January 20th, 2025 | Posted in Tools

This page lists free ATMs around the world where Wealthsimple and EQ Bank customers can make international currency withdrawals without paying any fees. Using your Wealthsimple or EQ card at one of the ATMs listed below allows you to avoid buying foreign currency at a marked-up exchange rate (typically +2.5%), and to avoid transaction fees (typically $3 to $5 Canadian dollars) each time you withdraw money.

As someone who loves to travel frugally (read: an inclination towards hole-in-the-wall restaurants vs. five-star experiences), I’ve spent more time than I’d like to admit searching online for the best ways to withdraw foreign currency without paying exorbitant exchange rate mark-ups and ATM transaction fees. I’ve compiled this database based on my own travel experiences in over 10 countries, travel reports from friends, and also based on dozens of posts on Reddit, Red Flag Deals, blogs, etc.

Some of my most cherished travel memories started by stumbling into tiny local restaurants where only hard cash is accepted. Slurping a piping hot bowl of noodles while trying to avoid elbowing the customer beside me — ordering at random from a signboard written in an indecipherable script — searching for culinary bliss in places that don’t appear on Google Maps.

There are 84 banks in 47 countries covered here. I’ll continue to add / update this list as I come across new sources. If you’d like to contribute to this database, please drop a comment below. Let’s save money at the ATM so that we can drink more espresso and eat more pho!

Table of Contents

- List of free ATMs for Wealthsimple / EQ Bank customers

- General tips for withdrawing money while travelling abroad

- ► Always withdraw in “local” currency (not Canadian dollars)

- ► Look for official bank branches — avoid outdoor machines / ATMs

- ► Never use a credit card to withdraw money from an ATM

- 101-basics guide to Wealthsimple / EQ Bank

- Parting Thoughts and Notes

List of free ATMs for Wealthsimple / EQ Bank customers [back to top]

[This list was last updated on May 24, 2025]

Find free ATMs worldwide for your Wealthsimple / EQ bank card. Enter a country name below to search/filter the results.

| Country | Bank Offering No-Fee ATM Withdrawals |

|---|

If you’ve travelled abroad recently, it would be appreciated if you could confirm this content, indicate any errors, or add new countries with free ATMs to this list. I will keep this list up to date with the latest info that I’m able to crowd-source or find online.

You can confirm / deny / add new data in the comment section below, or by emailing me at themeasureofaplan@gmail.com

Below, I’ll cover some best practices and general tips for withdrawing money when travelling internationally.

General tips for withdrawing money while travelling abroad [back to top]

There are three steps to follow to withdraw foreign currency without paying any fees:

- Go to the right bank (see table above)

- Use the right card (either Wealthsimple or EQ card)

- Click the right buttons on the ATM (see guide below)

Always withdraw in “local” currency (not Canadian dollars)

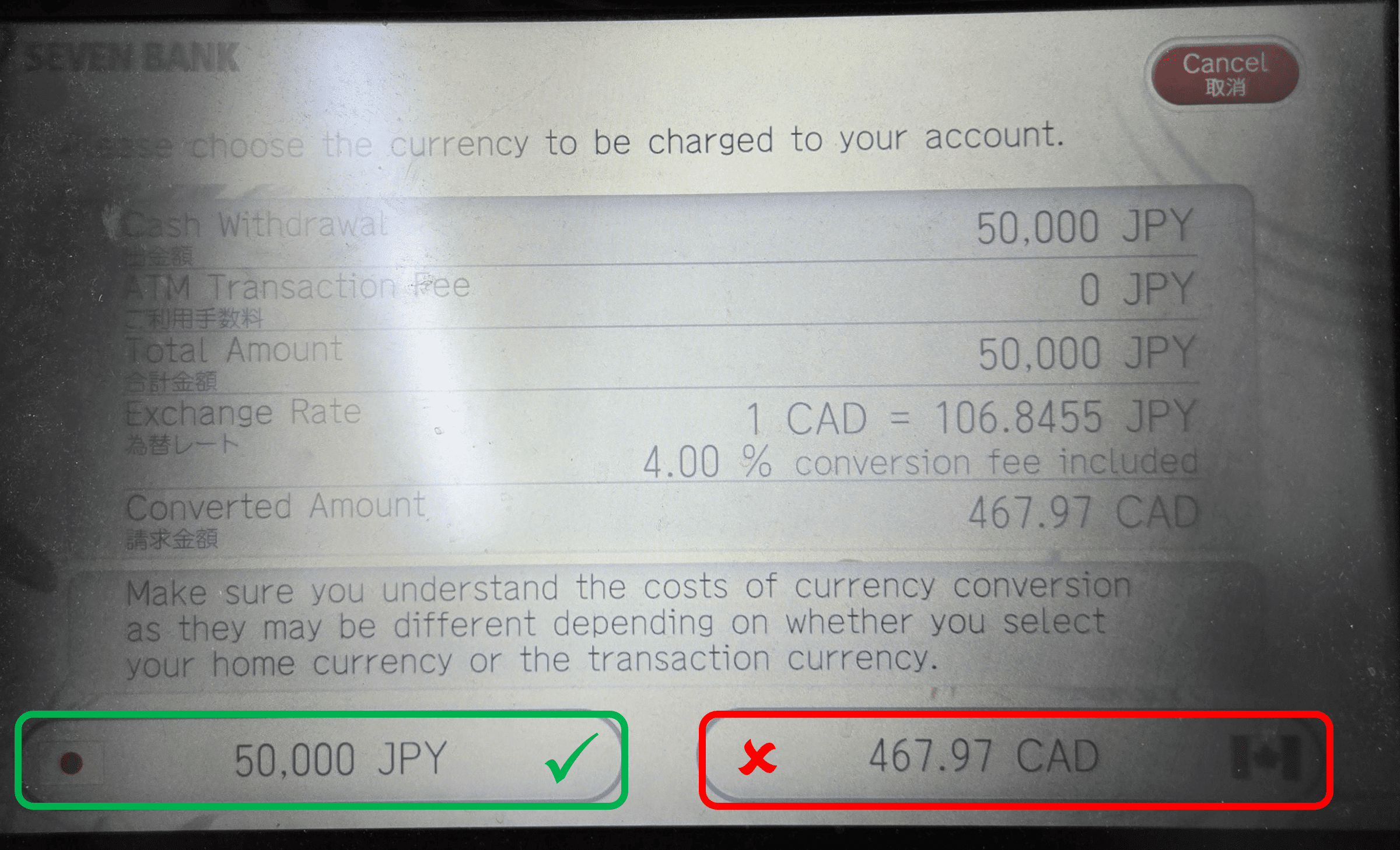

When using an ATM abroad, if the machine offers to charge you in Canadian Dollars (CAD), make sure you decline that option. Always choose to be charged in the local currency of the country you’re in (i.e., Yen in Japan, Euros in Europe).

This means that Mastercard will handle the conversion into Canadian dollars, and Wealthsimple / EQ Bank won’t charge any mark-up fees on top of that. The conversion rate offered by the ATM provider will be a horrible rate, often with a ~4 to 10% mark-up applied on top of the actual rate that Mastercard would have charged.

For example, the image below shows your options when withdrawing Japanese Yen at 7-Eleven. If you select to be charged in “local” currency (Japanese Yen), the entire transaction will be free for Wealthsimple / EQ Bank customers.

However, if you select Canadian dollars, a 4% mark-up would be charged on the exchange rate. In other words, on a withdrawal of $500 Canadian Dollars, selecting the wrong option would cost you $20!

In some countries, you’ll see an option for “Dynamic Currency Conversion” (DCC) or “immediate currency conversion”. Always decline this option if it’s presented. Similar to the example above, this option will charge you in Canadian Dollars, but at a significantly inflated rate. Always pay in the local currency of the country you’re in (i.e., pay in Yen in Japan, pay in Euros in France / Germany / Italy).

Look for official bank branches — avoid outdoor foreign exchange machines / ATMs

When finding a place to withdraw money in a foreign country, always try to do this at an official bank branch (preferably an indoor branch with clear signage belonging to the bank). Use the list above to find a bank that offers free ATMs in the country you’re travelling in, then search for that bank on Google Maps to find a branch location near you.

Avoid standalone ATMs / privately-branded foreign exchange machines that are located in touristic areas, or machines that are clearly marketed towards foreign tourists. These machines are often located at the airport or in tourist hotspots (near museums, monuments, temples, or other major points of interest) and often charge high transaction fees and/or marked-up foreign exchange rates.

See the image below for examples of what to look for and what to avoid.

When in doubt, think and act like a local!

Never use a credit card to withdraw money from an ATM

Using your credit card to withdraw money at an ATM is a costly mistake. Your card will typically be charged an upfront withdrawal transaction fee ($3 to $5 Canadian dollars), and the credit card provider typically treats the withdrawal as a “cash advance”.

A cash advance means that you are borrowing money from the bank, and the bank will charge you interest on any amount withdrawn. The interest starts to accrue immediately, meaning that for each day you don’t pay back the loan, your total amount owed will be higher. This is different from how a credit card usually works wherein you are given a “grace period” when no interest is charged on your purchased until the end of your statement cycle.

Long story short, never use a credit card to withdraw money from an ATM. Using a debit card or prepaid card (like the Wealthsimple / EQ Bank cards discussed in this post) is always the better choice.

101-basics guide to Wealthsimple / EQ Bank [back to top]

For Canadians who don’t yet have accounts with Wealthsimple / EQ Bank — here’s a quick guide to these companies. Wealthsimple and EQ Bank are “challenger” banks have disrupted Canada’s “Big 5” banks by offering well designed online-first user experiences and fee-free banking and financial products.

It is free to open an account with Wealthsimple / EQ, there are no monthly fees for checking and savings accounts, and there are no account minimums that need to be maintained to keep your account open. In other words, you can use these accounts entirely for free without paying a penny.

Both Wealthsimple and EQ Bank offer a “prepaid” spending card that is effectively a hybrid between a debit card and a credit card. Similar to a debit card, the customer needs to load money into their account before it can be spent (you cannot borrow money using these cards). However, these cards are issued through the Mastercard network, and therefore can be used to purchase in-store / online wherever Mastercard is accepted.

Wealthsimple / EQ cards both offer cashback on purchases, and also charge zero fees for purchases made in foreign currency. This is a stark contrast to most debit and credit cards which charge a 2.5% mark-up fee on any purchases made in foreign currency.

For these reasons, I bring both the Wealthsimple cash card and EQ Bank card in my wallet whenever I travel (it’s recommended to bring multiple cards in case one gets lost or blocked).

If you don’t already have an account with Wealthsimple or EQ Bank, you can review the latest list of benefits and sign-up using the links below (disclaimer: these are my referral links, meaning that we’ll both receive a cash bonus if you sign up using these links):

As a reminder, for both accounts it is free to sign up, there are no fees to use the accounts, and there are no account minimums.

Parting Thoughts and Notes [back to top]

I’ve personally travelled to several countries in Asia in recent years and can personally vouch for the list of free ATMs in Hong Kong, Vietnam, Malaysia, Indonesia, Japan, and Taiwan — I’ve used my Wealthsimple / EQ Bank cards in all of those countries and have benefitted from free ATM withdrawals.

However, there are many countries on this list that I’ve yet to travel to (particularly in South America / Europe), and I’m relying on outside sources and several threads from places like Reddit, Red Flag Deals, blogs, and other online searches.

If you’ve travelled abroad recently, it would be appreciated if you could confirm the accuracy of this list, indicate any errors, or add new countries with free ATMs to the database. I will keep this list up to date with new info that I’m able to find online or crowd-source.

You can confirm / deny / add new data in the comment section below, or by emailing me at themeasureofaplan@gmail.com

Thanks to everyone who has contributed to this list — let’s make this the best place for Canadians to find free ATMs so that we can travel widely and eat/drink to our heart’s content.

*****

If you liked this post, you may be interested in some of my other tools and data essays:

- Free spreadsheets and tools for budgeting, investment portfolio tracking, and more

- Tracking Canadian Housing Market Affordability (1999 to 2024)

- The Wealth of Nations: income, cost of living, and purchasing power for 110 countries

- Investment returns by asset class (1985 up to today)

- US stock market returns — a history from the 1870s up to today

*****

—–

Header image credit: Pete Ryan

I used my wealthsimple card in Japan this month at 7-11 stores (January 2025). Worked flawlessly and the withdrawals were free.

Thanks for this post, great resource. Will save it for future travels.

Thank you Tom for confirming! I travelled to Japan last year and used 7-eleven for free withdrawals as well.

It’s surprising how many restaurants only accept cash in Japan, so it was great to be able to take out cash so conveniently (and cheaply).

Your blog is amazing. Keep up the great work and thanks for your newletters!

Thank you Rafay — much appreciated!

What a great resource, thanks for compiling!

Currently travelling for a year with an EQ Bank card for ATM withdrawals and so I can add a few more to the list:

Turkey – Halkbank

Georgia – Bank of Georgia

Oman – Bank of Muscat

Thank you very much Shannon — I’ve added those to the list!

Much appreciated for your contribution, and safe / happy travels 🙂

[…] Measure of a Plan has put together a page listing ATMs around the world (currently 67 bank companies in 40 countries) where Wealthsimple / EQ Bank customers can withdraw […]

Thanks for this! I’ve been an EQ Bank customer for a few years and I didn’t realize they had this perk.

Thank you Dave. I’d guess that EQ and Wealthsimple don’t mention this perk much given that the fee-free status varies by country / bank (i.e., whether the foreign bank decides to charge fees).

It’s amazing to be able to withdraw cash freely. I was in Taiwan recently and it was great to be able to top-up on cash withdrawals every few days (I used Cathay United Bank / Mega Bank when I was there). It was convenient to carry a small amount of cash with me and then pop into a bank branch as needed.

I visited Spain in Fall 2024 and used Wealthsimple to withdraw at Unicaja bank. No ATM fees were charged.

This is a really awesome list. I’ll definitely be coming back to check before my next trip to Europe. Thank you!

Thank you JJ — great to hear, I appreciate the confirmation

i have a wealthsimple card but not an EQ card.

Am I missing out on some countries with just a Wealthsimple card?

What countries charge a fee for WS cards but not for EQ cards

From my experience travelling (mainly in Asia), the Wealthsimple card is equivalent to the EQ card. Whenever I’ve used one card for free withdrawals, the other card worked as well.

I’d recommend having both cards though. It’s free to get / keep the cards. And I’ve noticed that sometimes one card isn’t accepted at some stores or ATMs. It’s useful to have a backup card for free withdrawals in that case.

Hi,

Thank you for this valuable list.

Question: while EQ or WST does not charge an ATM fee, how about the local host bank, do they charge a withdrawal fee?

Does it differ from bank to bank (and if they do, they would display the fee on the screen, so you can decide whether to continue or not)?

Thank you Jeff. For the countries / banks shown on this list, there is no withdrawal fee charged by WS, EQ, or the local host bank.

I’ve personally travelled to several countries in Asia in recent years and can personally vouch for the list of free ATMs in Hong Kong, Vietnam, Malaysia, Indonesia, Japan, and Taiwan — I’ve used my Wealthsimple / EQ Bank cards in all of those countries and have benefitted from free ATM withdrawals (no fee from WS, EQ, or local host bank!).

In my experience, if there is a withdrawal fee to use the ATM, a message will appear on the screen indicating so. For example, ATMs in Thailand typically charge a fee of ~220 Thai Baht, and I don’t believe there are any free ATMs in the country (hence why Thailand is not included on this list).

I’m in Indonesia right now, and I put my EQ Bank card to the test. Bank 1 charges a withdrawal fee of ±$3. The screen does ask if I agree with it (which I refused)

Bank 2 does not mention a withdrawal fee (so it doesn’t ask if I agree with it).

My receipt does not show a fee either

I submitted my 2nd comment, before I noticed that your replied to my 1st one.

Bank 1 is BRI, and bank 2 is BCA.

For both banks, I used their branch ATM, on a major street. It could be that BRI has changed its no-fee policy

Thank you Jeff — much appreciated for the real-time updates!

It would be appreciated if you could write back here in a few days if possible to confirm the final fee status for BCA (checking against the transaction record on the app to confirm no fee charged). I will update the list accordingly.

FYI — I double checked my transactions from when I travelled to Indonesia last year and see that I was able to make free withdrawals at Bank Negara Indonesia (BNI). You could give them a try as well.

Cheers!

Hi. I am local in Indonesia.

Your list is correct. I just wanted to add BRI and other banks’ fees here.

BRI: IDR 30k

Permata: IDR 65k

CIMB: IDR 75k

BCA: IDR 0

Mandiri: IDR 0

BNI: IDR 0

I have not tried Maybank. I will try it later.

Very helpful resource. FYI I shared your post on the Wealthsimple subreddit and some other users are mentioning other countries with free ATMs!

Thought you’d want to know / add to the list: https://www.reddit.com/r/Wealthsimple/comments/1i8syy1/list_of_42_countries_where_wealthsimple_card_can/

Cheers and thanks again for compiling this. Very useful.

That’s amazing, thank you for sharing! I will monitor that post for other ATM reports and update this page accordingly.

Cheers and thanks again for spreading the word — much appreciated.

I used my EQ bank card at a NAB bank branch ATM in Australia in Dec 2023 and got charged 7.50 AUD fee

Thank you Arya for your report. I had included NAB for Australia based on a post on the Red Flag Deals forum in 2022. It seems like many banks in Australia have changed their policies recently and are selling off their ATM networks to private companies.

Unfortunately there doesn’t seem to be any free ATM in Australia as of now. I’ve removed NAB Australia from the list.

Thanks again for your contribution.

France ATMs don’t charge any fees as long as it’s operated by a bank. Learned this while on exchange two years ago.

Thank you for the report — cheers!

Aeon Bank in Japan is free as well. (bright pink ATMs) Can be found in many malls as well as Aeon grocery stores.

Much appreciated — added onto the list now

Armenia: Unibank

Georgia: Basisbank

North Macedonia: Central Cooperative Bank

Serbia: Halkbank

Very helpful — thank you for these reports. I’ve added them to the list!

Can you add VP Bank for Vietnam please. Also, TP Bank has changed their ATM systems and don’t accept International credit card anymore.

Hi Le,

Thank you for the report. I’ve added VP Bank in Vietnam to the list

I just wanted to say THANK YOU for this list! Currently traveling around SEA right now, and this has been a great reference that I check for each country I’m in. Really appreciate you putting this together 🙂

You’re welcome! Wishing you many great meals and adventures 🙂

Bank of Georgia is not free, they charge 3GEL (about $1.50 cad) per transaction. Some of their ATMs will not warn you about this fee

thank you Ethan for the report. I’ve removed Bank of Georgia from the list

Azerbaijan: Expressbank (free withdrawals for both AZN and USD)

Added to the list! thank you EM

You can add Banco de la Nacion in Peru to this list as well, free for any cardholder.

Also, wanted to get clarification on this post since you call out Wealthsimple and EQ specifically as the cards needed to be able to avoid ATM fees for these specific banks in the list, but I can confirm that Bradesco in Brazil for instance is free for everyone, not just WS or EQ clients.

So is this list just a list of free ATMs for everybody or is there some kind of specific agreement in place for Wealthsimple and EQ that allow their clients specifically to avoid the ATM fees for those banks?

Added to the list, thank you!

While some of these ATMs will charge no transaction fee for all cardholders (not just Wealthsimple / EQ), the home Canadian bank will charge a marked-up foreign exchange rate on the withdrawal.

For example, using a Tangerine or TD card at 7-11 in Japan will be free at the ATM machine itself, but will incur a 2.5% foreign exchange fee charged by the Canadian bank.

The WS / EQ cards don’t charge a foreign exchange fee, so it is truly free to use!

Whether the home bank charges a 2.5% FX fee is irrelevant to whether the ATM itself charges a fee to use it.

Therefore, this list is a list of ATMs that will not charge a withdrawal fee for anybody, regardless of what card they use to withdraw from it. One does not need a WS or EQ card to avoid the ATM Fee at the banks on this list.

The WS/EQ cards just have the added benefit of not charging an additional 2.5% fee on FX transactions like other Canadian banks do.

Just thought that should be made clear because the way you worded the article made it seem like you needed to use a WS or EQ card to unlock 0 fee ATM withdrawals at the banks on this list.

I’m in Zagreb now, OTO banks charging 5,49 euro fee, haven’t tested Kent yet

I meant OTP sorry

NH in Korea does charge a W3,500 withdrawal fee. For that matter, I tried multiple banks while there, they all do.

Thank you for compiling the list – great resource

was just in the netherlands and ING no longer exists as an atm branded by the bank itself. apparently all the banks in netherlands banded together and created “Geldmaat” which, while free to EU cards, most definitely charges a €5 fee for overseas cards. as far as i could find there was no fee free option in the netherlands anymore.

Portugal- Milennium banks dont charge the ATM fee.

I got money out at the airport, its 5 EUR there 😞

Hello, thank you very much for your list! It’s really useful for travelers. I’m just waiting for an update for Thailand. I don’t have any bank account in this country and it would make very handy if they ad it on the list. Keep my fingers crossed.

Don’t think Banca Popolare di Sondrio ATMs are free anymore. Tried withdrawing money from one in Rome and was shown a €5 service charge

Used National Bank of Greece ATM in Santorini and was not charged ATM fee.

thank you! much appreciated

I used my Wealthsimple cash card at Swedbank in Latvia last month. Can confirm there were no ATM fees.

thank you for the confirmation report! much appreciated and happy travels

There have been a recent update on Wealthsimple that they will reimbues forging ATM fees of any amount.

as of today, wealthsimple card offers full ATM fee reimbursement in all countries and all ATM where the card is accepted.

I was in Japan earlier this year, and the EQ card definitely DID NOT WORK there. I first tried 7-11, then tried a variety of other banks, all of them spit it back out. Which was very frustrating as I wasted time and got screwed with fees figuring out other ways to get cash. If I had known EQ would not work there, I could have made alternate arrangements. So in short, make sure you have a backup plan! I’m bringing WS for my upcoming trip but will have other accounts and some cash ready just in case.