May 26th, 2018 | Posted in Tools

Download the Investment Portfolio Tracker spreadsheet:

To make a copy: log in to your google account, click File –> Make a Copy, then save onto your own folder to create your own version). This spreadsheet — like everything else on this site — is completely free, and will always remain so.

[The latest update is now Version 8.9 — published on September 12, 2024, with improvements to make the Monthly Performance script more robust, and to add support for corporate spin-off transactions. If you’re using an older version and would like to upgrade, just open up a fresh version of the sheet, and paste in the info from your old “setup” and “trade log” tabs into the new version. Voila!]

[Previous versions have added features such as: letting you to specify a custom benchmark and see how your portfolio performance compares (many thanks to Alessandro Coscia for building this!), and the additions of the “Monthly Performance”, “Dividends”, and “Realized Gains” tabs.]

Welcome to your new portfolio tracker — the latest, greatest, and only tool you need to monitor your investment portfolio.

All investors — from the index couch potatoes, to the dividend aficionados, to the active day traders — need a tool to track their investment portfolios.

To measure your progress against your financial goals, you’ll need to have a strong grasp on how much money you have, where it’s invested, and how those investments have been performing.

This spreadsheet is easy to use but still comes packed with powerful features:

- Uses Google Finance formulas to automatically pull the current share price of your investments daily

- Calculates the $ and % return of your portfolio between any range of dates

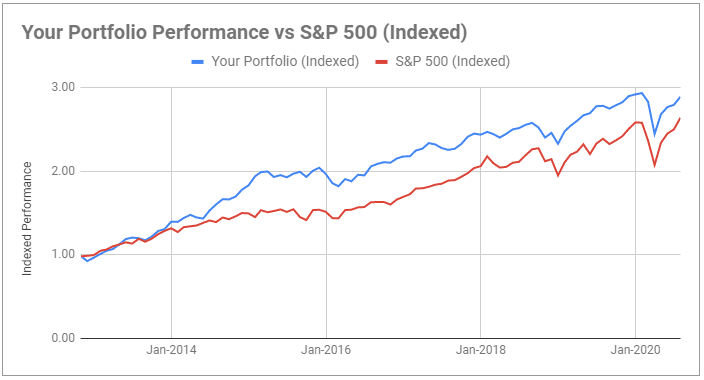

- Comparison of your portfolio’s performance versus the S&P 500 index and any custom benchmark of your choice

- Dividend tracking

- Reporting on realized gains (super helpful during tax time!)

- Flexibility to group your investments into custom categories (e.g., domestic stocks, international stocks, bonds, etc.)

- Tracks assets in multiple countries, and converts all values into one common currency

- Automated re-balancing calculations versus your target asset allocation

- Supports up to 250 stock tickers, 10 investment accounts, 25 investment categories, and 5 currencies

And did I mention that this all comes free? Say goodbye to monthly subscriptions fees, paid premium features, and all that jazz.

Since I published this spreadsheet back in May 2018, thousands of DIY investors from all around the globe have used the tool, leaving comments such as…

“Thanks so much for sharing this. Took me an afternoon to rebuild 4 years of trading history over multiple accounts in different countries. This is really a great tool.”

“Awesome spreadsheet! This is exactly what I’ve been looking for months now!”

“This an amazing spreadsheet and by far the best I have come across so far. I can’t imagine the amount of effort that must have gone into making this so sophisticated.”

I hope that you’ll feel the same way 🙂

Down below, we’ll do a detailed walk-through of the features, along with some tips on how to use the investment portfolio tracker.

Table of Contents

1) Spreadsheet Instruction Manual

- Setting Up The Spreadsheet

- Trade Log

- Your Portfolio Dashboard

- Monthly Performance Tracking

- Your Portfolio Holdings

- Dividend Tracking

- Realized Gains

- Re-Balancing

2) Tips & Tricks

Setting Up the Investment Portfolio Tracker [back to top]

If you haven’t done so already, open the investment portfolio tracker file:

Get the Google Sheets file

To make a copy: log in to your google account, click File –> Make a Copy –> save onto your own folder.

First up, use the “Setup” tab to customize this spreadsheet for your own investment portfolio.

This is where you can set:

- Your investment categories (e.g., domestic equity, international equity, bonds, REIT)

- Your investment accounts (TFSAs / RRSPs for Canadians, 401ks / IRAs for Americans, taxable accounts, and so on)

- The individual ticker symbols for the stocks and ETFs that make up your portfolio (AAPL, VTSAX, VXC, etc…)

A note for investors outside of the US: It’s a best practice to enter your stock tickers including the stock exchange symbol in front of it. Sometimes there is a different company in the US which has the same ticker, in which case google finance will pull the incorrect price. For example, for Bank of Nova Scotia (which is traded on the Toronto Stock Exchange), input the ticker TSE:BNS instead of just BNS (which is traded on the New York Stock Exchange).

To find the precise code to use, just use the search bar on google finance and copy the full ticker that’s shown there.

The Trade Log [back to top]

Once you’re finished with the Setup tab, move on to the Trade Log tab, where you’ll input your history of trades — with each transaction in a separate row.

Let’s take the example of an investor who buys shares of Microsoft (MSFT ticker) over time, then sells a portion of their holdings, and then receives a dividend.

This is what their Trade log tab might look like:

This investor bought 30 shares of MSFT in total, over three separate transactions (10 + 15 + 5).

Then, 12 shares were sold on August 21st for $213 per share. This leaves 18 shares remaining.

As shown on the last row, on September 10th a total dividend payment of $9.18 was received. This is broken down as 18 shares held, with a dividend of $0.51 per share paid.

When you’re entering dividend transactions, only the total $ amount is required ($9.18 in the example) — inputting the quantity of units and amount per unit is optional (18 shares held and $0.51 dividend per share in the example above).

A quick note on tracking cash positions and cash contributions: this tool was built to track your investments (shares held for stocks, ETFs, bonds, etc.), and doesn’t do any cash tracking by default.

Therefore, your trade log only needs to reflect when you buy/sell shares or receive dividends. No inputs are needed for when you add cash or take cash out of your account.

That being said, if you’d like to track your cash balances, please see below in the FAQ section about the $CASH workaround.

Inputting your history of trades into the Trade Log requires time and manual effort, but the reward and insights that you’ll get are just over the horizon!

I’ve got 8 years of trading history in my personal spreadsheet, and now that I’ve put in the work upfront, it just takes a few minutes per month to log new trades and dividends.

Your Portfolio Dashboard [back to top]

The spreadsheet will now handle the heavy lifting!

On the “Dashboard” tab, you’ll be presented with a summary of your portfolio.

At the top of this tab, you’ll find a few drop-down menus which control the outputs of the sheet.

The date cell (C2) determines the date at which your portfolio will be valued. By default, the sheet auto-updates for today’s value, but you can modify this to view your portfolio at at any other date in the past (e.g., at the end of last month or last year).

The currency cell (C3) tells the spreadsheet what currency you want the values to be summarized in. For example, I have this set to Canadian Dollars (CAD $) in my personal spreadsheet since I live in Canada. International investors can convert all values to their local currency with the click of a button!

The account filter cell (C4) allows you to filter all outputs by a specific investment account. By default this is set to show all accounts, but you can use this feature to drill down on the value and performance of any individual account.

The dashboard also shows pie charts for how your total portfolio value is broken down into:

- Individual holdings

- Investment categories

- Investment accounts

- Currency exposure

With this view, you can get a quick snapshot of the total value of your portfolio, and a view of how your investments are allocated.

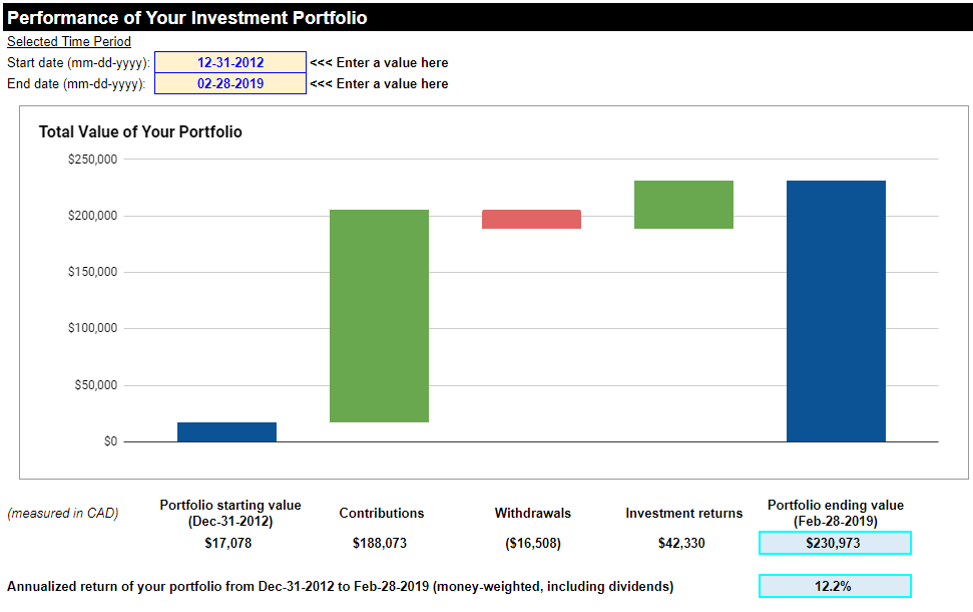

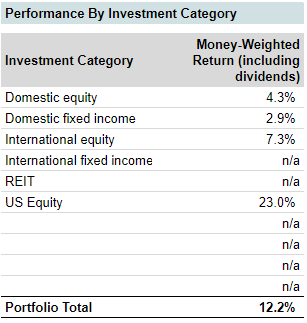

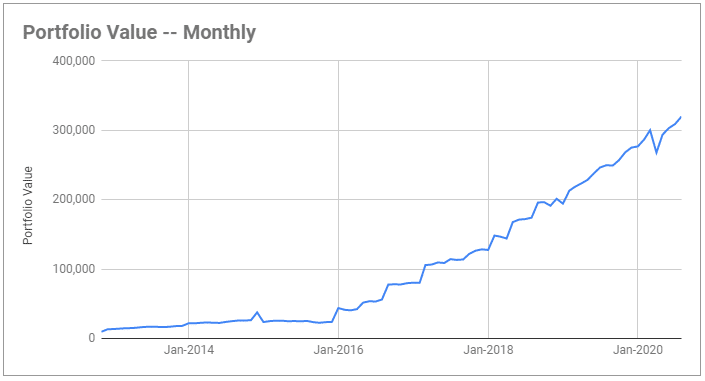

Scrolling down on the “Dashboard” tab, you’ll be able to track the performance of your portfolio over time.

Enter a ‘start date’ and ‘end date’, and you’ll be presented with an overview of how your portfolio grew from start to finish, along with the money-weighted return of your portfolio over that time period.

And just below that, you’ll find a breakdown of your overall portfolio performance by investment category.

Monthly Performance Tracking [back to top]

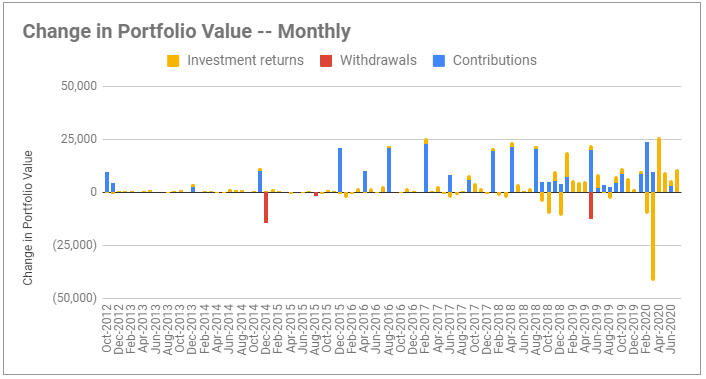

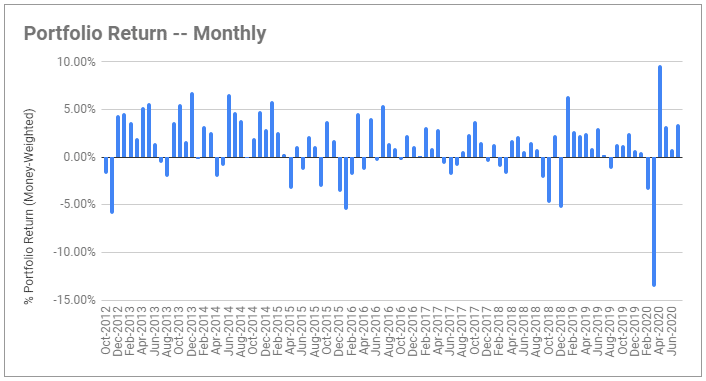

The “Monthly Performance” tab gives you a month-by-month view of how your portfolio is growing, your investment returns, and also allows you to benchmark your performance against the S&P 500 index and a custom benchmark of your choice.

Follow the instructions at the top left, which will explain how to use this tab. It will require you to “authorize” a script to run in the spreadsheet. The tab uses a few lines of code to cycle through each month in your trading history and record your performance values.

Your Portfolio Holdings [back to top]

Digging one level deeper, the “Your Portfolio Holdings” tab shows details about your individual investments.

For each of your holdings, there is info on:

- The number of shares owned

- Your adjusted cost base

- Current market value

- Your unrealized gains

- Your dividends received

Dividend Tracking [back to top]

This tool will also give you a visual overview of your dividend progress over time.

You’ll find a trending report for the last 5 calendar years, and the last 24 months.

Realized Gains [back to top]

The Realized Gains tab shows your profit or loss on shares that have been sold.

Gains are calculated based on the price at which you sold, minus the adjusted cost base of your investment.

The spreadsheet can generate a realized gains report over any date range, and provides various summaries — by account, by category, by currency, and also shows the realized gain for each of your individual holdings.

Re-Balancing Your Portfolio [back to top]

To help you stick to your targeted asset allocation as time goes on, you can use the “Re-Balancing” tab.

After plugging in your target asset allocation values, the tool will provide you with a re-balancing plan to get your portfolio back in line with your ideal weightings.

In the example below, the spreadsheet shows how a contribution of $20,000 would be divided between your investment categories to re-balance the portfolio weights back to your target asset allocation. The results are shown in the cells highlighted in blue.

By default, the “allow for sells” assumption will be set to “No”. This means that the re-balancing calculations will not plan for you to sell any of your current investments in order to re-balance your portfolio.

I’ve set it this way since many people are reluctant to sell parts of their portfolio (preferring to re-balance by adding in new money), and also because selling your investments can trigger capital gains taxes.

If you’d like the re-balancing calculations to allow for sells, just switch the assumption to be “Yes”.

Troubleshooting Tips for the Investment Portfolio Tracker [back to top]

This spreadsheet pulls in the market value of your investments through Google Finance. Occasionally Google Finance will return errors for certain investment symbols or certain dates.

The “Dashboard” tab includes a warning at the top of the tab when it is detected that Google Finance is returning errors.

If you are running into this issue, please try the following:

- Refresh your browser

- Read through the FAQ section below — especially item #5 about using a new copy of the spreadsheet

- If none of that works, you can enter the prices of your investments manually on the “Your Portfolio Holdings” tab, in columns H, AF, and AL (look for prices that are appearing as zero, and manually input the correct price in the next column)

Frequently Asked Questions (FAQs) [back to top]

To keep track of regular dividends that are received as cash:

- Enter a “dividend” transaction on the Trade Log tab, where you input the date, ticker, total $ amount, and investment account where the dividend was received

- It’s not necessary to enter the quantity of shares or amount per share (however, no issues if you do want to enter this extra info) — just entering a total amount in column G is sufficient

To input dividends that are reinvested into new shares (a “DRIP” strategy):

- Enter your dividend as two separate transactions. One transaction is the regular “dividend” transaction, and the second transaction is a “buy” transaction to record the purchase of additional shares

- For example, assume you get a dividend of $20 which was reinvested into 4 new shares of XYZ Corp. Enter two transactions: a “dividend” transaction where you receive a total amount of $20, and then a separate “buy” transaction where you buy 4 new shares of XYZ for $5 per share

- The spreadsheet will now record that this dividend has been reinvested to purchase additional shares of XYZ

Please go to the google finance website (https://www.google.com/

Then, use that full ticker symbol in the investment portfolio tracker, on the Setup tab. Make sure that you delete any spaces in the ticker name.

For example, for the Bank of Nova Scotia company on the Toronto Stock Exchange, enter “TSE:BNS” instead of just “BNS”.

For any stocks or mutual funds which don’t appear on Google Finance, you can do the following in order to have them included in your total portfolio:

- Add a new holding on the Setup tab — any ticker is fine as long as it isn’t an actual ticker on google finance (for example, “$TDB900” for the TD e-series 900 Canadian Index fund)

- Then, use the manual price entry columns on the Your Portfolio Holdings tab (columns H, AF, AL) — since Google Finance won’t return a price per share for these tickers automatically, the spreadsheet will use these manual entry prices instead

Now, the Dashboard tab will show these stocks or mutual funds in your total portfolio value.

Similar to the answer above, try entering the full google finance ticker for the company, including the stock exchange symbol.

For example, for the Bank of Nova Scotia company on the Toronto Stock Exchange, enter “TSE:BNS” instead of just “BNS”. There is another company with the ticker BNS that is traded on the New York stock exchange, so google finance gets confused if you don’t enter the full ticker.

If the market prices still look wonky, go back to the Dashboard and check the date cell (C2). All of the market prices will be pulled as of that date, so much sure that it’s set to the date you want to see!

Absolutely! This investment portfolio tracker can be used by investors in any country. The spreadsheet even allows you to track investments in multiple currencies (up to five), all in one place.

For the calculations and outputs in the spreadsheet, all amounts are converted into a single common currency based on the currency that you select at the top of the Dashboard tab (cell C3).

So, if you now select GBP (British Pounds), all values will now convert to GBP. Likewise for CAD, USD, JPY, etc…

If something just seems off in the spreadsheet — values of “n/a”, “#REF”, or “Error” for example, it’s possible that some formulas were broken accidentally as you inputted your data.

The best way to proceed is to open a fresh copy of the spreadsheet.

Once you’ve done that, copy the values from the “Setup” and “Trade Log” tabs of your old version, and paste them into the fresh spreadsheet.

9 times out of 10 this does the trick!

This spreadsheet calculates the total return of your portfolio over any given time period — including realized gains, unrealized gains, and dividends.

Go to the Dashboard tab, and scroll down to the Performance section. Once you enter a start date and end date, the spreadsheet will calculate the “money-weighted” return of your portfolio.

The money-weighted return is equivalent to the “internal rate of return” (or IRR) of your portfolio. This return calculation captures portfolio contributions, withdrawals, realized / unrealized gains, and dividends received.

If the time period you’ve entered is greater than 1 year, the result will be shown on an annualized basis. As an illustrative example, the tool would show a return of 7% per year instead of a total three-year return of 22.5%.

If the time period you’ve entered is less than 1 year in length, the result will not be annualized. For example, if your portfolio has earned a return of 5% over 3 months, the spreadsheet will show a return of 5%, rather than an annualized value of 21.6% (which would be misleading in my opinion).

By scrolling further down in the Performance section, you’ll also find the money-weighted returns shown for each of your custom investment categories. This allows you to compare the relative performance of different groups of investments (e.g., U.S. stocks, Canadian stocks, bonds, etc.).

Please note that the spreadsheet does not calculate the money-weighted return of individual stocks at this time.

However, you can view the unrealized gains and dividends received per stock over the life of the investment on the “Your Portfolio Holdings” tab.

You can also view your realized gains per stock on the “Realized Gains” tab.

This tool wasn’t built to track cash. However, if you do want to keep tabs on your cash balance as well, you can try this workaround:

- On the “Setup” tab, add a new stock ticker called $CASH (or something else that doesn’t return a market value on google finance)

- Whenever you get extra cash in your account — dividends, contribution, etc., enter in a buy transaction on the Trade Log where you purchase X shares of cash at $1 per share (X being the total amount of added cash)

- Then, on the Your Portfolio Holdings tab, in the manual price entry columns (H, AF, AL), input a value of $1 per share for your $CASH investment

- Now, you’ll see your new ticker $CASH, and the corresponding total $ amount reflected

- If you use up that cash, remember that you’ll have to enter a corresponding sell transaction

I’ve written a script (a.k.a., a few lines of code) that runs when you click the “Go!” button.

This allows the spreadsheet to cycle through each month in your trading history and record the performance of your portfolio — starting value, contributions, withdrawals, investment returns, and the ending value.

Specifically, the script will copy the numbers in row 76 of the Dashboard tab, and then paste those values into columns N to T of the Monthly Performance tab.

Please note that these numbers are “pasted as values”. Therefore, they will not update if you add new transactions to the trade log that impact a prior month.

If you do update your trade log to reflect new transactions in prior months, you just need to delete the numbers found in columns N to T (delete only the data, not the columns themselves), and then re-run the script.

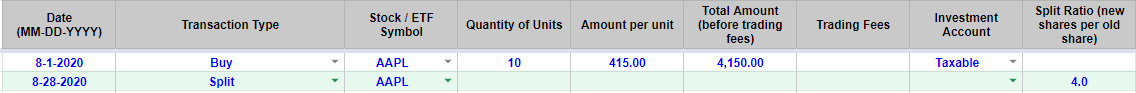

Yes! The spreadsheet can handle stock splits and reverse splits swimmingly.

To enter a split transaction, you need to input the following information in a row on the trade log tab:

- Date when the split occurred — in column B

- Transaction type of “Split” — in column C

- Stock ticker — in column D

- Split Ratio (new shares per old share) — in column J

You can leave columns E through I empty.

To illustrate with an example, let’s assume that you purchased 10 shares of Apple (AAPL ticker) on August 1st, 2020, for $415 per share.

Apple subsequently split its shares on a 4-for-1 basis on August 28th, 2020.

This means that you hold 40 shares after the split, given that you purchased 10 shares initially, and then the split occurred, giving you 4 new shares per 1 old share.

To reflect this on the trade log, you would need to enter two rows of data — one BUY transaction, and one SPLIT transaction:

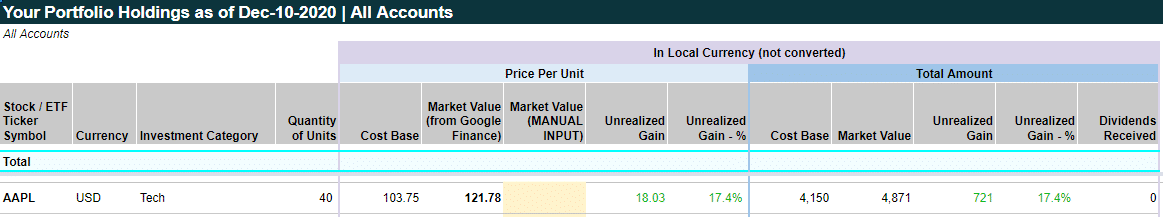

Now, when you flip to the Your Portfolio Holdings tab, you’ll see the correct values:

Notice how you now own 40 shares of AAPL, and have a cost base of $103.75 per share — this is because your initial cost base of $415 per share was divided by 4 after the split occurred.

When you enter a split, you can leave column I (Investment Account) blank.

You only need to enter a split once even if you hold the same ticker in multiple accounts — it will automatically be applied across all accounts when you enter it once on the trade log tab.

In some cases, companies will perform a “reverse” split, where your number of shares will decrease after the split. This should be handled in the same way, where you enter the appropriate split ratio in column J.

For example, if a company does a reverse split on a 1-for-10 basis (1 new share per 10 old shares), you can enter either “0.1” or “=1/10” in column J. The two methods are equivalent.

Unfortunately not.

For those keeping score at home, you’ll know that I have a preference for excel over Google Sheets. However, I haven’t been able to find a reliable way of getting current and historical stock/ETF price data to import automatically into excel.

While Office 365 has a new “Stocks” feature that lets you import real-time stock prices into excel, this unfortunately doesn’t work for historical prices (yesterday, last month, last year’s price, etc).

This spreadsheet uses historical pricing info to calculate portfolio performance between any two dates, so historical prices are a critical input.

Yes they are! This spreadsheet tracks crypto currencies in the same way that it tracks more traditional stocks and ETFs.

On the Setup tab, input the ticker as the label for the crypto currency (e.g., BTC), followed by the label for the currency that it is priced in (e.g., USD). So, if you buy bitcoin with US dollars, the code is “BTCUSD”.

In the screenshot below, I’ve shown the tickers for Bitcoin and Ethereum, first priced in US dollars, then priced in Canadian dollars.

Next, use the trade log to input your transactions as usual.

Now, the spreadsheet will track your crypto currency investments and will include them in your total portfolio value, asset allocation, and all performance calculations.

Yes — the spreadsheet does support fractional / partial shares. Here’s an example portfolio showing an investor buying 0.4 shares of Apple and 0.8 shares of JP Morgan.

If you flip between the Trade Log, Dashboard, and Your Portfolio Holdings tabs, you can see the calculations properly reflected.

In your spreadsheet, you’ll just need to increase the decimal points shown in the columns where the spreadsheet shows the number of shares you hold (I did this in the example I created). As it stands, the spreadsheet shows 0 decimals by default, but you can easily show more decimals by using the toolbar at the top of the sheet.

By default, the spreadsheet is set up to accept dates in MM-DD-YYYY format. For example, February 15, 2021 would be inputted as 02-15-2021.

To change the date formatting to your liking, you can update the format manually in the Trade Log by selecting the cells in the Date column, then Format > Number > More Formats > Custom Number, and then type in your preferred format — e.g., DD-MM-YYYY or YYYY-MM-DD.

You can use this process for any and all other dates cells as well — e.g., at the top of the Dashboard tab.

This tool was built with fairly ‘vanilla’ investors in mind (buying individual stocks / ETFs), so unfortunately it does not handle options or derivatives well.

However, you can try this workaround:

– Add a new ticker symbol on the Setup tab (for example, AAPL-CALL if you are buying calls on AAPL)

– When you buy a call, add a buy transaction on the AAPL-CALL ticker, reflecting the premium paid

– When the call is exercised or expires, enter a sell transaction on AAPL-CALL at the price at which you sell ($0 if the option expires)

The price of this ticker won’t be tracked in real time since google finance does not recognize the ticker, but once you close your position out, the returns will be reflected in the spreadsheet’s performance calculations.

ETFs can give “distributions” in a few different forms. Depending on the type of distribution, there will be different impacts on the adjusted cost base of your investment / different tax consequences.

Here are some good guides for understanding fund distributions:

This spreadsheet allows you to enter various transaction types on the Trade Log — including dividends, return of capital, reinvested capital gains distributions — and will adjust your adjusted cost base accordingly.

Final Thoughts [back to top]

I hope that you’ll get good use out of this investment portfolio tracker. If you have any questions or feedback, please leave a comment below or send me an email at themeasureofaplan@gmail.com.

I’ve gotten amazing feedback on the spreadsheet from investors from all corners of the globe, and I’ve been improving the spreadsheet with new features and outputs on a regular basis (see the change log tab for more details).

When I upload a new version of the spreadsheet, you’ll see a little red box notification at the top of your “Instructions” and “Dashboard” tabs. You can also simply check this page every month or two to see if anything is new.

And that’s a wrap — cheers to good health and growing wealth!

P.S., if you’d like to show your appreciation for this spreadsheet, you can buy me a coffee or beer by clicking the little blue button below 🙂

—

Header image credit: The Sacramento Bee

—

Holy moly this is incredible! I love having all my investments in one place and being able to see the current value without manually plugging in the stock prices myself.

Thank you so much!!

Hey Sam,

That’s awesome to hear! Thanks for sharing.

I will definitely check out your spreadsheet, it looks like it might be very helpful and build on my own spreadsheet.

I have been using this method to get my stock quotes from Google Sheets into Excel. The only downside is the manual step of “refreshing all data” to get the latest stock quotes.

https://www.vertex42.com/ExcelTemplates/excel-stock-quotes.html

Hi Dan, thanks for the heads up on that query method.

Unfortunately this spreadsheet is a little bit more complicated than that; information would need to be passed both ways (from the excel sheet to the google sheet and vice versa), as opposed to only from the Google sheet to excel as outlined in your link.

The reason is that this spreadsheet calculates portfolio returns between two selected dates (both dates can be changed). As such, the excel file would need to pass date info to the google sheets file, and then the resulting stock prices would need to be passed back to excel.

It’s a shame that excel discontinued their direct stock price lookup feature…

I am having a problem with one stock symbol TCAP google finance enters a price that is not correct much higher than the price quoted by other services. tried refresh, exit and reload, reboot, etc. can this be resolved? I sure hope so because this is exactly what I have been looking for… Thanks so much for your effort…

Hi James,

Is the company you are looking for named “Triangle Capital Corp”? That company appears to be called “Barings BDC” now. Google Finance lists the ticker for that stock as BBDC as opposed to TCAP. Perhaps the ticker changed…

Can you try BBDC and see if it works?

In general, the best way to make sure the ticker is correct is by searching for the company at google.com/finance and plugging in the ticker that Google uses. Sometimes companies change tickers, sometimes you need to add the full ticker (NYSE:BBDC) because there is a company on the Toronto or London stock exchange with the same ticker.

Hope this helps.

Problems solved quickly. Faster than any support resolution that I have experienced…

Cheers, glad to hear it Jim!

Thank you. That was the problem. Two other questions if you have time… 1. The totals line on portfolio holdings sheet (line 56) does not show any totals.. 2. The dashboard page doesn’t work. A lot of “#N/A”. Thanks so much. Jim

Hey Jim,

Sorry to hear that. Have you read through the Troubleshooting Section of this post? There are a few things you can try there. Is Google Finance populating market values for all of the stocks that you’ve entered? Perhaps one of the ticker symbols you entered is incorrect.

You can send me a screenshot by email, or better yet share your spreadsheet with me so that I can take a look at what is going on.

Cheers.

Thanks so much for this great spreadsheet! I love it.

Just one questions though: In the trade log I have entered the dividends received. They just don’t sync into my portfolio holdings page as dividends received. Do I need to manually input the values on the portfolio holdings page? Also, are dividend received not reflected on the market value of the Dash Board? If no, where should I best look for my current net worth of my investment?

Once again, thank you so much for this lovely spreadsheet and your time for answering our questions.

Jerry

Hi Jerry,

Glad to hear that you’re getting good use out of this spreadsheet.

Here is how the tool treats dividends / how dividends are factored into returns:

Your dividends received are also shown on the “Your Portfolio Holdings” tab (in column Y). On this tab, the unrealized gains for each of your holdings are calculated based on the market value of your investments as of the date value you select on the Dashboard, minus the cost base of you investment.

For the calculation of your investment returns over time, dividends are treated as ‘contributions’ to the portfolio to the extent that the cash your received was used to buy new investments.

For example, if you receive $100 in dividends, and use that to buy a few more shares of a stock, this money will be treated as a contribution to your portfolio, and will also be reflected in the value of portfolio at the end of the time period. If you do not re-invest this money, it will not be included in your portfolio.

To log dividends correctly in the “Trade Log” tab:

For regular dividends (without DRIP), you should just enter them as a dividend transaction.

For dividends that are re-invested, enter them as two separate transactions. One transaction is the regular dividend transaction, and the second transaction is the purchase of additional shares.

e.g., let’s say you get a dividend of $20 which was reinvested into 4 new shares (implied current price per share of $5). You’d enter a dividend for $20, and a separate ‘buy’ transaction of 4 new shares being bought for $5 each.

This way, your DRIP investment will be tracked properly since your share count will match what you actually have.

I hope this helps!

That’s very clear explanation, thank you very much. I was thinking ‘hmm, where are my dividends gone?’, without thinking that it could be treated as a re-investment.

Big help indeed!

I’d appreciate if you could explain a little bit more because I am not convinced that dividends are correctly treated in your tool. I am not a financial professional so that might be because I missed something…

To me, dividends contribute to the performance of the portfolio. For example, if one share of a stock is worth $100 on Jan 1st and $110 on Dec. 31st and it distributed $10 of dividends, then the returns are +$20 (or +20%). In your tool, I don’t see how dividends are included in the calculation of returns. I don’t think dividends should be treated as contributions because even though they are reinvested, this is not new money transferred in the portfolio. Currently, your tool treats my dividends as if I transferred new money (contributions) in my investments, thus diminishing my returns.

Another example, if I buy 5 shares at $20 each on Jan 1st (portfolio value = $100) and it still $20 each on Dec 31st, but I received $20 dividends on June 30st that I reinvested in one share. Your tool will give a return of 0 while it should actually be +$20. My portfolio cost me $100 from my pocket and it is now worth $120.

Your tool is very helpful and I thank you for sharing it but I can’t use it if I am not fully convinced with the returns it provides. I hope you’ll will have the time to explain me how it works!

Hey Gloubo,

I still re-iterate what I mentioned to Jerry above about how to log your dividends / reinvestment of dividends. However, you make a good point about the returns.

The return calc should factor these in.

I’m a bit busy currently, but I’ll adjust the tool and update you when it is tweaked!

Thanks for pointing that out.

EDIT: As of Dec. 8, 2018, this update has been made and released in version 3.

I want to second that post and that dividends contribute to the performance of the portfolio. It would be great if a future update is created to accommodate for this.

I also second that the spreadsheet is great and very useful. A big THANK YOU for creating!

Thanks FS.

I’ve just released an updated version 3 of the spreadsheet that factors dividends into the return calculation.

Cheers!

Thank you, it works and I love how easy it is to “upgrade” to the new version – only a few copy & paste actions.

Cheers, glad to hear that.

For those who aren’t as spreadsheet savvy as FS, if you are on an older version and want to ‘upgrade’, just copy and paste your data from the “Setup” and “Trade Log” tabs from the old version into the new version. Voila!

Hey Gloubo,

Version 3 of the spreadsheet has now been published. The money-weighted return calculation now factors in dividends.

Thanks again for pointing that out!

This is great! Thanks for the quick update.

Quick question. If I have a previous version the only way to update is to change the file I guess? I’m asking because I made few personal updates as well after I copied the file and It might be hard remembering what I tweaked.

On an unrelated note. It’d be great if you can keep a change log like (https://keepachangelog.com/) to keep track of all the different changes and version 😉

Again keep up the great work!

Thanks Alex.

To move over to a new version you just need to copy & paste the info from your “Setup” tab and “Trade Log” tab into the new version.

Unfortunately you’ll need to replicate your custom tweaks (formulas, charts, etc.) if you want to carry those over.

Re: the change log, great idea. I will do that.

Hello, I’ve been investing for about 3 years with wealthsimple and want to keep know the money weighted returns. I was just reviewing one of the stocks I own which I happen to own in tfsa, non registrered and rrsp account. It looks like each month there’d be several entries to make for ‘non us resident tax’ as well as ‘dividend reinvested’ mulitplied by the number of accounts that stock is in. If I were to multiply this by app 50 stocks the process of keeping up with dividend reinvestimetns (which are very small amounts) seems like it would be quite onerous. Is there a simpler what to just find a ballpark money weighted return? This website is amazing and thank you for sharing your work with everyone.

Hi There. I had sent a question earlier, but I can’t find it and wanted to edit it with the question: how should one track the non-resident witholding tax? It’s not an option in transaction type in the trade log. Sorry for the double questions.

Awesome work! Just a question — and I’m not sure if a bug or stupidity on my own part or what.

I have holdings of the same symbol in two of my accounts (different amount of shares). But in the “Your Portfolio Holdings” sheet, it shows up twice as expected but both entries have the combined number of shares. To word it more precisely, if the combined amount of shares is (80 in account A + 20 in account B=) 100, both entries in that sheet have 100 shares. And I’m almost sure this is thus recording double how much I hold of this category and such.

Is there a way to resolve this?

Hi Luis,

On the “Setup” tab, have you entered in that same symbol twice in the “Portfolio Holdings” table? If so, please delete one of those entries. The intention is for you to enter unique symbols in that table, otherwise it will double count as you mention.

The “Your Portfolio Holdings” tab will then show the combined 100 shares in one row, but only once. The tool won’t be able to show the 80 shares on one row, and the 20 shares on another row if it is the same symbol you own.

Let me know if that helps!

You’re absolutely right. That was a silly mistake.

Hi, I haven’t started using your spreadsheet, but like to ask if there’s a way to add in more currencies?

cheers

Glenn

Hi Glenn,

You can use whichever currencies you want (just need to change the symbols on the Setup tab), as long as you respect the maximum of 5 currency symbols in total. It isn’t currently possible to enter in more than 5 total currencies.

Thanks so much for sharing this.

I have entered my trades – which aren’t that many. However, an issue arises when I enter the following trade:

LON:TSCO – 500 @ 2.23 GBP.

The set-up tab shows the correct total – $1,115. Yet, when I look at the Dashboard, the value of this stock is then inflated 100x to $105,00. This would be great if that were true but sadly that’s not the case.

It is probably to a set-up option – where one is in cents/pence, the other is in dollars/pounds.

Any idea how I fix this?

Many thanks

Hey Damian,

I scrubbed through the file this morning. I think I’ve made the fix. Can you please try opening up a fresh version of the spreadsheet, and then re-pasting your old Trade Log into the new spreadsheet?

I’ve tweaked the formulas so that if a stock is in GBP, that the price from Google Finance is then divided by 100. Issue is that most stocks report the price in dollars, while British stocks are in pence.

Let me know if this works.

PS – unfortunately there’s no way to easily format all the currency as the pound symbol instead of the dollar symbol depending on what the user selects, so you’ll just have to mentally note that the figures are in GBP even though a $ symbol is showing up…

Thanks for the new version of the spreadsheet – and sorry for the delay in getting back to you. At first glance, the new version divided all my investments by 10 – so I simply reverted to the previous version, and left off the TSCO stock, for now, And the previous version works a dream. I will take a closer look at the spreadsheets later this week and get back to you. But thanks again for your help.

How can i add in KLSE stock in my portfolio? Google sheet doesnt seem to recognize it despite i’m able to find it on Google Finance (Eg. PBBANK:KLSE)

Hi Jerry,

I just tried on my end as well (KLSE:PBBANK) and it returned an error. After some googling around it seems that Google Docs cannot access price data from certain stock market exchanges for some strange reason — even though it shows properly on Google Finance. The Malaysian market KLSE seems to be one of those.

See here…

https://productforums.google.com/forum/#!topic/docs/HDnOnJc8MRE

Unfortunately there doesn’t seem to be a work-around that Google has proposed. Sorry about that.

Awesome spreadsheet! This is exactly what I’ve been looking for months now! 🙂

Just a quick question.

How is the total Contribution calculated on the Dashboard sheet? I assumed is the sum of all “Buy” transactions in the Trade Log, but by calculating the sum manually on the log sheet, I get a slightly different value (1% short) from the one in the Dashboard. Not sure why.

I checked all the functions too. Am I missing something?

Thanks in advance for the help! And again. Awesome job!

Hey Alex,

Glad to hear you found what you’ve been looking for.

To your question — in your trade log have you invested in assets in more than one currency? The trade log column G is the total amount of your trade in “local” currency (e.g., in CAD if a Canadian stock, and in USD if an American stock). However, when you go to the dashboard, everything has been converted to one common currency.

For the overall concept you are absolutely right — the total contribution amount should be equal to the sum of all your buy amounts.

Let me know if you’re still having an issue reconciling.

Really great tool ! Would you consider adding the time weighted returns in the dashboard?

Hey again Gloubo,

Time-weighted returns are more complicated given that it would require a recalculation of the entire portfolio value at each date at which money is added or withdrawn from the portfolio. This means Google Finance quotes would need to be pulled for each holding.

The spreadsheet is already quite slow, so unfortunately I don’t want to burden it further.

Thanks for the comment.

I use a simplified method where I just input the portfolio value once a month when I receive my monthly statement. This is especially useful to benchmark against index.

Hi Thanks for the spreadsheet. I am trying out for the first time. when I input a stock (Genting Singapore Ltd G13) the Valid Symbol on google finance ? returned a #N/A. The command says, Not authorized to access data on exchange. Can you help ?

Hi Law,

It seems that Google Docs cannot access price data from certain stock market exchanges for some strange reason — even though it shows properly on Google Finance. The Singaporean market SGX seems to be on that no-go list.

See here…

https://productforums.google.com/forum/#!topic/docs/HDnOnJc8MRE

Unfortunately there doesn’t seem to be a work-around that Google has proposed. Sorry about that.

Quick tip that I’ve found useful.

For each holding that’s not on Google Finance I just import the quote from Bloomberg with the following function.

=IMPORTXML(“https://www.bloomberg.com/quote/”&B7,”//*[contains(@class,’priceText’)]”)

Where B7 is the “Bloomberg Symbol” of the holding you’re looking for. In case of “Genting Singapore Ltd G13” it will be G13:SP.

The drawbacks are

1.If you want to update the function and the quote you need to reload the file (I believe Google Finance pulls automatically the quote every 20 min or so)

2. When Bloomberg will decide to redesign their site, most likely the function will return an error. This is will happen when the HTML class of the element containing the current price quote is renamed to something different from “priceText”

Let me know what you guys think.

The IMPORTXML function is awesome but requires some knowledge of HTML to find the data that you need on every webpage.

Very cool, thanks for pointing this out Alex.

Do you know if you can use IMPORTXML to get historical price data from Bloomberg (e.g., ability to pull the closing price as of any previous date)?

This investment portfolio tracker needs to be able to do that to calculate portfolio returns, given that you can enter a start and end date and get the return for that period.

Not sure if this function can do that.

I just use it to override all the manual inputs in yellow and speed up the process instead of going online and looking for the day’s market value.

MPORTXML takes a snapshot of the current state of a web page when invoked and retrieves a specific value determined by a specific HTML attribute. It can’t store this specific value or go back in time unless Bloomberg (or any other site) stores already these historical values and renders them all on a page.

Hope that helps. 🙂

Good to know. Cheers!

Hi,

Thanks you for this tools, great job.

I’m trying to use it with investment in two different currency.

In the dashboard, i guess there’s a currency conversion to CAD ? What is the rate/source ?

Do you think I should create two different portfolio sheet for the two currency ?

Cyrille

Re,

It’s ok, found everything I need to know.

Again great Job.

Cyrille

Thanks Cyrille, you’re making my job easy 🙂

I will respond to your questions anyways, in case this will help other users.

Yes, if you have investments in multiple currencies, these will all be converted to your selected common currency on the dashboard. The source for these currency exchange rates is google finance. If you go to the “Your Portfolio Holdings” tab in column AA, you can see the rates that are used. These are pulled as of the date you select on the dashboard.

I recommend that you track all your investments in one spreadsheet, it will be easier that way. Personally, I have investments in both CAD and USD, and I track everything in this one sheet.

Cheers!

Hi,

Though I find your sheet very helpful, I am trying to tweak it to give me a portfolio of only a single asset class (domestic India Equity) for a single currency (INR), which I also want to balance to target allocations given a list of ~ 40 individual stocks. What is the best way to do this?

I am also unable to figure out how you incorporate splits/bonuses (I don’t know what the input data format is for splits/bonuses in the Trade Log sheet), since the quantities/prices in the Trade Log sheet aren’t automatically updated for splits post the initial purchase dates.

Thanks

Hi RK, thanks for the message.

Everything is customizable on the “setup” tab, so you can set up the asset categories as you wish. For example, you could bucket your 40 individual stocks into 6 industry groups (e.g., tech, energy, healthcare, consumer staples, etc.). Up to you.

To enter in stock splits, just add this as a new transaction row. Select “Split” in column C, select the stock ticker which is relevant, and then enter the split ratio in column J (new shares per old share). e.g., if your share count has doubled, enter in a value of 2.

Any previous transactions for that stock will be automatically adjusted on the “Dashboard” and “Your Portfolio Holdings” tab. Note that the trade log itself is not adjusted, but all calculations for that stock are adjusted so the figures are correct.

For example if you purchase 4 shares on Jan. 1st, and then split 3-for-1 on Feb. 1st, the tool will consider that you own 12 shares now. Again, this is shown on the Dashboard and Your Portfolio Holdings tab, not the Trade Log tab. The trade log tab is meant to be an input tab only, not an output.

Great tool–thanks for sharing!

My roboadvisor does automatic Tax Loss Harvesting. This makes my Contributions and Withdrawals look out of whack. What edits would you suggest in order to account for TLH so that the Performance graphs have more meaning?

Similarly, I saw your comments here and on Reddit about reinvested Dividends showing up in the Contributions. Any ideas or plans to change how reinvested Dividends are represented in the Performance?

Hey Nukem,

Tax loss harvesting is a tough one. I’m assuming that your performance charts show very high contributions and withdrawals given that positions are sold and then the money is re-invested.

One thought would be to record your robo-advisor position as a single aggregate investment. i.e., instead of recording each of the underlying investments that the robo-advisor holds, just record the total amount. This way, the performance figures would have more meaning.

The downside would be that you’d need to manually record the price info (see the “Your Portfolio Holdings” tab), and you wouldn’t be tracking the granular data on holdings.

On reinvested dividends, those are now accounted for properly in the calculation of returns. They still show up as contributions, but they now count towards performance.

Hey,

Awesome… Really great spreadsheet… Thanks for sharing it!

Hey Arcadi,

Glad to hear it, thanks for letting me know!

hey,

Thanks for sharing this. Really great work.

For fixed income assets like GICs or Term Deposits…

1) if an investment was purchased on Day0 for $10,000, do you recommend putting “$1” for “$ per unit” and “10,000” for “Quantity of Units” upon purchase?

2) and the investment was sold on Day1 for $11,000 on Day1, you’d put “$1.1” for “$ per unit” and “10,000” for “Quantity of Units” upon purchase?

Is this the best way to approach it with this spreadsheet?

– what’s the best way to account for idle cash in this spreadsheet?

– in what situation would you use “Return of capital” for a Transaction Type in the trade log? Are you able to walk through an example and how it impacts the return calculation?

Hi Chris,

For GICs / term deposits, the method you describe would work. You can also input it as 1 single share (e.g., you purchase 1 share for $10,000 per share initially, and then later sell the investment for $11,000 per share). Whichever you prefer.

I use this tracker purely for my investments in stocks and bonds, so there’s no automated tracking of cash here. However, one workaround is to add a investment called “Cash” on the Setup tab, and then add “buy” or “sell” transactions on the trade log to reflect changes in your cash balance.

For return of capital transactions, here is an overview of what they are: https://investinganswers.com/financial-dictionary/investing/return-capital-roc-914

Your brokerage account statements should tell you when these transactions have occurred.

ROC transactions impact the investment returns similarly to how a dividend would be treated — they increase your money-weighted return. For example, if you buy an investment for $100 on Jan. 1st, the investment grows to $110 by Dec. 31st, and you receive a $5 return of capital during the year, your return for the year would be 15%.

Awesome spreadsheet!! Has everything I’m looking for in one place the only thing I can’t seem to find or figure out is my gain or loss for tax purposes for each stock bought and sold in a particular year (Short Term or Long Term Gain). Am I missing something or is it possible to add another Tab (Tax Exposure) at the bottom similar to Your Portfolio Holdings but for Realized Gains/Losses to reflect tax exposure for each stock bought and sold in a given tax year, or perhaps another column showing the tax data in Your Portfolio Holdings. Thanks again for creating this awesome tool!

Thanks for the comment Kim.

You are not missing anything — unfortunately this tool doesn’t contain any tax calculations at the moment.

On the “Your Portfolio Holdings” tab, you can see the unrealized gains on all of your holdings (e.g., your profit / loss on your current portfolio). Note that these are unrealized gains, so they do not take into consideration positions that have been sold.

A workaround that you can use now is to set the date on the dashboard to be the day before you sold a position. Take note of the adjusted cost base per share of your investment at that date. Then, use that ACB per share to calculate your capital gain/loss based on what you executed the trade at (for example, if you sold at $30 per share and your ACB per share was $20, you have a capital gain of $10 per share).

The complication with adding in automated tax calculations is that the adjusted cost base of the investments would need to be tracked separately for taxable and non-taxable accounts. For example, if you hold the same investment in both a TFSA and a regular taxable account, your adjusted cost base for tax purposes should exclude the TFSA.

As it stands, this tool aggregates all instances of the same investment ticker into one row.

At first glance, this would be a relatively complicated change. If I release another version of this tool, I will try to add in this feature.

Thanks for the reply. Appreciate the info.

Interested in utilizing this spreadsheet. Would this be able to capture the diversification of my mutual fund holdings?

Hi Mayor,

This tool uses google finance to grab the current market values, so if you’re able to find your fund here: https://google.com/finance, then it should work in the tool.

If that doesn’t work, you’d have to manually enter the NAV per share of your mutual funds into the tool.

What does that mean? (pardon my ignorance, I don’t use Google Sheets or even Excel). For example, Tangerine Equity Growth Fund (INI240) isn’t pulled by Google Finance. How does one enter the price manually under the NAV?

Hi DR,

The Net Asset Value (NAV) per share of a mutual fund is the current market value of one share of the fund.

For your Tangerine fund, you can find the NAV per share online, for example: https://www.theglobeandmail.com/investing/markets/funds/INI240.CF/

Your fund has a NAV of $19.68 per share as of April 26, 2019.

Since this spreadsheet tracker isn’t able to automatically find and input this value for you (since it is not available on google finance), you would need to manually input the values yourself.

You can do that on column H of the Your Portfolio Holdings tab in order to calculate the current value of your portfolio.

If you want to do performance tracking, you’d also need to input the values in columns AE and AJ of the same tab.

Thank you for the spreadsheet! How can I get the TSX symbol/price? If I enter for example BNS, I get the price in US $ Iin the portfolio tab. Thank you

Hi Ed,

If you enter “TSE:BNS” as the ticker on your Setup and Trade Log tabs, this will grab the Canadian price instead.

In general, adding the stock exchange (TSE / Toronto Stock Exchange in this case) before the ticker would be a best practice.

Hi , What a fantastic spreadsheet one of the best i have used for a long time. Thank you for all your efforts.

I have a small problem with the second chart, your investment categories – the chart isn’t showing, and a error message is there : “Couumn 2 must be numeric”

Any help please most welcome.

Hi Carl,

Thanks for the kind words! Sorry to hear that you’re having issues.

Can you share your spreadsheet with me by email (see the bottom of the post) so that I can take a look and troubleshoot?

Thanks for your reply, I actually worked it out myself, just needed to copy a few cells around that were missing on my side- so all good now.Works really well.

Have you thought of creating a total wealth sheet, which would link the investment sheet, with information on bank accounts (manual input – not linked to the actually banks, maybe linked to the budget sheet you have made? ) c other investments, cards etc, for a one sheet overview of were ones money is, as a high over view.?

Once again thanks for all your efforts on these sheets, they have inspired me very much.

Carl

Thanks Carl.

I’ve built a simple sheet to track my net worth over time here: https://themeasureofaplan.com/getting-your-ducks-in-a-row/

At the end of each month, I spend a few minutes to log in to each of my accounts and manually input the current balance. This sheet then provides a history of my overall net worth by month (total assets, debt, implied net worth).

In the future I may try to build something more sophisticated that auto-links to some of the other tools I’ve built, but I think my system works fine for now, and I don’t want to over-complicate things for users.

This is awesome; thank you! Anyway you can add a calculation to calculate dividend revenue by month and year? I would like to track dividend progress. Thank you!

Thanks Div Interest.

I’ll try to add that in for the next version, to be published hopefully this month.

Hey Div Interest,

I just released version 5.0 of the investment portfolio tracker. On the “Dashboard” tab, you’ll now find a section which tracks your dividends received over time.

There is a report on dividends received over the past 5 calendar years, and also for your monthly progress over the past 24 months.

Thank you again for adding the dividend tracker. This is a really awesome tracker. A couple more requests if I may:

1) Investment Categories: Anyway to make this 20? Or add a new version. I like to track performance through sectors and there are at least 10 of them. Add to that, I like to track index funds separately so 10 is not enough. So perhaps a Sector section?

2) I don’t think the Investment Returns calculation is how I would normally track my returns. It calculates all my sells as withdrawals which somehow distorts my return value. While I rarely sell, I do so sometimes and I re-invest my money always. I found that unless I use Reinvested Capital instead of Buy, it distorts the return value. However, I do not like using that because my sold money mixes up with my contributions and therefore hard to track. How about make an assumption that all new contributions are from sales until the contribution amount exceeds the sell amount and then the assumption can be any money over that is net new money to the account?

Again, this is by far the best tracker I could find.

1) I’ll test out adding some more investment categories. The spreadsheet is a bit slow as it is, so I don’t want to add too much more weight.

2) The spreadsheet treats all buys as contributions, and all sells as withdrawals. If you reinvest the proceeds from a sell, this will have no impact on your performance figures. See this simple example that I created: https://docs.google.com/spreadsheets/d/1kl0Zws1mRvu1K14z4qWjxz7HcFhwfiOobS59gPuBwJ8/edit#gid=0

You’ll see two examples. The first example treats the sell as a withdrawal and the reinvestment of the proceeds as a contribution. This is how the tool works today.

The second example ignores the withdrawal and contribution. The money-weighted return calculation is exactly the same between these two methods.

When you calculate your own returns, are you calculating the money-weighted return?

Took me a while to get around to this. I am referring to Investment Returns calculation. I calculate it the following: net sales proceeds + dividends + unrealized gains. I calculated the net sales manually and added dividends and unrealized gains from your spreadsheet and my numbers are ~58% higher.

I calculated sales by taking average of all sales from average of all buys (even if I did not sell everything). Your calculation looks like it does not take into account dividends because when adding sales + unrealized gains, it was pretty close or simply a coincidence.

Hmm, that’s strange that we are getting such different numbers.

I’m using a money-weighted methodology to calculate those returns (https://www.investopedia.com/terms/m/money-weighted-return.asp). The calculation used already takes dividends into account as well.

What time period are you using to calculate your return? The tool will give you an annualized return if the period is longer than one year, and a simple year-to-date return otherwise.

I am only referring to “Investment Returns” calculation (cell F76 in “Dashboard” tab) and not the time weighted return. When I look at the calculation (cell B1581 in “Calculations” tab), it only counts Buys and not Dividends or am I wrong?

Thanks for always being responsive.

Which version of the tool are you using? In December, I changed the return calc to include dividends. That was version 3 — the latest is now version 5.2.

Also, FYI there is no time-weighted return in the tool. Only money-weighted. When I say that the return is annualized, it means that return periods longer than one year will be converted back to an annual rate.

For example, if you had a return of 12% over 19 months, the tool will actually show you an annualized return of 7.4% instead (1.12)^(12/19)-1.

I am using 5.0. I don’t think the version is an issue. I also do not care about time weighted return. I am referring to “Investment Returns” which gives me my total return over the life of the investment. The calculation does not include dividends IMHO in cell B1581.

I took a look at v5.2 and the cell I am referring to there is B1596 (Contributions). Your calculation for Investment Return is this: Portfolio Ending – (Portfolio Starting + Contribution – Withdrawals)

The issue is none of the variables in this calculation are accounting for dividends unless I am missing something?

1) Portfolio Ending is value of stocks held at end of trading day

2) Portfolio starting is value of stocks held at end of day

3) Contributions is stocks bought

4) Withdrawals is sales

Where is dividend calculated? You would either need to add it to Contributions or add it as a separate variable. I would prefer it as a separate variable.

Thanks.

Hi Div Interest,

I think I understand now. The Investment Returns cell on the Dashboard (cell F76 in v5.2) and the money-weighted return calculation (cell G78) are two different things.

The investment returns cell shows the implied returns to reconcile the starting portfolio balance to the ending portfolio balance. Investment returns = ending – starting – contributions + withdrawals

This spreadsheet tracks your investment portfolio (i.e., the investments that you currently hold), as opposed to tracking your total cash balance. So if you receive dividends which are not re-invested back into the portfolio, that cash is no longer in your portfolio. Thus, it is not in the ending portfolio value, and therefore also doesn’t appear in the investment returns amount. I cannot add a column for dividends without throwing these figures off-balance.

i.e., if you hold $50K of stocks and $3K of cash, this spreadsheet only tracks the $50K (as opposed to $53K).

However, for the purposes of the money-weighted return (cell G78), dividends ARE included in the return calculation. If you want to see the full backup where they are included, see the tab “Calculations”, in the section Money-Weighted Return, starting on row 282.

In columns C and D, you’ll see that dividends are included. Thus, if you had a price return of 8% per year, and a dividend yield of 2% per year, your money-weighted return will be 10%. This 10% figure will then be reported on the dashboard in cell G78.

This money-weighted return is the relevant figure to look at when considering your portfolio performance.

This is a very useul spreadsheet. Thank you. I have one (noob) query. How do I enter bonus shares? The Transactions drop-down list doesn’t have that option.

Thanks Chidra.

By bonus shares, do you mean a “stock dividend” transaction where the company issues new shares to each of its existing shareholders?

If so, you can just add a new “buy” transaction on the trade log where you buy the number of new shares you’ve received for a price of $0 per share. The net effect will be to increase your share count without impacting your adjusted cost base for that investment.

I hadn’t heard the term “stock dividend” before, but yes, it’s when a company issues new shares to existing shareholders free.Thanks for your prompt answer. That should solve my problem.

For some reason some of the information I have entered into the Trade Log does not appear in my Portfolio Holdings.

Specifically I have enter 30 shares of AAPL at 170.52. It show Quantity of Units as 30 but shows -0- Cost Base in Portfolio Holdings.

I have tried to copy and paste the formula and also deleted and re-entered the transaction but have not had any success.

Any suggestions?

Thx

Hi Kim,

A couple ideas:

– Is cell C2 of the dashboard set to a date that’s after the date you bought those shares?

– Can you try opening up a fresh version of the spreadsheet, then pasting in your data from the “Setup” and “Trade Log” trade logs tabs into the new version? Doing this type of refresh can often fix things if you accidentally changed or deleted some formulas

If it still doesn’t work, can you share your spreadsheet with me by email? I can take a look and troubleshoot.

Thanks for the quick reply. Dated is set for after. I will try a fresh install as suggested and see how that works. Thx

I have just spent the last several weeks with version 4.4 of the spreadsheet and it is absolutely fantastic! Thank you, I love it.

I found a bug in the Trade Log: Cell L2 uses the Setup Sheet, but only goes to column $C$86, when there are 100 more rows in the Setup, so it should go to $C$186. Likewise in the same formula for B86 (should go to B186.

Question: Is it okay in the Trade Log sheet to enter rows non-date order? That is, do the dates need to be ascending or descending order for everything to work properly?

Question: Contributions and withdrawals don’t look right to me on the Dashboard. The source cells on the calculations sheet only has two rows of meaningful data under “# of cash flows in period”. How does the spreadsheet indentify or define Contributions and Withdrawals?

Now, I have a few feature requests, and I am hoping these will be easy to do:

1) I added 1000 rows to the trade log because I had more than 1000 buys/sells/splits. At first, this broke a bunch of stuff but I am spreadsheet savvy so I was able to fix everything. Now I realize that as you release new versions I will have to make the same changes I already made again and again. So my request is for you to add 1000 rows to the Trade Log

2) My portfolio is complex. Could you add these items to the Setup tab:

– another 100 rows to Holdings?

– another 5 rows to Accounts?

– another 10 rows to Investment Categories?

3) I invest through several different investment strategies, and I like to track how these are doing, so I used the Investment Categories to manage this breakout. Works awesome. And this drives me to (yet another) request: On the dashboard tab/Performance Area, would it be possible to add a drop down input box allowing to see performance by Investment Categories?

4) Finally, I purchase Options and google finance does not seem to be able to pull prices for options. Would love to add ability to track options as a over the top feature request.

Thanks again for a really useful tool for tracking investments!

Hi Gary,

Thanks for your comment. You’ve clearly done a detailed scrub-through of the tracker, and I’m glad to hear that you find it useful.

– Good catch on the formula on the “trade log” tab which was only picking up 50 stocks instead of the full list of 150. This is now fixed

– You don’t need to enter your trades in sorted date format. The formulas can deal with any random date order. My own version of the spreadsheet (which is not the most organized) can attest to that…

– On the “Dashboard” tab in the Performance section, you can select the start and end dates for which you’d like to analyse your portfolio performance. The spreadsheet calculates the market value of your portfolio on those start and end dates. Then, the “contributions” are simply the sum of the value of all your “buy” transactions from the Trade Log IN BETWEEN the two selected dates, and the “withdrawals” are the sum of the all your “sell” transactions on the Trade Log (again between the selected dates). The “Investment returns” figure is then implied based on a formula: investment returns = ending portfolio value – contributions + withdrawals – starting portfolio value. These figures are then used to calculate your portfolio money-weighted return (using an IRR formula)

– In the new version 5.0 of the tool, I added a table in the Performance section on the Dashboard which breaks down your overall portfolio return into a return by each investment category. I believe this will address your ask #3?

For your feature requests, I will mull them over a bit further. As the spreadsheet already runs fairly slowly, I’m a bit hesitant to add too much more weight (more than 150 stock tickers, more investment accounts / categories, etc.).

When I have some time, I’ll do some testing to see what I can add without adding too much more run / update time.

Re: options, I don’t know of a way to auto-pull market values for these, but if I come across something I’ll try to add it in.

Thanks again for your comment.

I just upgraded to version 5 and I see that my feature request #3 above is essentially fulfilled. Shazam! Thanks!

Cheers 🙂

I left a response to your other questions & requests yesterday as well. See above.

Hi Gary,

I just wanted to follow up on a couple of your points…

I had some spare time (plus motivation / coffee) today, and managed to make some changes to the investment portfolio tracking tool.

Version 5.2 (just uploaded!) now allows the user to input 2000 transactions on the trade log (up from 1000), and for your portfolio to be grouped into 25 investment categories (up from 10).

I tweaked a few of the formulas as well to speed up the calculation time, which mostly offset the extra bulk added by the increase in transactions / categories.

I’ve yet to add in more portfolio holdings / investment accounts, but hope to get to that soon-ish.

Cheers — hope this helps.

How do I globally change the currency throughout the spreadsheet? I would like to change $ to ₹ (code: INR) without breaking anything.

Hi Chidra,

Unfortunately I don’t know of an easy way to do this in Google Sheets. If you want, you can manually change the $ symbol wherever you see it in the spreadsheet. See this tutorial: https://infoinspired.com/google-docs/how-to-get-your-own-countrys-currency-format-in-google-doc-spreadsheet/

Thank you. I’ll look at that.

This is a brilliant way to track your investments, really great work on the Google Sheet!

I’ve built an Excel Add-In (https://www.excelpricefeed.com) which feeds live financial data to cells via simple formulas. I currently have data from Yahoo Finance and IG Index, I am working on other data providers.

For example to populate a cell with the latest Apple stock price simply use: =EPF.Yahoo.Price(“AAPL”).

I’ve used it to build a much simpler portfolio in Excel: https://www.excelpricefeed.com/tutorials/excel-realtime-stock-fund-portfolio

which retrieves price data from Yahoo Finance and has some simple currency conversions, valuations etc using live data.

I will see how I can implement some of your ideas in conjunction with my Add-in so I can use Excel rather than Google Sheets.

Thanks again for doing this.

Thank you. Noticed the the monthly dividend tracker in Dashboard does not show February…it duplicates March instead.

Hey Interested,

Thank you for pointing that out. I realize the formula I used to generate the dates would cause duplication once it got to be the last day or two of the month. This has now been fixed — see the latest version 5.1 of the spreadsheet.

Cheers.

I’ve been using this sheet since Version 1, and just upgraded to v5.2. Thanks for creating this, so useful!

If you ever find time in the future, it would great to be able to be able to filter asset allocation (‘Your Investment Categories’) by Investment account, to see performance by individual accounts and not just the total portfolio.

Cheers.

Thanks Mike! Having a filter for investment accounts is a great idea — I hadn’t thought of that before.

If I manage to build that, I think I will move to v6.0 🙂

Hello, My apologies for what may be the most obvious questions.

1. When I plug in a trade, for example AAPL, the market value under My Holdings is inaccurate and doesn’t update by refreshing the browser. For example, AAPL is listed at $191.24 (currently $200.03). Am I missing a switch that makes the spreadsheet activate?

2. ALB is successfully added to Portfolio Holdings, but when I add a purchase in Trade Log does not calculate into My Holdings (Quantity of Units remains at 0).

3. Am I correct about dividends that if the dividend was received as cash it should be entered once in Trade Log as a dividend (1 unit x $ per unit), and if dripped entered a second time as a buy?

Many thanks! Having no expertise in spreadsheets, and not much in finance, I’ve been looking for a tool like this for a long time. I really appreciate your kindness in making it available and helping resolve issues like mine!

Hi John,

1. At the top of the dashboard tab, there’s a cell that lets you plug in a date. The rest of the spreadsheet will show your portfolio info as that date. If you try entering in today’s date, you should see the same market value per share that Google Finance would show online.

2. Perhaps this is the same issue as in #1. If the spreadsheet is showing your portfolio at March 31st, but your buy of ALB was done in April, the sheet will show 0 units held. Again, changing to today’s date should solve this.

3. Correct about the dividends. You enter a dividend transaction to record the cash received, and then a separate buy transaction if the dividend was reinvested.

Hope this helps!

If other things in the spreadsheet look wonky to you, feel free to share your spreadsheet with me by email. I’d be happy to take a look and troubleshoot.

It does indeed, thank you! Sometimes the most obvious things are the least self-evident. That takes care of 1 and 2, and I’ll get to work now testing the dividends. Thanks again!

Cheers! Glad to hear it works. Best of luck with your portfolio tracking efforts.

Does not recognize stocks from the Philippine Stock Exchange Index (PSEI) and the stocks in it. what seems to be the problem?

I tried to enter stocks from the Philippine Stock Exchange Index. FGEN, FPH, and MER were valid but not the ones I am holding. Other were not valid symbol on Google Finance. I tried to enter PSE:MER but no result. Please could you help me on this?… Thanks in advance.

Hi Feliciano,

Please try going on the google finance website (https://www.google.com/finance), typing the name of the name of the company in the search bar, and copying the ticker that Google Finance shows you (the full ticker including the exchange). Then, use that full ticker symbol in the investment portfolio tracker (Setup tab). Make sure that you delete any spaces in the ticker name.

Unfortunately, google sheets sometimes isn’t able to play nice with google finance and grab the market value. This seems to be more an issue for Asian stock exchanges.

If that still doesn’t work, the only other solution would be to manually input the market value per share on the “Your Portfolio Holdings” tab.

Hello,

Just came across your spreadsheet and must say it’s fantastic! I’m wondering if you could suggest how I would enter holdings that I don’t have the full history. For example I would like to include my 401k holdings but since I’ve had it for many years how would I enter this data in the Trade Log as I don’t even have all the records to indicate purchase date, $ per unit, and # of units. I’m planning to be more diligent with future transactions and would update the trade log with new activity, but just not sure how the enter the “starting” data.

Russ, I’ve been wondering the same thing as I’m coming to this rather late in the game.

A related question, at the other end of the process, is what to do with positions I’ve moved out of. Right now I’ve moved them to the end of Portfolio Holdings on the Setup tab, since to remove them from there deletes them from the larger record.

That helps by also moving them to the end of the list in My Portfolio Holdings. But over time the entry section in Setup is going to fill up (max 150). I wonder if a space for retired holdings might do the trick, or is there a workaround I’m missing?

Thanks for your help, and thanks again for this fantastic tool!

Hi John,

See my reply to Russ about how you can start using this tool even if you don’t have a full history of your previous trades.

In terms of “retired holdings”, unfortunately there isn’t any perfect workaround. The method that you’re currently using is a good one (moving those stocks to the end of the setup tab).

I may try to add more than 150 stocks tickers in the future, but the spreadsheet already runs a bit slow, so I don’t want to add much more bloat.

If you do exceed the 150 stock limit, I suppose you could start recording your trades in a new version of the tool. For example, you could start up a fresh version every decade?

Hi Russ,

I’d suggest just making one lump sum “buy” transaction as of today. Your 401K statement should tell you your total # of shares owned as of today.

Let’s say you’ve got 200 shares of XYZ that you’ve been building up over the past 10 years. If you don’t have the detailed record to indicate all the various times you’ve invested in XYZ, you could just input a single buy transaction on the trade log.

Purchase date: today

# of units: the total number of shares you own

$ per unit: If your 401K statement reports your total cost base, you could divide that cost base figure by the # of shares to get your blended average $ per share. If not, make your best guess 🙂

I hope this helps!

Thank you so much for the reply. I do see a value called Cost Basis on my statement so your suggest was perfect! i appreciate your time and for sharing such a great spreadsheet.

You’re welcome! Glad to hear that it works.

Hi John,

Thanks for the great amount of work you put into this tool.

Quick question from a not so advanced investor : my understanding is that dividends are part of the performance of a portfolio in terms of value ($).

However, in the ‘total value of portfolio’ chart, dividends don’t seem to appear. I consider cash dividends as withdrawals (just as cash dividends goes to a cash account with my broker and is usable). In your file, I have to sum dividends (max 5 years) with investment returns (max 5 years again) to get an accurate view of the actual cash I would have if selling all.