Hey – first off…. amazing. I recently quit Mint because of bad functionality as well as privacy concerns and hadn’t really been tracking my stuff. This spreadsheet is great, and now I feel stupid for procrastinating creating one… I didn’t have to!

I do have one question – it’s May right now. In the dashboard, under Time Period, it says “Last Month (Aug-18)” and “Last 3 months” (Jun-18 to Aug-18). Am I missing a date adjustment somewhere? Date is set correctly on my computer, though I’ve only uploaded May transactions to the spreadsheet so far.

Hey Zanthia,

Thanks for the kind words!

Are you using the excel version? I have a feeling that some of your date values have the ‘day’ and ‘month’ swapped (dd-mm-yyyy instead of mm-dd-yyyy).

For example, it could be that the tool thinks a date is August 5th 2018, instead of May 8th 2018.

Can you try the troubleshooting step 7 at this link? It is at the bottom of the page. https://docs.google.com/spreadsheets/d/1cT-MVaNSj5-TTubP6j7Df9y9wxdFckg-0kUrjdAhTnU/edit#gid=944042521

You can use that to swap your day and month values.

If that doesn’t work, can you share your spreadsheet with me by email (see the bottom of the post for my email)? I’ll take a look and troubleshoot.

Hello there,

Love the spreadsheet! I just have a quick query.

I successfully pasted about 6 months worth of income and expenses. However, when i go to the dashboard it shows total income (lets say its 90K) then it shows total expenses (70K) and then total savings as 160k instead of (90-70=20k). It appears that it is taking my expenses as income somehow. Am i doing something wrong to cause this ? I have also noticed with the pie graphs, after I add a few more categories it will display “n/a” for all the labels.

Any help would be greatly appreciated!

Matt

Hey Matt,

A strange one! Perhaps you’ve entered your expense numbers as negatives? Can you check if there is a minus symbol in front of your expenses?

If you send me a copy of your spreadsheet, I’ll take a look and troubleshoot. You can find my email at the bottom of the post.

Here’s a super stupid question: is there a way to change it all to be in a different currency than USD? If there isn’t, which cells should I change the format of?

Massive thank you for this tool!

Hey Alex,

Not a stupid question at all! There’s actually not an easy way to do that unfortunately.

To change the format of individual cells, here is a guide: https://www.howtogeek.com/240316/how-to-change-the-currency-symbol-for-certain-cells-in-excel/

Pretty much all the cells currently formatted as $ would need to be changed.

To change the currency format for your entire computer, you can use these steps: https://www.howtogeek.com/240216/how-to-change-windows-default-currency-from-dollars-to-euros/

If you send me an email at themeasureofaplan@gmail.com and let me know what currency you want the spreadsheet in, I’d be happy to help you in making those format changes.

Love your spreadsheet. Thank you for your hard work in putting this together for everyone’s use!

Hi Pedram, thanks for letting me know! You are very welcome.

First of all, a terrific spreadsheet. I tried several of budget/expense tracking apps, but there is always something missing. I was starting to build my own spreadsheet, and then stumbled onto this on Reddit. It looks great, just what I need and I couldn’t get so many things for at least a year.

There is only one “small” thing that I would find also great to have: subcategories for expense categories. For Instance, I would have apartement as category and then rent, utilities, electricity, gas, internet as subcategories and etc.

I think this would help me get a better overview over the months where my money is going. It doesn’t have to be literally like this, but some sort of a mechanism where I can group several categories into one bigger categorie for a better overview.

Would something like this be possible? I imagine it would take some work :/

Hi John,

Really happy to hear that you’re getting good use out of this.

Good idea on the parent / sub categories. I’ll do some thinking about how this could be built. I want to keep this budgeting tool simple and easy to use, so I don’t want to force people to go through too many steps if that’s not what they want.

Stay tuned…

Hey that is excellent spreadsheet, well done! The amount of work and references is amazing.

I agree with John on the subcategories and agree with you. I liked the spreadsheet is simple and I don’t have 12 categories and then each having 12 subcategories. It could be something like tags or similar to group the categories, for example home, leisure, work.

I’ve got another question, how should I qualify my savings, I mean is this another expense? I got several pots where I transfer money every month but also long-term savings/deposits. For example, I pay my utilities on a quarterly basis, I know what the average is and got this as a monthly budget. So, every month I’d transfer this to a pot and when the time comes I will use the money to pay my utilities bills.

I’d be useful to have the concept of pots, for example utilities, car, insurance, savings and then build a dashboard to show how much money you got into each pot. At the moment I know how much my savings are but half of them went for deposit, another for insurance pot (paid annually), pot for gig I go in the summer and another pot for utilities. Hope it makes sense.

Thank you and keep up the good work!!

Thanks for the comment Sven.

The type of savings that you mention can be tricky since people often have unique ways of accounting for this.

If you are saving money for a short-term expense (utilities, insurance, travel, etc.), I would think of this as “deferred spending” as opposed to savings.

Let’s say you are putting away $50 each month for utilities, which is actually paid out as $150 every three months. You could deal with this in the tool in two ways:

– Log an expense of $50 each month, even though you only actually pay out this cash every three months. This would smooth out your results

– Don’t log any expenses until the $150 is actually paid out. If you do it this way, your spending is bumpier but it is more accurate with reality

When I do my own personal budgeting, I don’t log expenses which are just moving money from one account I control to another. For example, if I’ve got some money in my checking account and move it to either my emergency fund account or to my investment brokerage account, I don’t log any expense. I only record expenses which are actually paid out to a third party. Anything that I earn and is not a third-party expense is then automatically classified as “savings”.

Excellent!

Yes, I know what I paid last year and I got estimate for this year. Thus I transfer the same amount of money into the pot every month, for example £180. I think I will go with the latter, I will log the utilities only when paid.

What about long term savings. Sorry, to confirm I got it right, you don’t expense savings but anything that’s left of the current month automatically goes to savings i.e. the blue bar on the dashboard ?

Thank you!!

Yes, exactly right for long term savings. No problem!

I’ve been using this for a couple of months and it’s been fantastic. Is there any ability that the graphs have pivot table ability i.e. double clicking on a certain slice opens up the expenses at a granular level/data input level rather than going to the “expenses” tab?

Also, hiding certain expenditure (column F) in the expenses tab skews “total savings” in the dashboard. Is this intentional?

I like to hide certain fixed expenses (rent/internet etc) as I like comparing the variable expenses month to month.

Hi Jeff,

Glad to hear it!

Good idea on the pivot table ability for the charts. I don’t know of a way to do this, but I’ll keep that in mind if I release an updated version. Would definitely be a nifty feature.

For the hiding of expenses, yes this is intentional. If you hide an expense it will exclude it from all calculations in the spreadsheet (i.e., expenses go down, so implied savings go up).

For that type of analysis, you could hide all of your fixed expenses on the Expenses tab. The charts on the dashboard would now only show variable expenses. Remember to go back and un-hide those expenses afterwards.

Hope this helps.

How do I keep track of my credit card transactions? I am struggling to understand that I’m really sorry.

For example, I receive my credit card statements on 18th or 19th of every month and the due date to clear them is usually 8th of the next month. Uber is linked to my credit card so do I tag it “Debt” or just as-is “Public Transportation”/”Travel”? Similarly I have Netflix and Scribd as well as my food app that are linked to the credit card. I just need some pointers, is all. Thanks =)

Also, I am confused about Budget Targets. How does it work? Do I have to enter data for a few months before setting Budget Targets?

I mean I entered $10 for the month of October “Gas” but when I go to the Budget Targets sheet, I see Monthly Average =$10/number of months (=6).

But my monthly average is $10.

Hi Sami,

For credit card transactions, I would download your entire credit card statement including all of the transactions and then put those transactions into the spreadsheet. To avoid double counting, I wouldn’t include any payments you’re making on the credit card.

For example, instead of including the $800 payment that you’ve made on your credit card, I’d instead include all of the underlying transactions that made up that $800 bill. I’d then tag each of those transactions with the appropriate category (eating out, transportation, entertainment, etc.).

This way, you’ll have your granular spending data available for you to see.

For the Budget Targets tab, you should enter in a few months of data first (with tagged categories). Then, column D will show what your average monthly spending is for each category. In column G (the yellow highlighted cells), you can then input your targeted monthly spend for each of those categories (e.g., in the past 6 months you’ve actually spent $150 per month on restaurants, and your goal is to reduce this to $125 per month instead).

After that, in every new month that you enter afterwards you’ll see how your actual spending corresponded against your targets (on the Dashboard tab and the Variance to Budget Detail tab).

Hope this helps!

Hi! Just found your spreedsheet on Reddit and I must say, it’s really great. I just wanted to ask 2 questions. For reference I’m using Google Sheets version:

1. Will changing $ sign to £ everywhere break some parsing code or will it all continue working correctly?

2. Similar question but changing MM-DD-YYYY to DD-MM-YYYY. Will it continue working as expected? + Any insight on how I could do it efficiently? It might generally be useful to have the feature to toggle date formats (and I guess also currency symbols) as I think more people would use your tool!

Thanks!

Thanks Alex.

Changing the currency symbol to pounds should be fine.

For changing the date format, this is a little trickier but should be doable as well. Try adjusting the date columns on the “Expenses” and “Income” tabs.

This should work: format >> number >> more formats >> custom format. Then change “mm-dd-yyyy” to “dd-mm-yyyy”. After this, you should be able to input dates in your preferred formats.

I spent some time thinking about how to make the formats toggle-able, but it is quite tough!

[…] Sheets wiz, you can easily make tweaks to adapt it to your unique financial situation. – Budget Tracking Tool by Measure of a […]

Hey I’ve got a suggestion.

You can save a huge amount of time categorizing your expenses/income by starting with Mint’s categories and translating them.

Start in Mint –> Select all relevant accounts –> on the bottom on the page hit “export all” –> .csv created with all accounts and Mint’s own categories –> paste these as values into the expense/income portion of the budget sheet –> hit the filter button on excel and sort by Mint’s categories –> for each of Mint’s categories, say for example, some are ‘Fast Food’ and ‘Coffee’. I’ve lumped this into ‘Dining Out’ as an expense, so all i need to do is sort by all the food categories set my Mint, select them and change to ‘Dining Out’ –> repeat for all categories.

You can also select ‘Transfer’, and ‘Credit Card payment’ from Mint’s categories on the filer and delete them all because they will be are not captured as expenses.

Mint also notes is a transaction is ‘debit’ or ‘credit’, you’ll know right away if this an expense or income to your account.

I did all of my transactions for 2018 in about 1 hr using this method.

Second thing! I have a recommendation. I think it would be useful to have a line graph with days as the horizontal axis as oppose to a bar graph with months on the dashboard when selecting ‘Month’. It seems redundant if all the days are lumped into the a single column for the month. It’d be nice to see which days i’ve been spending more money on ‘Dining Out’ over the month.

Hey Khan,

That’s a great tip for people who are switching over from Mint to this spreadsheet tool. I’ve added a note in the article asking people to check out your comment to make the data entry process easier.

For your recommendation — thanks very much for that as well. I’ll look to make this change in the next version. Stay tuned…

Hi,

Brand new to this particular spreadsheet but I think it’s what I’ve been looking for. Already have one question 🙂

I’m retired, and a large portion of my income does not have taxes withheld, so I pay quarterly estimated taxes. I think I need an expense line to capture and budget for these payments, but perhaps there’s a better way. Or should I have a line for all taxes, and record my gross income, and so be able to track the total taxes I’m paying.

Hi Michael,

I’d suggest the following:

– Book your gross income amount on the “Income” tab

– Add a custom expense category called “Taxes” (or something like that) on the “Expense and Income Categories” tab

– Whenever you make a quarterly estimated tax payment, add an expense transaction on the Expenses tab using that new “Taxes” category for the amount that you’ve remitted; you could even do it once per month if you prefer

– At the end of the year, after you file your taxes, add a new expense in the “Taxes” category for the true-up adjustment (depending on if you over and under estimated your actual taxes owed)

This way, you’ll have a clean record of your total income before taxes, and how much you’ve paid in taxes over time.

I hope this helps.

I just found your budget tracking tool via a recent article in the NYTimes and think it will work for my purposes. My (probably) dumb question is that with all the increasing privacy concerns I would like to know how private is Google Sheets? Do they/can they access this information? Not that my income or expenses are anything but vanilla; however, I don’t want to prying eyes of Big Brother (i.e. the internet gabbing it. Thanks.

Hi Robin,

Apparently Google does not look through info stored in Google Docs (https://computer.howstuffworks.com/internet/basics/google-docs4.htm), but of course it’s hard to be sure.

If you have privacy concerns, using the excel version would be your best bet. It would be a local file saved only on your own computer.

I would like to use this budget tracking tool, but I am unable to save it to my Drive. When I make a copy in Google Sheets, the only option I have is to save it to a shared file and I don’t want this info shared. Can you tell me how to save it so that it is downloaded to my own folder? Thanks!

Hi Pammi,

When you’re in the google sheets file, click file >> make a copy >> then click the folder field >> then go back in the directory until you get to “My Drive” >> click OK.

By saving it onto “My Drive”, your file won’t be shared with anyone else.

Thanks!

I just wanted to let you know how well this tool is working for me. Now that I can see where my money is going I’ve been able to rein in my spending, pay off my credit card debt and save more money than I thought I could. Thank you!!!

That’s amazing — I’m so happy to hear that! Keep up the good work 🙂

Thanks for letting me know, you’ve made my day.

Hi, I am going into college next semester and trying to get a habit of budgeting started. This is exactly what I need! I was wondering how do I add what I currently have in my savings account? I don’t see any place to enter savings anywhere. Thanks!

Hi Jack,

It’s fantastic that you’re making the effort to get organized at such an early age. I certainly could have benefited from kick-starting the process a few years earlier…

To your question, this budget tracking tool was built so that you could track your cash inflows and outflows. This wasn’t really built for the purpose of tracking specific account balances.

For my own personal tracking, I have a separate spreadsheet which I update at the end of each month with the current value of all of my balances. Takes about 10 minutes to log in to my various accounts and type in the $ balance as of today.

You can find that spreadsheet here: https://themeasureofaplan.com/getting-your-ducks-in-a-row/ (this article is part of a much broader guide to personal finance, if you’re interested)

If you go down this route, you’ll have a neat and tidy recorded history of your total assets, total debts, and net worth. The sheet will also display the info for you visually.

Hope this helps!

How do we handle return/refunds of transactions? The expense tab is always a positive number. If I add a refund of a prior transaction as a negative value it does not seem to work correctly. I’d rather not show that as income.

Hi Ed,

I’m able to enter negative values in the expenses tab when I try it out.

For example, if I have a refund of $100, you’d add a new transaction row, input -100 as the dollar amount, and make sure that the expense category is the same as in the original transaction.

Can you try that out and let me know if it works?

Noticed a new version (11) is available for your Microsoft Excel Budget spreadsheet. Can you provide best way to upgrade to the new version. ie: how can I migrate my data from version 10 into version 11 easily?

Thanks,

J. Barber

Hi J,

To upgrade to a new version, you just need to copy and paste in all of your info from the expenses, income, and expenses & income categories tabs from the old version into the new version.

You’ll be all good from there.

Amazing work with this spreadsheet! Love the dashboard section. Two suggestions… let me know your thoughts 😉

1. Would it be crazy to add a column “Account” in Account and Expenses categories sheet? This way you can better track the cash flow between accounts and eventually your net worth goals.

2. The portfolio tracker tool supports multiple currencies. Would it be hard to adopt the same approach in this file? I frequently travel from Canada to US and have different accounts in different currencies. I’d be awesome to track my budget taking in account different currencies as well.

Hi MrBeard,

Thanks for your comment and suggestions.

This tool was built to track your overall cash flow (what comes in and what goes out), as opposed to the balances of individual accounts. However, I’ve built another simple sheet for that purpose here: https://themeasureofaplan.com/getting-your-ducks-in-a-row/

At the end of each month, I spend a few minutes to log in to each of my accounts and manually input the current balance. This sheet then provides a history of my overall net worth by month (total assets, debt, implied net worth).

In the future I may try to build something more sophisticated that auto-links to some of the other tools I’ve built, but I think my system works fine for now, and I don’t want to over-complicate things for users.

For taking multiple currencies into account, that’s an interesting idea. I will think further about that. However, at first glance, I’m hesitant to add a new column to the “expenses” and “income” tab where people specify the currency, as this would require more time & effort from users (who may not have accounts in multiple currencies as you do). As well, I’d have to add in calls to Google Finance for the exchange rates, which would slow down the spreadsheet.

Thanks again for your thoughts.

I like the content that you have shared with and love to share this information with my friends. Keep doing good work.

Cheers, thank you!

Awesome spreadsheet! I started to working with this 2 hours ago. I messed up and deleted A14 – A42 I am a beginner with excel, How do I fix this?

Thank you in advance.

Hi Jim,

The easiest way to fix this would be to re-download a fresh version of the spreadsheet, and then paste in all your transaction data (expenses and income) back into the new version of the spreadsheet.

Everything will run smoothly afterwards.

Cheers.

Hi!! Just started using the spreadsheet! Excited to get going.

I have begun putting information in but all numbers are coming up with a “MWK” infront. E.g. MWK 96 or MWK 55, depending on what amount I enter, the number changed.

Any help would be great.

I am using Macbook.

Hi Elena,

When you click the link for the excel file (https://drive.google.com/drive/u/1/folders/1oPbqIRS5TTEwmiocGqlr66vTJ-oIW8xd), in the first menu you’ll find an excel file called “Budget Tracking Tool – TMOAP Official Version 12”. Please download and use this file.

You must have clicked into the sub folder “MWK Version 12”. This is a custom version of the tool that I created for someone who lives in Malawi. I converted the visuals to be based in Malawi currency — which is why you see the MWK everywhere.

Hope this helps! Best of luck with your budget tracking efforts 🙂

Ahhhh! Yes, thank you so much for the help and for all the luck!

Cheers! Happy to help.

Hi, Just started using the spreadsheet and I really love it!

I was wondering how would you go about refunds. Not sure if you can handle money going in and out from the same category.

Let’s make an example. Let’s say I spent $200 on X and $100 on Y but then after returning both items I get back the $300 I’ve spent.

In theory I should see that the average dollar amount is $0 for both X and Y since I got back what I spent in each category.

In the current spreadsheet I still see that I spent $200 for X and $100 for Y and then I have an undefined income of $300.

Not sure how to work out the categories to have the sum being $0 for both categories X and Y. Is it even possible?

Thanks in advance

Alex

Hey Alex,

On the expenses tab, enter in new rows with offsetting negative $ amounts. e.g., -$200 for category Y, and -$100 for category Y.

The spreadsheet will then effectively cancel out the previous transactions, leaving $0 as the final net result.

Good luck with your budget tracking efforts 🙂

Yes, this means that every time I have a refund I have to add a the category twice. Both as income and expense right? Isn’t there a more elegant solution that avoids having lots of income categories for different returns?

Cheers

Alex

You don’t have to enter any transactions on the Income tab, or add any new Income categories. Instead, you’ll just have two offsetting transactions on the EXPENSES tab, in the same category.

As an example:

Expenses tab:

– Transaction 1: +$200 in Category Y

– Transaction 2: -$200 in Category Y

Income tab:

Nothing to do here!

Your excel sheet inspired my husband and I to budget for the first time, and it was really easy to use! We were hesitant to give bank information to online services and apps, and this provided us an easy and free way to do it ourselves. Thank you so much!

Sam, that’s amazing! Really happy to hear that.

You are very welcome. Best of luck with your budget tracking efforts.

Hi,

this is an excellent spreadsheet! Thank you for your hard work! 🙏🏼

I have one suggestion, is it possible to add an excel column where a user can select his payment method (ex. cash, credit card, debit card)?

Thank you. 🙏🏼

Hi Alfio,

You’re welcome!

Could you let me know why you’d like to have that column?

I don’t want to add extra burden on users to fill out more info for each transaction, as you already need to input quite a few things.

If you wanted to do this in your own spreadsheet, you could write “Cash”, “Credit Card”, or “Debit Card” for each transaction in the Notes column (column G on the Expenses tab).

Then, on the dashboard, you can use these formulas to sum up the totals for each category:

=SUMIFS(Expenses!$D:$D,Expenses!$G:$G,”Cash”)

=SUMIFS(Expenses!$D:$D,Expenses!$G:$G,”Credit Card”)

=SUMIFS(Expenses!$D:$D,Expenses!$G:$G,”Debit Card”)

If you input these 3 formulas, one in each cell, this will sum it up for you.

Started using this spreadsheet this year and I couldn’t be happier with the results! Finally have real clarity on my family’s spending and savings.

One question — Is it possible to add more Income Categories?

Thanks!

Hi Tom,

Happy to hear that the budget tracking spreadsheet has been useful to you.

I can certainly add in a few more income categories. Are you using the excel version of the tool?

Sorry I am just seeing this response! I’m using Google sheets version.

Hi Tom,

I’ve just uploaded a new version of the budget tracking tool, increasing the max number of income categories from 7 to 15.

– The latest google sheets version is 3.1

– The latest excel version is 13

To “upgrade” to this new version, you just need to open up a fresh copy of the spreadsheet, paste in your category labels, and all of your transaction data from the “expense” and “income” tabs.

I’m having the same issue that other people reported with the date column(s). I am 100% inputting it in the requested format and it keeps rejecting it.

Expense tab also does not work, entries do not show up in the dashboard as entries. I made sure to paste properly as per the instructions above and also tried typing it in manually. I’m using the Excel version of the spreadsheet. Thx.

Hi J,

Sorry to hear that you’re having issues using the file.

Can you try the steps listed in the troubleshooting guide?

https://docs.google.com/spreadsheets/d/1cT-MVaNSj5-TTubP6j7Df9y9wxdFckg-0kUrjdAhTnU/edit#gid=944042521

When you start from a fresh version and use the dummy data, does it populate correctly?

The tip #7 may help as well.

If this still doesn’t work after that, I have two last alternatives:

– Send me an email (see the bottom of the post) with your excel file, and I will take a look and troubleshoot

– Try using the google sheets version instead. Google sheets is a little bit smarter at handling date values

[…] Find the budget tracking tool here […]

Thanks so much for all the work you’ve put into these tools. I just graduated from college and am about to start living and working on my own for the first time. Your tools and website have actually gotten me excited about budgeting and my personal finances.

Do you have any recommendations for how to budget irregular expenses such as renter’s insurance that are billed/paid for the entire year in one payment? Or Christmas gifts which can be a significant expense, but you wouldn’t budget for in May? It seems unnecessary to have categories for such specific things, but I still want to track my money. Any tips?

Hi Andrew,

Great to hear that you’ve gotten such an early jump on personal finance!

Irregular or “bumpy” expenses like the ones you mention are definitely tricky. There isn’t a perfect way to do it, but here are some suggestions:

– When you’re recording your expenses, you could allocate annual expenses into monthly expenses instead to smooth it out. For example, let’s assume your renter’s insurance has a cost of $300 per year, paid in March of each year. Instead of recording a $300 expense every March, you could instead record a monthly expense of $25 in each month

– For things like gifts which are much less predictable, in my personal tracking I just record the actual amounts as I spend them. I tend to monitor these types of expenses on an annual basis instead of a monthly basis. So if I usually spend $240 per year on gifts, I just set my monthly target spending at $20 per month. I recognize that my spending in some months will be much higher or lower than the target, but I just want to make sure that my spending in that category in the past 12 months has been roughly in-line with my historical average.

– You can use the “Variance to Budget Detail” tab, and set the date range over a 12 month period to get an annual view of your expenses and income

I hope this helps!

[…] The Measure of a Plan Budget Tracking Tool […]

Hey, I found this sheet incredibly useful for my personal finances over the last five months. Was able to cut one of my expenses by 60% thanks to this!

Do you happen to have a business version of this spreadsheet?

Hi Carlins,

Amazing to hear! Keep up the good work 🙂

Unfortunately I haven’t built a version of this spreadsheet specifically for business purposes. I suppose you could run a separate version of this tool, with your various revenue types recorded as “income” categories, and your expenses recorded in the “expenses” section.

Did you ever update with option of bi weekly instead of monthly? For us government workers 😀

Hi Marc,

I haven’t built out a bi-weekly option unfortunately. This would require re-building large chunks of the spreadsheet, and I haven’t found the motivation for that…

However, if you start to track your income and expenses over a large enough time period (>1 year), the bumps start to even out and monthly tracking is a good enough approximation (I’ve been tracking my own expenses for more than 5 years now and now I just monitor broad trends).

You can also use the “Variance to Budget” tab to set a custom date range which covers 2 or 4 week periods. This way, you can get a detailed view on a weekly basis.

Hey there,

At first I emailed you about the graphs not showing up and I got those to work by switching from a desktop to a laptop. However on the laptop unfortunatley I am getting an error code “please enter the valid date” when I am entering it properly, the same as I was on the desktop and it was working.

Any solution or idea whats going on here?

Thanks!

Hi Mitch,

Sorry to hear that you’re having an issue. Have you tried running through the steps in the troubleshooting guide?

https://docs.google.com/spreadsheets/d/1cT-MVaNSj5-TTubP6j7Df9y9wxdFckg-0kUrjdAhTnU/edit#gid=944042521

Some common problems / suggested fixed are listed there.

If you go through those steps and it’s still not working, you could share your file with me via email (address at the bottom of the post) and I can take a look.

[…] Grab your free Google Sheets budget template (plus an Excel version) at The Measure of a Plan. […]

Thanks for putting together such a great spreadsheet. I noticed there’s no table that compares all the current spending categories with previous months/yeas.

I was imagining to customize the “Variance to Budget Detail” to have a couple more columns that compare all the categories to another custom reference period. Would you see value in implementing such a feature in future releases?

Hi Alex,

On the Dashboard tab, you can see the monthly trending for your overall expenses / income, or use the drop-down menu to focus in on a specific expense category. This allows you to make quick comparisons between different months.

However, there isn’t any comparison table as you’ve outlined. I think this would indeed be useful — if I upload a new version of the tool, I’ll try to add this in.

Thank you for the suggestion!

This tool is amazing! I just spent a few hours transferring my 2019 data from another spreadsheet and it was so easy! I like that you can customize expense/income categories easily. Most other tools I’ve found had too many categories I didn’t need but were too complicated to edit. The dashboard is very satisfying to look at. This is exactly what I needed!

The only issue I had was Excel not recognizing dates properly when I pasted data from my bank’s CSV files but it was easy to fix using Text to Column.

Thank you again! I’m looking forward to playing with the other tools available on this site!

Hi Caroline,

That’s amazing to hear, thank you for letting me know 🙂

Unfortunately the excel date issue has popped up with a couple users of the sheet. I’m not sure why this happens, but I think it’s due to some incompatibility between the way that certain banks show the date format, and the system date settings on a user’s computer.

In any case, I’m glad that you were able to sort it out with the ‘text to column’ trick.

Cheers!

This is great spreadsheet! I love it!. wonder if there is a way to auto-fill the expense category in stead of going through the drop-down list and populate line by line? I have to do this 200 times if I have 200 transactions on one of my credit cards? I prefer auto-fill the category info on my CSV file before copy and paste it to your spreadsheet. Appreciate if you could shred some lights on this, either a code, or something to pre-process the data.

Hi rememe,

Happy to hear that you like the spreadsheet.

Unfortunately, I don’t have any silver bullet solution for you! Indeed the categories need to be inputted manually for each transaction.

However, excel and google sheets is smart enough to provide auto-fill suggestions once you have already entered some data into the sheet. For example, once you’ve typed “groceries” a few times, the next time you type “gr”, excel will prompt an auto-fill for the rest of the word. Therefore, you can just hit the ENTER key instead of typing out the rest of the word.

This makes the process much quicker.

For my personal budget tracking which I do every 3 months or so, this usually takes 30 minutes to input the data and review the final results.

Just curious, can anyone confirm if this spreadsheet will work in LibreOffice?

To answer my own question, the answer is no as it appears several required features are broken. It might be reproducible in LibreOffice for those cost-conscious people who don’t want to shell out the annual feel for Excel but I haven’t had time to play around with it to confirm that.

Hi Alex,

That’s correct — unfortunately the excel version won’t work in LibreOffice.

However, I have also built a Google Sheets version which does not rely on any paid software.

Feel free to use that version!

Is there a way to add to the number of expense categories? Can I just insert a row on the expense & income categories sheet? I know 40 seems like a lot, but I like to break down minutiae, haha. Thanks!

Hi Pedram,

Unfortunately it isn’t super simple to add new expense categories. You’d need to add new rows, and then adjust the tabs “Selected Time Period Data”, “Selected Time Period Total”, and “Chart Backup” to include those new rows you added.

As well, you’d need to adjust the drop down function on the “Expenses” tab (column E) to capture those new rows as well.

All in all — a fair bit of work and you’d need to have some decent excel experience, but it can be done!

Other than using “Find and Replace” function, is there a quick way to update previously listed a Category value on the drop down function at “Expenses” tab (column E) each time we rename it on Expense/Income Category tab? Thanks!

Hi Jess,

Find and Replace should work well for that task.

Alternatively, you can add a filter on the column headers (of the “Expenses” tab), and then use the drop-down menu to filter on the category you want to change. After changing the value once manually, you can copy and paste to replace the rest.

For a guide on filtering in excel:

https://www.excel-easy.com/data-analysis/filter.html

I hope this helps.

Thank you for this AMAZING spreadsheet! I am now using it and finding it helpful.

On the “Budget Targets” tab, the instruction states: “If you’ve entered a budget target which is higher than your actual data, the data will show up in red font. If your budget target is lower, this will show up in green font.”

Should it not be the reverse or opposite?

I ask because if we look at the “Variance to Budget Detail” tab, the opposite is true: if the budget target is higher than actual data, the data shows up in GREEN font (instead of red). This tab makes sense, because when the budget target is higher than actual data, it means we stayed under budget, thus data should be green.

Just checking why the “Budget Targets” and the “Variance to Budget Detail” tab font color show in the opposite direction. Or did I misunderstand? Thanks for clarifying.

Hi Jessica,

You are very welcome!

Here is my thinking about the red / green fonts, and why the colours switch between the different tabs…

The “budget targets” tab is for you to set targets for future months. However, the “Variance to Budget Detail” tab is where you can analyse how you’ve been doing against those targets and see if you are over-spending or under-spending.

On the Budget Targets tab, you see red figures when you’ve plugged in a target which is higher than your historical spending (i.e., allowing yourself to over-spend).

However, the Variance to Budget Detail tab acts as a report card showing how you’re doing against your targets. On this tab, results will be green if you spend less than your target, and red if you spend more than your target.

In other words, the Budget Targets tab is used for planning purposes, and the Variance to Budget Detail tab is for analysis / tracking purposes.

I hope this helps!

This is great, thank you! I’m ok at excel, so I think I’ll give it a shot. It’ll force me to get a bit familiar with matrices and named ranges, but no harm in trying. Thanks again!

Awesome! If you run into some difficulties while upgrading your sheet, feel free to send me your file by email and I can try to troubleshoot.

Got it to work. Had to tweak the budget variance and target sheets too, but everything seems to be working. Just wanted to say thanks again!

Nicely done! You are very welcome.

I love the spreadsheet! One issue I am having however is that whenever I try to add an expense date, it keeps giving me an error and says “Please enter a valid date in MM-DD-YYYY formate, which I am doing. Any help would be greatly appreciated, thanks!

I am having this exact same issue. Tried just about everything I can think of. Using the excel link on a mac. Any suggestions?

Figured it out. Dont follow the “example” format. 01-01-2020.

Instead enter your dates with the following format 2020-01-01 and it will accept the entry.

Perhaps the input format should be adjusted, or the example changed so it is more intuitive.

Hi Madison and Harry,

Thanks for your comments. I think for the majority of users the current date format works OK (mm-dd-yyyy).

In the past, I’ve seen users have issues with the date format if their system date settings are set in a different date format (yyyy-mm-dd for example).

If your system date is in a different format (on Windows you can just look at the bottom right of your screen to check), you can just input your dates in a consistent formatting.

Again, from what I’ve seen, the mm-dd-yyyy format works for most users.

I hope this helps!

i tried 2021-01-02 (my systems date format) and 01-02-2021. Neither work for me. In Data Validation, if I uncheck the boxes to show me these alert messages it will accept whatever Date format I choose? I can’t seem to figure out which Date format it will accept and the error message keeps popping out. Its kinda frustrating. If my Dates are not in the right format will all my expenses be messed up?

Are you using the google sheets version or excel version of the tool?

Some users have had issues with the date formatting. The spreadsheet was built to accept dates in MM-DD-YYYY format.

However, sometimes it helps if you try DD-MM-YYYY or YYYY-MM-DD instead. I’m guessing it has something to do with the excel version / operating system / default system date settings that people have on their computer.

Can you try different date formats to see if that helps? You can enter a handful of the dummy transactions and see if it populates properly on the dashboard.

See the troubleshooting guide here. You can follow the steps to enter the dummy data.

https://docs.google.com/spreadsheets/d/1cT-MVaNSj5-TTubP6j7Df9y9wxdFckg-0kUrjdAhTnU/edit#gid=944042521

I am working off the excel sheet. I decided to re-download and start fresh with the sample data you suggested. Everything is working fine now. I think you are right that it is related to the system’s Date format. I have to enter it like my system’s date format YYYY-MM-DD and then it shows up as MM-DD-YYYY with no error message.

I just got a new computer for Xmas so learning how to use this computer and how to budget at the same time has been a big learning curve for me today. Thanks so much!

OK great, glad it all works. Cheers!

Hi!

This is a wonderful spreadsheet, but is there a way to change the colors on the dashboard?

Hi beaver,

You can change the colours in the charts by following these steps:

https://support.office.com/en-us/article/change-the-color-or-style-of-a-chart-in-office-f4db3f23-f5a1-4b30-abb3-62e8c2c33d9b

hey! thanks a ton for this tool, it’s been super helpful. I’m working on a budget that has some one-time expenses (for construction) and then other items which are recurring costs (some once/month, others once/3months). I’m wondering if there’s a way to add this into the existing tool so that I don’t need to manually add the recurring expenses at different frequencies? Thanks in advance for your help. 🙂

Hi Francesca,

Unfortunately there isn’t any way to automate recurring expenses like you mention.

To speed up the manual entry, you could copy/paste those recurring transactions and change the dates yourself.

I just wanted to thank you again for this spreadsheet! In the last year I have been to change my spending habits and deposit more money in savings. I even eradicated credit card debt, finished paying off one of my college loans and raised my credit score.

I just lost my job this week due to the coronavirus, but I have enough money to tide me over for over a month. I’m determined now more than ever to reach my goal of having 3-6 months income in reserve in future so I can be prepared for any setback.

That’s amazing Pammi. Your progress is inspiring, keep it going!

Best wishes for you and your family during this crisis.

As like everyone else, thank you for putting this together.

I just went through all the comments to see if my question was already asked and didn’t see it.

I would like to ‘ignore’ a certain expense category from the analytics. When pasting in my transactions, there are a number of ‘transfers’ from other institutions, like a credit card payment from a chequing account. I don’t want this to be tracked as a purchase or other expense since it’s just moving money from one account to another.

Is there a way of ignoring categories? Kind of like how the dashboard has the ability to filter on a single category, can I filter on ALL except one category?

Thanks again

Hi Ryan,

In the excel version of this tool, you can use the “Hide” column F on the Expenses / Income tabs to do this.

By entering Y in that column beside a certain transaction, the tool will then ignore that transaction from all calculations and analytics.

Unfortunately this ‘hide’ feature doesn’t exist within the Google Sheets version. You’d need to manually delete transaction rows in order to remove them from the calculations.

I hope this helps!

Hey great work!

Is there a version with the euros currency?

Thanks Luca.

There isn’t a version in euro currency format, but you could make that change manually.

To change the format of cells, here is a guide: https://www.howtogeek.com/240316/how-to-change-the-currency-symbol-for-certain-cells-in-excel/

Pretty much all the cells currently formatted as $ would need to be changed.

Otherwise, you can just use the default version and ignore the “$” symbols. It’s just a visual formatting. For example, you could just consider $1,000 to be the same thing as €1,000.

Hi, I did this for all the tabs except Dashboard. How do I change the format of the currency in the the charts?

Hi, you can try the steps here:

https://www.techrepublic.com/article/change-your-excel-charts-number-formats/

Hello, I love the spreadsheet. I already use your net worth tracker and I am trying to populate this one now.

I am running into a snag for the date cells in both income and expenses tabs.

I am trying to input my expenses for June, when I type 06-01-2020 for the expense date, excel returns a message prompting me to put a valid date format. When I switched the months and days as per the above format I get the same message.

Can you please help me?

Found a solution up in the comments! For some reason you have to enter the dates as YYYY-MM-DD, then the cell converts it to the given example of MM-DD-YYY?

Hi Timo,

I’m glad to hear that you sorted out the date issue. It’s a bit strange, a small portion of users have had issues with the date formatting. Sometimes, it is DD-MM-YYYY that fixes it, whereas sometimes YYYY-MM-DD does the trick.

Not sure why! I’m guessing it has something to do with the excel version / operating system / default system date settings that people have on their computer.

For some reason when I try to put in the date, it keeps throwing the error message that I have an invalid date format. I was putting in 05-01-2020 for May 1, 2020. I even tried reversing to 01-05-2020, but I’m still getting the prompt.

Hi Sherri,

Can you try YYYY-MM-DD format instead? i.e., 2020-05-01 for May 1st, 2020.

Some users have reported problems with the dates. I think the formatting gets swapped around depending on a user’s operating system, default system date settings, excel version, etc…

This tool is awesome. I’m obsessed. Thanks so much for sharing!

You are most welcome Amanda 🙂

Really happy to hear that — thank you for letting me know.

Please feel free to share with friends and family who could benefit!

When copying new expenses or income into the spreadsheet, I notice that you can’t add rows at the top of the sheet. The “Budget Targets” total will only calculate from the first previously existing row. Originally it is row 8. If you had 5 rows it will only start from row 13. Is there instruction related to this anywhere?

Must say as previous poster, Amanda, I too am obsessed with this tool. Awesome work in putting it together and sharing it with everyone!

Thanks Andrew 🙂

Hi Andrew,

When building the spreadsheet, I’d intended for users to enter their new expenses going down in the rows (e.g., row 8, 9, 10, 11, etc.), rather than adding new rows at the top of the sheet.

However, you can add new rows at the top of the sheet by just leaving row 8 blank, and adding your new rows as new row 9s. This way, all the formulas will now take into account the new rows.

I hope this helps!

Just seeing this now. Thanks, Alan.

When adding new Expense or Income Categories, is there any way to sort the list alphabetically without screwing everything up?

Further to last email: If I cut the list of Expenses or Income Categories, sort it in another sheet, then paste it back into the Expenses and Income Categories sheet, it seems to work. Feedback?

Oops, above idea doesn’t work after all.

Hi Andrew,

Cutting and pasting will usually break the formulas, as they get mixed up / out of order.

However, copying and pasting (instead of cutting) will work fine.

Please note that if you re-arrange the order of your categories, you’ll need to go into the Budget Targets tab and re-arrange your budget target amounts accordingly.

Thanks. I’ll give it a try.

Thank you so much for this spreadsheet. It is so helpful to manage my daily/weekly/monthly expenses!

Is there anyway to divide/split amounts in certain categories into two?

For example – my parter and I split 50/50 on groceries, is there a way to show that in the dashboard?

Thanks!

Hi Salmon,

You’re very welcome!

You could try adding some new expense categories, and then splitting the relevant transactions in two.

For example, instead of just inputting $20 for groceries, you would input two separate transactions instead:

– $10 spend for “groceries – partner A”

– $10 spend for “groceries – partner B”

[…] Start using the Budget Tracking Tool. […]

I just saw this…..after looking at countless others on internet. Awesome work again my man!!

While this is mammoth for budgeting..dO you have something similar and MUCH SIMPLER for just expenses, income & networth tracking…like a simpler Quicker on Goog sheets perhaps…that has

1. An income and expense log with all trasnactions – specially those including taxes paid in US and canada etc.

2. Just like ur investment tracker goog sheet – have ability to pull out all tax related trasnaction for the year…from Jan 2019 to April 15 2020 for instance and have a summarized view.

3. See how over the years a couple ha earned and either blew off or saved and how it has reflected in their increasing networth..

thanks

apologies if post above isnt clear…due to typos..improved version 😉

I just saw this…..after looking at countless others on internet. Awesome work again my man!!

While this is mammoth for budgeting..dO you have something similar and MUCH SIMPLER for just expenses, income & networth tracking…like a simpler QUICKEN version of Goog Sheets perhaps…that has

1. An income and expense log with all transactions but ability to have multiple credit card accounts, bank accounts and also a cash at home account.

2. ALl payments and income, specially those including taxes paid in US and canada etc. And all transaction from bank etc. can be imported from a website like mint or personalcapital as a CSV and added to this sheet.

2. Just like ur investment tracker goog sheet – have ability to pull out all tax related trasnaction for the year…from Jan 2019 to April 15 2020 for instance and have a summarized view.

3. See how over the years a couple ha earned and either blew off or saved and how it has reflected in their increasing networth..

thanks

you made my day!

this tool is amaizing.!!!

Cheers 🙂 Happy to hear it!

Hi,

First of all thank you so much for this spreadsheet! Quick question, should I enter my income in as net or gross? Thanks so much!

Hi Brett,

In my personal tracking, I enter my net income (the amount that actually gets deposited in my bank account every two weeks). I’d recommend that others do the same just for simplicity’s sake.

If you’d like to enter gross income and then record taxes as an expense, it would be more effort, but would work fine as well.

[…] 4. The Measure of a Plan Budget Tracking Tool […]

Thanks for providing such an invaluable tool! Wondering if there is a way to see the expenses by category/dashboard for multiple credit cards. My wife and I have separate credit cards and share a joint card so it would be nice to see the breakdown of each card. Thanks again!

Hi Carl,

The spreadsheet can’t do that by default, but you could try this workaround:

– On the Expenses tab, add a new column

– Beside each expense, tag it with a label for what credit card got used — e.g., “My card”, “Her card”

– On the Dashboard tab, use the SUMIFS formula to sum accordingly — you will need to enter in criteria for the date range, credit card used, and expense category

https://exceljet.net/excel-functions/excel-sumifs-function

Pivot tables! They have a short learning curve, and they can be made in Excel & Google Sheets. Just as TMOAP recommends, add that new column in the Expenses tab for Credit Card. Then you create a pivot table for the expenses tab.

If you are using Google Sheets you would add two columns to the pivot table: Expense Category and then Credit Card. Under values just add $ Amount and you should get a sum of all expenditures for each expense on a credit card basis. You can add more columns too (e.g. Vendor). You can get fancy by adding Rows too, but generally I find just two-component column pivot tables are the best if you only care about total money in each category/subcategory.

Thank you so much for this brilliant tool. I was wondering, how can I integrate my current debt into the excel? If I for example have a debt of 1000, where should I put the total amount vs. monthly repayments?

Thank you!!!

Another questions, a rather technical one.

The “income” graphs in the Dashboard tabs are blank, no matter the date range I input. I filled out my income in the “Budget Targets” and “Income” tabs. Any suggestion how to fix these blank graphs?

Furthermore, looking at the “Budget Targets” tab, I have a monthly average difference of $18 between Total Expenses and Total Income (column D) – however – in the “Dashboard” tab, according to the info presented in the “Savings by Month” My average saving is more than $2000. It doesn’t make sense. Any idea what’s the reason for this error?

Thanks again!

Hi again,

You may delete my questions. Apparently the ‘paste as value’ option was disabled because I did not authorise a certain Google Docs Offline extension. Once I did and copied in the info again (as values), it sorted it. thank you.

Great spreadsheet! Quick question regarding the dashboard. How can I create a separate panel to show the Expenses by merchant? IE I want to see which merchant has been getting the most of my money based on the selected time period.

Thanks!

Hi Ehsan,

The spreadsheet can’t do that by default, but you could try this workaround:

Use the SUMIFS formula to sum the expenses on the Expenses tab accordingly — you will need to enter in criteria for the date range, merchant name, and expense category

https://exceljet.net/excel-functions/excel-sumifs-function

First apologies, as this is basically of re-post of my answer to Carl’s question in this thread. I think your situation can be solved the same way.

Pivot tables! They have a short learning curve, and they can be made in Excel & Google Sheets. Create a pivot table for the Expenses tab. If using Google Sheets, you would find pivot tables under the Data tab up top (as of this posting).