April 12th, 2020 | Posted in Data & Insights

[This page was last updated on April 20th]

With the daily news cycle dominated by the COVID-19 crisis, we’re facing a near-constant stream of situation updates, new data points, and government announcements.

It’s become increasingly difficult to separate the signal from the noise.

To shine a light on the most pertinent pieces of information, this page will serve as a curated guide to COVID-19’s economic impact in Canada.

You’ll find a collection of links, charts, and tips to help you understand and get through this emergency. Focus has been placed on:

- How COVID-19 has impacted Canadian jobs, investment returns, housing, and the future economic outlook

- The government’s response to the ongoing crisis

- Steps that all Canadians can take today to improve their financial situation

As circumstances evolve, this page will be updated with new facts, figures, sources, and resources.

Table of Contents

1) The Impact to Canada’s Economy

2) How the Canadian Government Has Responded

- The Canada Emergency Response Benefit (CERB)

- Goods and Services Tax credit (GSTC)

- One-Time Increase to the Canada Child Benefit (CCB)

- The Canada Emergency Wage Subsidy (CEWS), a.k.a the “75% Wage Subsidy”

- Extended Tax Filing Deadline

- Pausing Federal Student Loans

- Other Responses from the Canadian Government

3) Practical Tips for Canadians Impacted by COVID-19

1) The Impact to Canada’s Economy

Jobs [back to top]

Between March 13th and March 27th, a state of emergency was announced in all provinces and territories across Canada.

Public and private gatherings have been prohibited. Non-essential businesses (such as restaurants, bars, clothing stores, gyms, etc.) have been ordered to close up shop. Strict physical distancing measures are being enforced.

With most Canadians hunkering down in their homes and the economy on pause for the foreseeable future, millions of Canadians have had their working hours reduced, or have found themselves out of a job entirely.

On April 9th, Stats Can released their monthly update to the Labour Force Survey.

In short, COVID-19 has caused a fast and furious drop in Canadian employment. Over the survey period of March 15th to March 21st:

- 1 million Canadians lost their jobs, comparing the March survey (March 15-21) versus the February survey (Feb 9-15)

- 0.8 million Canadians had a job, but didn’t work any hours (during the March 15-21 period)

- 1.3 million Canadians had a job, but worked less than half of their usual hours (during the March 15-21 period)

All in all, an estimated 3.1 million Canadians had their job situation impacted for the worse in March. This implies that 16% of Canada’s workforce was impacted in the month (out of the 19.2 million Canadians who were employed in February).

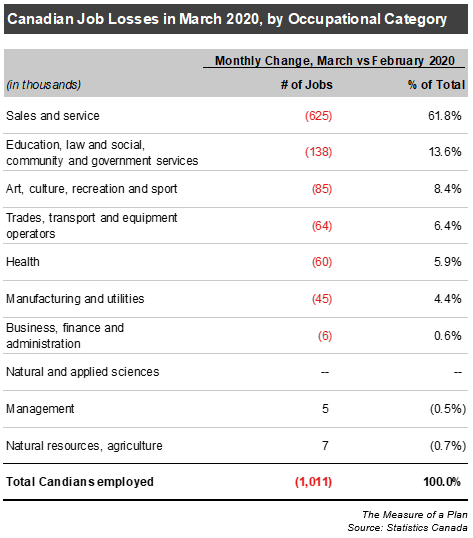

For the 1 million jobs lost in March, the following chart gives a breakdown of the occupational category of those jobs.

625,000 job losses were in “Sales and service” occupations, illustrating the swift impact of nationwide physical distancing measures on Canadian jobs.

As air travel has all but ceased, malls have shuttered, and in-person gatherings have been cancelled, we’ve seen high-profile layoffs announced by:

- Bombardier – 12,400 temporary layoffs due to a shut down of private jet and rail production in Ontario and Quebec (Financial Post)

- Indigo – 5,200 temporary layoffs of retail staff due to an indefinite closure of Indigo’s stores during the pandemic (Global News)

- Cirque du Soleil – 4,679 temporary layoffs due to the cancellation of all of the Cirque’s 44 shows around the world (Montreal Gazette)

For a more comprehensive summary of layoffs announced by Canada’s largest companies, The Logic has compiled a database of Canadian layoffs. As it stands, this resource covers more than 130,000 job losses which have been publicly reported.

However, these announcements by major Canadian corporations are only the tip of the iceberg.

Across the country, thousands of small businesses have laid off some or all of their staff in the past few weeks.

A crowd-sourced database compiled by the Save Small Business group provides a glimpse into the struggles of small business owners. Over 28,000 small businesses have submitted stories of how the COVID-19 crisis has cancelled projects, forced jobs cuts, and pushed companies towards bankruptcy.

With millions of Canadians unemployed or underemployed, the pace of our economy has taken a corresponding nosedive.

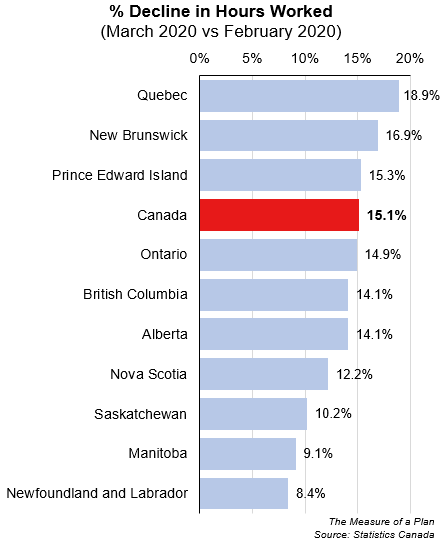

In the month of March, Canadians worked 15% fewer hours when compared to February. The steepest drop was in Quebec, which had 19% fewer hours worked.

All in all, the month of March was nothing but negative from a jobs perspective.

On April 13th, the CBC reported that nearly 6 million Canadians had applied for emergency aid through the Employment Insurance (EI) or Canada Emergency Response Benefit (CERB) programs.

When Stats Can releases its next update to the Labour Force survey on May 8th, we’ll get a clearer sense of the magnitude of COVID-driven job impacts.

The way things are headed, it’s seems that we’re in for more bad news.

Investments [back to top]

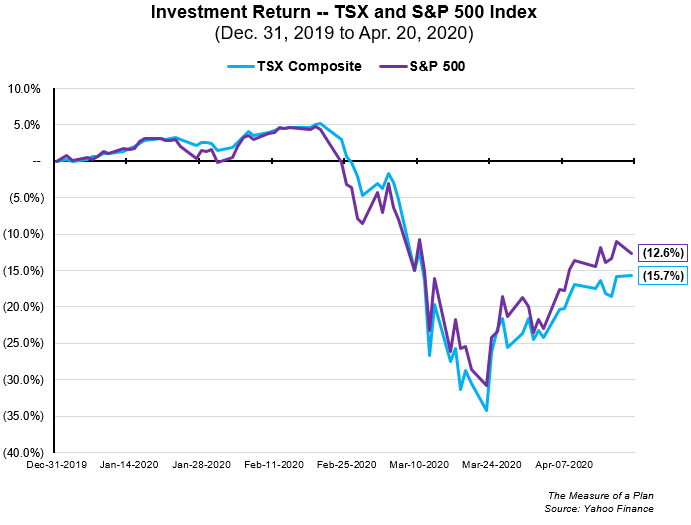

As COVID-19 spread beyond China into each and every one of the world’s top economies, stock markets reacted swiftly.

By March 23rd, the TSX and S&P500 indices had fallen by 34% and 31%, respectively (compared against December 31st, 2019).

However, investor optimism has improved somewhat in the last week of March and first week of April. North American stock markets have recovered roughly half of their losses in that time.

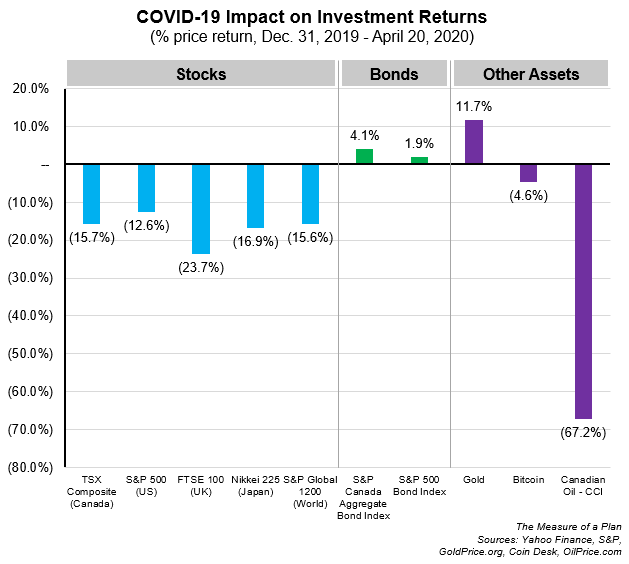

The next chart shows the 2020 year-to-date investment returns (up to April 9, 2020) of a broader set of assets.

- Major stock indices around the world have dropped by roughly 15 to 20% this year

- Bond prices have been roughly flat

- Gold prices have fared well, as investors tend to flock to gold in times of economic uncertainty

- Canadian oil prices (measured through the Canadian Crude Index, or CCI) have fallen sharply in 2020, putting further pressure on the Canadian economy, and Alberta in particular

Consumer Confidence [back to top]

With orders to stay at home being issued nationwide, it’s unsurprising to hear that Canadians have a grim outlook on the prospects for our economy.

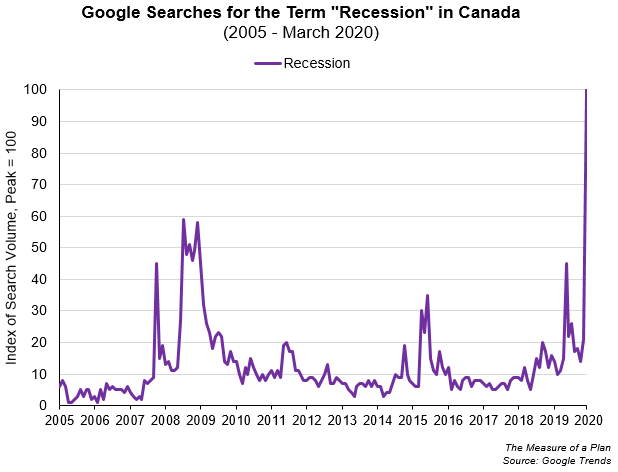

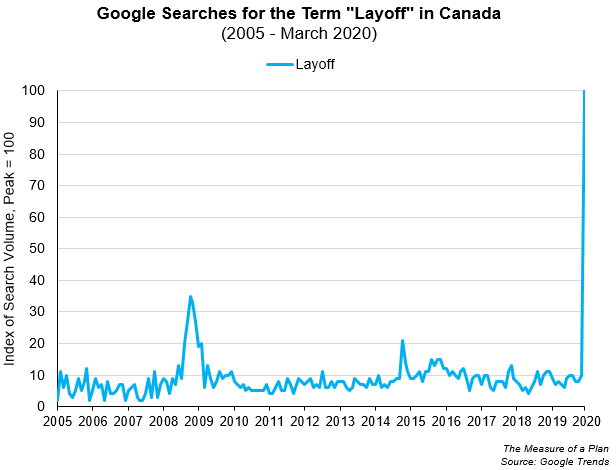

According to data from Google Trends, Canadians are searching for the terms “recession” and “layoff” now more than ever as the COVID crisis deepens.

As you can see below, the volume of searches on those terms in March 2020 was significantly higher than the search volume during the Great Financial Crisis of 2008.

Furthermore, data collected by the Conference Board of Canada shows that Canada’s “Index of Consumer Confidence” dropped by 32 points in March (from a value of 121 in February 2020 to 89 in March), making this the largest monthly decline on record.

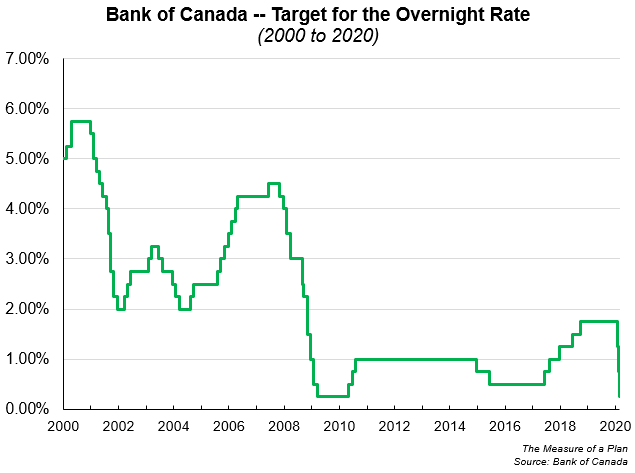

Interest Rates [back to top]

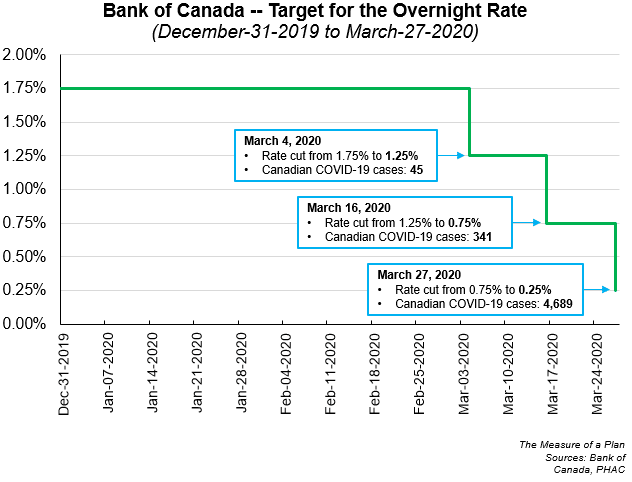

The Bank of Canada (BoC) uses its “overnight rate” (also known as the “policy rate”) to influence interest rates in Canada — bank prime rates, mortgage rates, GICs, savings account rates, and so forth.

When the BoC lowers the overnight rate, this reduces other lending rates across the country, and in theory should spur increased consumer spending and business expansion.

Throughout the month of March, the BoC cut the overnight rate three times, moving the mark from 1.75% to 0.25% — a total decrease of 1.50%.

For added context, the next chart shows the history of the BoC’s overnight rate over the past 20 years.

We’ve only otherwise seen interest rates this low during the aftermath of the Great Financial Crisis. It’s clear that the Bank of Canada thinks that overcoming this crisis will require significant stimulus.

Housing [back to top]

While the Spring season usually brings about increased transaction volume in the real estate market, this year is anything but typical.

Many potential home buyers will be reluctant to make large financial decisions during a period of financial uncertainty and job insecurity.

Home sellers might be forced to delay their timelines, as many provinces have started to ban open houses in favour of virtual home tours.

In the Greater Toronto Area, the Toronto Regional Real Estate Board has reported that sales volume in the second half of March was down by 16% (comparing 2020 vs 2019).

A much steeper drop has been called out by the Huffington Post, which has reported that homes sales volume in Toronto is down by 76%, during the week ending April 5.

A report by RBC Economics published on March 30th has predicted that “Canada’s housing market will slow to a crawl this spring”, and that housing prices will face a temporary set-back — with an estimated 2.9% year-over-year price decline in the second half of 2020.

More to come on this front in the subsequent weeks and months.

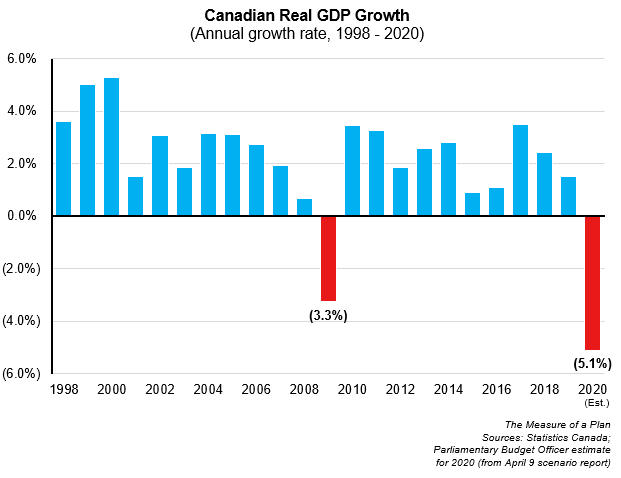

Post-COVID Economic Forecasts [back to top]

On April 9th, Canada’s Parliamentary Budget Officer released a “scenario analysis” report on the potential impact of COVID-19 on the Canadian economy.

A few highlights (perhaps more appropriately, lowlights):

- It’s estimated that the federal government’s responses to the COVID crisis will have a total cost of over $105 billion

- As a result, Canada’s budget deficit in the 2020-21 fiscal year will rise to $185 billion, or roughly 8.5% of GDP

- Canada’s budget deficit hasn’t been this high (based on % of GDP) since the 1984-85 fiscal year

- In 2020, Canada will have real GDP growth of -5.1%, and an unemployment rate of 12.4%

- The number of unemployed Canadians will rise from 1.2 million (Q4 2019) to 3.1 million (Q3 2020)

If this economic scenario comes to pass, the 5.1% decline in real Canadian GDP will be the worst annual figure in the last twenty years, even exceeding the 3.3% contraction in 2009 caused by the Great Financial Crisis.

It’s important to note that this report is just a scenario analysis of a potential future outcome. This analysis does not necessarily represent the expected or most likely outcome.

A few major assumptions were taken to derive these estimates:

- Social distancing measures will remain in place until August

- OPEC member counties will not limit oil production to target “relatively balanced global oil markets” (i.e., oil prices will continue to stay relatively low)

- The federal government’s economic responses to the pandemic will not have a stimulative impact on the Canadian economy; however, they will help to support the economy and help to prevent widespread personal and business bankruptcies

On April 14th, the International Monetary Fund (IMF) released an updated forecast of global economic growth in 2020 (measured in terms of annual growth in real GDP). Some key data points:

- Global GDP will shrink by an estimated 3% in 2020, compared to a decline of only 0.1% in 2009 following the Great Financial Crisis

- Canadian GDP will decline by 6.2%

- U.S. GDP will decline by 5.9%

- China’s GDP will increase by 1.2%

2) How the Canadian Government has Responded

The federal government has announced a slew of programs to offset the economic impact of COVID-19.

These programs have an estimated grand total cost of $105 billion.

As the names and terms seem at times taken from a can of alphabet soup, here’s a quick run-down of CERB, GSTC, CEWS, and more.

The Canada Emergency Response Benefit (CERB) [back to top]

On March 25th, the federal government proposed legislation to establish the Canada Emergency Response Benefit (CERB).

The CERB is a taxable benefit that will provide $2,000 a month for up to four months, for workers who lose their income as a result of the COVID-19 pandemic.

Subject to the eligibility requirements discussed below, the CERB covers Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19, as well as working parents who are forced to stay home to care for children.

Program duration: The CERB will be paid every four weeks and is available from March 15, 2020 until October 3, 2020. You will need to reapply for each four-week period (March 15 to April 11; April 12 to May 9; May 10 to June 6; June 7 to July 4; etc…).

Eligibility requirements — the benefit will be available to workers:

- Residing in Canada, who are at least 15 years old

- Who have lost work because of COVID-19, or are eligible for EI regular or sickness benefits, or have exhausted their EI regular benefits between December 29, 2019 and October 3, 2020

- Who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application (including employment and self-employment income)

- Who have less than $1,000 or income for at least 14 consecutive days in the initial four-week period that they apply for. For subsequent four-week periods, they expect to have less than $1,000 of income during the full period

- Who have not quit their job voluntarily

On April 15, the CERB program was expanded to also provide benefits to some part-time and seasonal workers.

These changes have been reflected in the text above–specifically, allowing workers to earn up to $1,000 per month while still receiving CERB payments, and the inclusion of workers who have exhausted their EI benefits and cannot find a job due to COVID-19.

Maximum payment: Each person can receive up to 4 payments of $2,000 each, for a maximum CERB payment of $8,000.

Timing of payments: Canadians will begin to receive their CERB payments within 10 days of application. The CERB will be paid every four weeks and be available from March 15, 2020 until October 3, 2020. Payments will be made through direct deposit or by cheque. You will be paid more quickly if you choose direct deposit.

Taxation: CERB payments are a taxable benefit. However, taxes will not be deducted when the CERB payment is made to you — i.e., each payment will contain a full $2,000. You must report the CERB payments as income when you file your 2020 tax return. In other words, you likely will have a tax payment owing to the government.

Who doesn’t qualify for CERB? Here are a few example cases where you wouldn’t qualify for CERB payments (this list isn’t exhaustive):

- You quit your job voluntarily

- You’re already receiving EI benefits for the same eligibility period

- You are a full-time student who does not earn income currently, and now cannot find a summer job due to the ongoing pandemic

What will the cost of the CERB program be? Canada’s Parliamentary Budget Officer estimates that the CERB program will have a total cost of $22.3 billion, and that 5.4 million Canadians will receive payments from the program.

This works out to an average benefit of $4,130 per person receiving CERB payments, and a total cost of $588 per Canadian ($22.3 billion total program cost allocated on 37.9 million Canadians).

More details: See the federal government’s overview of the CERB program / Questions and Answers about CERB

How to apply: You can apply online here.

In order to prevent the system from becoming overloaded, the government is encouraging Canadians to apply on specific days.

You should apply on:

- Mondays if you’re born in January, February or March;

- Tuesdays if you’re born in April, May, or June;

- Wednesdays if born in July, August, or September;

- Thursdays for those born in the October, November, or December

- Anyone can apply on Fridays or weekends

Goods and Services Tax credit (GSTC) [back to top]

The federal government is providing a one-time special payment to “low and modest-income” families through the Goods and Services Tax credit.

The payment will be made on April 9, 2020.

The maximum payment that you could receive is as follows:

- $443 if you are single

- $580 if you’re married or living common-law

- $153 for each child under the age of 19 (excluding the first eligible child of a single parent)

- $290 for the first eligible child of a single parent

There is no need to apply for this payment, as long as you have filed your 2018 tax return. If you are eligible, you will get it automatically.

One-Time Increase to the Canada Child Benefit (CCB) [back to top]

The federal government is providing up to an extra $300 per child through the Canada Child Benefit (CCB).

This is a one-time increase, which will be paid as part of the scheduled CCB payment in May 2020.

Those who already receive the CCB do not need to re-apply.

For those not already receiving CCB payments, you can apply here.

The Canada Emergency Wage Subsidy (CEWS), a.k.a the “75% Wage Subsidy” [back to top]

Announced on March 27th, the Canada Emergency Wage Subsidy (CEWS) is designed to encourage employers to:

- Re-hire employees who have been laid off due to the COVID-19 crisis

- Keep employees on the payroll — i.e., to prevent future layoffs

This subsidy will be paid directly to employers. Employers will use the money to re-hire and keep employees on the payroll.

For eligible companies (as defined below), the federal government will subsidize 75% of an employee’s wages, up to a maximum of $847 per week (in other words, 75% of the first $58,700 of an employee’s normal annual earnings).

The wage subsidy will apply for a 12 week period — retroactive to March 15, 2020 and until June 6, 2020.

This means that employers will receive a maximum subsidy of $10,164 per employee over a 12 week period.

Companies will have to reapply for the wage subsidy each month. The wage subsidy will be claimed in three periods: March 15 to April 11; April 12 to May 9; and May 10 to June 6 for each of March, April and May, respectively.

Eligibility requirements:

- The following employers qualify for the wage subsidy program: individuals, tax-paying corporations, partnerships, non-profit organizations, and charities. Public sector employers are not eligible

- Employers must show a revenue decline of 15% in March, 30% in April, or 30% in May; once an employer is eligible for one period, they become eligible for all other periods that follow

- The revenue declines will be measured against the same month in 2019 in most cases (i.e., a year-over-year percentage comparison)

- To assist start-ups and other high-growth firms, the government will permit the revenue comparisons to be measured against average monthly revenues in January/February 2020

- There is no restriction on the number of employees for which an employer can apply to subsidize

Timing of Payments: The wage subsidies will be paid to employers approximately 3 to 6 weeks after application. This means that employers will need to have the cash on hand to pay their employees, and will receive a reimbursement later on.

What happens with the remaining 25% of an employee’s salary? Employers will be expected to make their “best efforts” to pay their employees at the same rate as they were pre-crisis. i.e., companies should try to pay the remaining 25% of salary that isn’t being subsidized by the government.

Enforcement: The federal government is determining how to maximize compliance and prevent fraud. For now, it appears that individuals or companies who are in breach of the law may be hit with fines or face imprisonment.

During a press conference on April 1st, Prime Minister Justin Trudeau stated that “there will be stiff and severe penalties for trying to take advantage of this system and of your fellow Canadians”.

How to apply: When the program officially opens, eligible employers will be able to apply for the wage subsidy through the Canada Revenue Agency’s My Business Account portal. More details about the application process will be made available shortly.

What will the cost of the CEWS wage subsidy program be? Canada’s Parliamentary Budget Officer has estimated a total program cost of over $70 billion, which works out to roughly $1,870 per Canadian.

Extended Tax Filing Deadline [back to top]

Both the Canada Revenue Agency (CRA) and Revenu Québec have extended the deadline for filing personal 2019 income tax returns from April 30 to June 1.

In addition, the deadline for paying a personal income tax balance for 2019 has been extended to September 1, 2020.

More details here: CRA / Revenu Québec

However, if you’re expecting to receive a tax refund for the 2019 tax year, it would be wise to submit your tax return as soon as possible, so that you can get your hands on that money ASAP.

Pausing Federal Student Loans [back to top]

The federal government has automatically paused the repayment of Canada Student Loans (CSL) and Canada Apprentice Loans (CAL) for six months, starting from March 30, 2020 until September 30, 2020.

Interest on these loans will not accrue during this time period.

In other words, the total balance of your loan will not increase during the 6-month period, even if you do not make any loan payments.

There is no need to apply, as the change is being applied automatically.

Other Responses from the Canadian Government [back to top]

For a full view of the federal government’s various responses to the pandemic, see here: Canada’s COVID-19 Economic Response Plan.

These initiatives include further support for seniors, students, Indigenous peoples, and the homeless.

3) Practical Tips for Canadians Impacted by COVID-19

While the information presented above is meant to give a bird’s-eye view of the economic situation in Canada and the various ways the government has tried to respond to the situation, the next section is devoted to steps that all Canadians can take today to improve their own financial situation.

Contact Your Bank [back to top]

All of Canada’s major banks are offering relief measures for their clients during the COVID crisis.

By and large, the banks are offering the following options:

- Deferring payments on loans such as mortgages, credit cards, lines of credit, auto loans, and more

- Temporarily reducing interest rates charged on credit cards

- Personalized support for Canadians directly impacted by COVID-19, including refinancing or credit restructuring

For anyone considering delaying your mortgage payments (or payments on other forms of loans), please note that this will increase the total interest paid over the life of the loan.

During the time you defer your mortgage payments, interest will continue to accrue and will be added to the outstanding balance of the mortgage. You will pay more interest over the life of your mortgage, but a deferral will help you with your short-term cash flow.

Deferring your mortgage payments can add thousands of dollars onto the total cost of your loan, and therefore should only be used as a last resort.

You can learn more about your bank’s relief options through these links:

Contact Your Landlord [back to top]

Renters have an obligation to continue paying their rent, even during times of financial hardship. However, if you won’t be able to pay in full on the first of the month, considering talking to your landlord about alternative options.

Some Canadians have reported success in negotiating reduced rent, or a deferred payment plan.

A few tips:

- Explain to your landlord how your situation has been impacted, whether you’ve lost your job, had your hours cut, or are unable to work for any other reason

- Continue paying what you can over the next few months

- Offer up a solution for how you plan on paying back lost rent — for example, by making higher rent payments in the second half of the year

- Don’t go into this expecting that you’re “owed” something. Your landlord likely has a mortgage and property tax costs to pay during the crisis, and may not been on such solid financial footing themselves. Try to start off with a reasonable compromise

The Vancouver Tenant’s Union has created a helpful COVID-19 Renter’s Toolkit, with good information and tips for renters in and outside of Vancouver.

Take Advantage of Government Relief Programs [back to top]

If you have lost your job due to COVID-19, make an application to receive CERB payments ($2,000 per month for up to 4 months). Scroll up or [click here] for further details.

Visit the CBC’s COVID-19 Benefits hub for a comprehensive summary of federal and provincial government benefits that could help you–whether you’re a senior, student, parent, property owner, or business owner.

Monitor Your Financial Situation [back to top]

These free resources will help you to stay on top of your money–now and well into the future:

- Budget Tracking Tool (spreadsheet): Keep track of the money that comes in and out, identify expenses that you might be able to cut back on, and set budget goals

- Investment Portfolio Tracker (spreadsheet): View all of your investments in one place, track dividends and portfolio performance, and get automatic re-balancing calculations

- Debt Payoff Planner (web tool): Organize multiple loans in one place, calculate the total cost of your debt, and design an efficient month-by-month plan to become debt-free

Final Thoughts

The COVID crisis has been unprecedented in terms of its speed and impact on the lives of all Canadians.

On March 11th, the World Health Organization declared the COVID-19 outbreak to be a pandemic. On this same day, the 100th case was reported in Canada.

As of April 15th, the disease has now infected over 28,000 Canadians and taken the lives of 1,007.

The pandemic has upended every facet of Canadian life, and the changes will continue to be felt in the months–if not years–to come.

As the situation continues to develop in real-time, this page will be updated with the latest economic data, summary of government responses, and tips for Canadians.

Change log:

- April 14th: added a link to the IMF’s latest global GDP forecasts for 2020 into the Post-COVID Economic Forecasts section

- April 15th: in the CERB section, added the new eligibility rules (announced April 15) which allow some part-time and seasonal workers to collect CERB payments

- April 20th: in the Investments section, year-to-date returns were updated for April 20th closing prices

—

To download a spreadsheet containing all of the source data and charts from this page, click here.

—

Header image credit: Bernhard Lang

Very educative and analytical piece of paper.

Thanks Otu, much appreciated!

In these wild, wild times, it’s great to find a well researched round-up of what’s going on with the Canadian economy.

Thank you for presenting the facts, and for leaving out the speculative opinions and hysteria!

Thanks Sandy. It certainly feels strange to be living through history!