January 31st, 2021 | Posted in Uncategorized

[Feb-1 update: a new section “Clearing Houses & the Plumbing Behind Financial Markets” has been added]

[Feb-2: updated with Robinhood’s Q4 2020 revenues from “payment for order flow”]

This is a story about Robinhood, an online broker that promised to “democratize finance for all”, but ended up deceiving its customers and helping the rich get richer.

So buckle up — we’re heading off to the moon 🚀🌙! But first, let’s pause for a glance at:

- A run-down of Robinhood’s business model, and how they were fined $65 million for failing to disclose that most of their revenues come from Wall Street partners

- The opaque world of “payment for order flow”, and how this creates massive conflicts of interest for Robinhood

- The ongoing GameStop ($GME) saga — where Robinhood conveniently ends up siding with the hedge funds, to the detriment of everyday investors around the globe

The Origins of Robinhood

Robinhood’s co-founders Vlad Tenev and Baiju Bhatt were roommates at Stanford, and set off after graduation to work in New York, building trading software for hedge funds (note to reader: this is one of many ties to the hedge fund world that we’ll come across).

In 2013, Vlad and Baiju decided to strike off on their own and launched Robinhood — an online platform that allowed investors to trade stocks, ETFs, and other financial assets without paying trading commissions.

At the time, competing brokers were charging $5 to $10 per trade, so Robinhood’s free model helped them to win the trust of millions of customers across America.

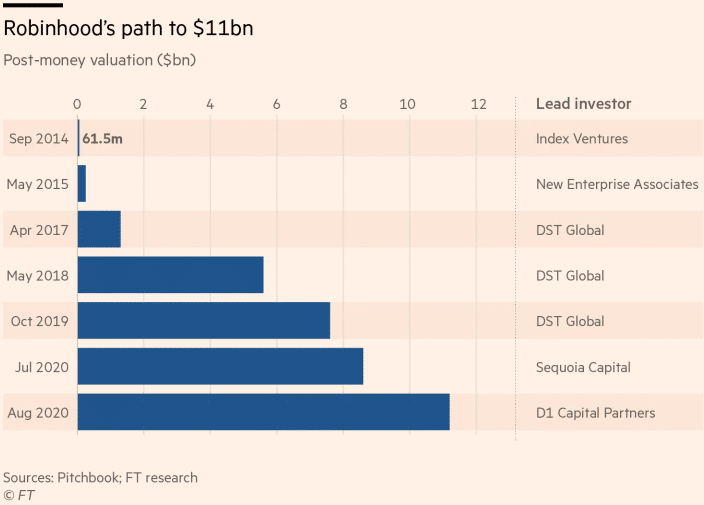

Fueled by crisp marketing, simple user interfaces, and their no-fee model, Robinhood grew by leaps and bounds over the next few years. The company now boasts more than 13 million customers, 1,200 employees, and a valuation of $11 billion after raising funds in August 2020.

The chart below from FT and Pitchbook captures Robinhood’s meteoric rise:

Robbing the Hood and Giving to the Rich?

All was green and all was good for Robinhood and the merry men.

Their founders made proud claims that “we believe the financial system should be built to work for everyone”, and “we didn’t build Robinhood to make the rich people richer”.

However, these claims don’t hold up to close scrutiny.

In December 2020, the SEC (America’s financial markets regulator) fined Robinhood $65 million for “misleading customers about revenue sources and failing to satisfy duty of best execution”.

This investigation shined a light on how Robinhood was operating beneath the glitzy marketing and lip service towards democratizing finance.

Excerpts from the SEC press release (my emphasis added):

According to the SEC’s order, between 2015 and late 2018, Robinhood made misleading statements and omissions in customer communications, including in FAQ pages on its website, about its largest revenue source when describing how it made money – namely, payments from trading firms in exchange for Robinhood sending its customer orders to those firms for execution, also known as “payment for order flow.”

As the SEC’s order finds, one of Robinhood’s selling points to customers was that trading was “commission free,” but due in large part to its unusually high payment for order flow rates, Robinhood customers’ orders were executed at prices that were inferior to other brokers’ prices. Despite this, according to the SEC’s order, Robinhood falsely claimed in a website FAQ between October 2018 and June 2019 that its execution quality matched or beat that of its competitors.

The order finds that Robinhood provided inferior trade prices that in aggregate deprived customers of $34.1 million even after taking into account the savings from not paying a commission. Robinhood made these false and misleading statements during the time in which it was growing rapidly.

“Robinhood failed to seek to obtain the best reasonably available terms when executing customers’ orders, causing customers to lose tens of millions of dollars,” said Joseph Sansone, Chief of the SEC Enforcement Division’s Market Abuse Unit. “Today’s action sends a clear message that the Commission will not allow brokers to ignore their obligations to customers.”

In other words:

- Robinhood was selling its customers’ trade data to market makers and high-frequency traders — Wall Street firms that profit off of these trades

- This is Robinhood’s largest source of revenue — a fact that they curiously left out on their FAQ page describing how they made money

- This practice meant that trades placed on Robinhood weren’t executed at the best price, costing customer tens of millions of dollars, even after taking into account the savings from not paying a commission

One more time: Robinhood lied about their business model, made money by selling customer data to Wall Street, at the ultimate expense of its own customers.

If you’re looking for other reasons to get riled up, how about this other time Robinhood was fined for failing to protect their customers’ best interest, or when Robinhood improperly stored their customers’ passwords, leading to 2,000 accounts being compromised and having funds siphoned off.

Next — let’s dive into how the murky world of “payment for order flow” works, how Robinhood makes money from it, and why this makes Robinhood beholden to their Wall Street partners.

Sally Schmo and “Payment for Order Flow”

As we saw above, Robinhood’s main revenue source comes from selling customer trade data to other firms. This is a controversial practice known as “Payment for Order Flow” (PFOF in financial regulatory lingo).

To give you a sense of it, PFOF was pioneered by Bernie Madoff (one of history’s greatest con men), and the practice is banned in Canada.

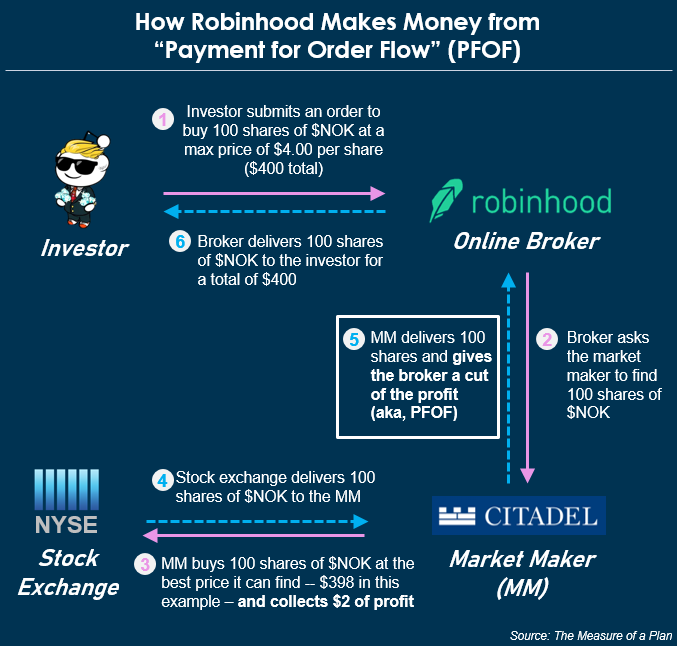

It’s a bit of a tangled web, so I’ve created the graphic below to lay it out in steps:

Let’s take the example of a Robinhood customer who wants to buy 100 shares of Nokia (NOK).

- Investor submits an order to buy 100 shares of $NOK at a max price of $4.00 per share ($400 total)

- Broker asks the market maker (MM) to find 100 shares of $NOK

- MM buys 100 shares of $NOK at the best price it can find — $398 in this example – and collects $2 of profit

- Stock exchange delivers 100 shares of $NOK to the MM

- MM delivers 100 shares and gives the broker a cut of the profit (aka, PFOF)

- Broker delivers 100 shares of $NOK to the investor for a total of $400

After all is said and done, the market maker and Robinhood walk away with $2 in profit, and the investor receives 100 shares of Nokia for $400.

The example above is simplified and uses dummy numbers, but the concept holds true.

Robinhood doesn’t carry out customer orders itself, it routes them to MMs (such as Citadel) for the MM to execute.

The MM buys the requested shares for a price, resells those shares to the Robinhood customer at a slightly higher price, pockets the difference, and shares some of the profits with Robinhood.

So what’s the big deal? Why does “payment for order flow” harm the everyday investor?

When you place an order on Robinhood, you don’t get transparency on what the best price was, whether your order was executed at that best price, and how much profit was captured by the MM / Robinhood in the process.

Even though Robinhood customers don’t pay commissions on their trades (the $5 to $10 per trade that brokers used to charge), there is an “invisible cost” to the customer since they are paying more for the shares that they trade.

Taking this from a different angle, why does the MM pay Robinhood for the order? If the MM wasn’t able to make a profit on the execution of these trades what would be in it for them?

Keep in mind that Robinhood was fined $65 million by the SEC because Robinhood customers weren’t getting the best price on their trades, and since Robinhood misled their customer about this practice.

How Much Does Robinhood Earn from “Payment for Order Flow”?

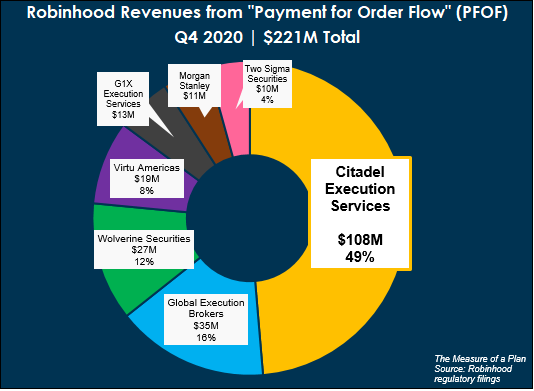

According to Robinhood’s regulatory filings for Q4 2020, Robinhood made a whopping $221 million in revenue from PFOF in Q4 2020 alone.

I’ve tabulated the data in a spreadsheet (available here), and have broken out their revenue from each partner:

Nearly half of Robinhood’s PFOF revenues — $108 million in Q4 2020 alone — come from Citadel. 🚨🚨 Remember that name, as they’ll feature prominently in the epic struggle for GameStop stock that follows.

Citadel is a hedge fund and market maker. Its success has vaulted founder Ken Griffin to a net worth of more than $20 billion. Technically, the two sides of Citadel (hedge fund / market maker) are split into two separate arms — but they are both under one parent company and both arms are owned by Ken Griffin.

As a side note, Citadel Securities (the market marker arm) has been fined numerous times in the past, for activities such as “misleading customers about pricing trades”, “trading ahead of clients”, and “trading rule violations”.

To reiterate — Robinhood makes hundreds of millions of dollars per quarter from selling customer data to Wall Street firms such as Citadel. These firms profit off of this ‘order flow’. And Robinhood has a documented history of misleading customers about these relationships.

So who is Robinhood beholden to: its customer — the general public who trades on the platform — or the Wall Street firms who profit off of these trades?

What was that in the back? Did someone say “conflict of interest”?

And yes, it’s true that most other brokers also make money from PFOF, but none rely on it nearly as much as Robinhood does.

From Forbes / Morningstar:

In the first quarter of 2020, 70% of Robinhood’s revenues derived from payments for order flows, as opposed to 17% for E-Trade and just 3% for Schwab. Yes, Robinhood has observed standard practice–but with distinctly above-average enthusiasm.

Enough about PFOF. Let’s get to the action of the GameStop story to see how conflict of interest plays out in a live situation.

$GME and Me

You’ve likely all heard this story already but I’ll breeze through the long and “short” of it.

GameStop is a brick-and-mortar retail company that sells video games, electronics, and gaming merchandise. The company has been struggling for years in the face of new e-commerce competitors.

Hedge funds have been betting on the further decline of GameStop (GME) by “shorting the stock” — whereby they borrow GME shares, sell the borrowed shares, and have the obligation to buy the shares back at a later date. These hedge funds are implicitly betting that GME shares will go down in price.

Over several years, these short trades drove down the price of GME shares to ~$4 per share.

Enter /r/WallStreetBets — a forum dedicated to finding and discussing high-risk stock market trades. Throughout 2019 and 2020, users developed a hypothesis that GME shares were significantly undervalued.

The theory held that there were fundamental reasons that GME would outperform expectations — largely centered around new board members with fresh ideas, a technical market event called a “short squeeze”.

The hedge funds had gotten too aggressive in their short positions and driven the stock price too low.

A short squeeze occurs when the share price starts rising, and short sellers (who borrowed the shares and sold them) are forced to start closing their positions by buying shares in the market. These buy orders cause the share to rise even higher (demand > supply), forcing even more short sellers to close their positions.

This process repeats again and again in a virtuous cycle, until the share price reaches astronomical heights.

At first, the theory sounded far-fetched, but everything changed… when the fire nation attacked(?)

More and more investors started believing in the short squeeze story — they really liked the stock! — and the price of GME began its lunar ascent.

From $4, to $10, $20, $40, $80, $160, $320 and beyond 💎🙌🌝🪐.

Short sellers now found themselves in a mighty pickle. They faced billions in loses if they bought back their shares at the current prices.

One hedge fund in particular — Melvin Capital — faced an existential crisis. They held a large short position betting against GME shares, and reportedly suffered a portfolio loss of 30% during the rise of GME.

It looked like Melvin Capital might go the way of the dinosaurs, until it was announced that they had secured new funding from fellow hedge funds Citadel ($2 billion in funding provided), and Point72 ($0.75 billion in funding).

🚨🚨 Antennas up — does the name Citadel sound familiar?

Yes ladies and gentlemen, this is the same Citadel who pays $108 million to Robinhood per quarter(!), and is therefore Robinhood’s single largest revenue source.

Here’s where the story get truly twisted.

In the same week that Citadel became a part owner of a hedge fund betting on the decline of GME shares, Robinhood imposed trading limits on its platform — first preventing customers from buying GME shares entirely (and only allowing them to sell), and then later allowing customers to purchase only a single share of GME in their accounts.

It’s worth repeating — Robinhood took actions that caused GME shares to go down in price. Meanwhile, Robinhood’s largest source of revenue (Citadel) is an investor in a fund which is betting on GME shares to go down in price.

Clearing Houses & the Plumbing Behind Financial Markets

To be clear, there isn’t any hard evidence that Citadel directly influenced Robinhood’s decision to prevent users from purchasing GME shares. The CEO of Robinhood has denied any connection whatsoever. Instead, the decision has been attributed to clearing house requirements and “market settlement mechanics”.

This claim by Robinhood does appear to be valid. The Depository Trust & Clearing Corporation (DTCC) — a “clearing house” where shares are exchanged between buyers and sellers — is a core part of modern financial architecture, which serves to reduce risk to the system if one broker were to go bust. The DTCC requires members to post collateral. As trading volume and volatility grows, the collateral requirements also increase.

However, it looks like the DTCC increased margin requirements on GME stock on Thursday — which forced Robinhood to post more collateral — which drove Robinhood’s decision to prevent users from buying more GME shares.

This adds another piece to the puzzle.

We need more clarity on: Why did the DTCC make its decision? Was that decision properly communicated to the market, or did some firms get early access to the info? What conflicts of interest do they have? Was the DTCC lobbied by other Wall Street players to make that change on Thursday?

Where Do We Go From Here?

We should reserve final judgement on this matter until all the facts come out, but it’s clear that this deserves a thorough and transparent investigation. The conflict of interest between Robinhood and Citadel is just too great.

We should support AOC, Elizabeth Warren, and Donald Trump Jr. (you read that right) when they call for the facts to come out into the light.

Financial markets are complex, with many intermediaries that allow the system to function. This is a tangled web of middle men, bilateral relationships, and murky partnerships.

What’s clear is that those at the top always put the best interests of their exclusive club first (see the GME case, see the subprime crisis of 2008, see any event in which hedge funds lose).

The Robinhood of old took from the rich and gave to the poor — the Robinhood of new is a complete mirror image.

Today’s Robinhood is a multi-billion dollar company funded by Wall Street, who sells its customer data to Wall Street so that they can profit (while hiding this fact from the public until the SEC forces them to reveal it), and prevents customers from making trades that would harm their Wall Street partners.

Let’s remember this event in history, because frankly the elites have gotten away with changing the rules too many times already.

Let’s call for a full investigation into this case, greater transparency on how our trades are being executed, and a truly fairer financial system for all — and not just one that’s part of a snappy corporate mission statement.

Header image credit: Matt Kenyon / FT

Hi MOAP,

Great explanation you have provided, thank you.

Questrade and Wealthsimple also offers its clients free trades when buying shares. What is their business model, how do they make their money, and should its clients have any concerns?

Clarification: Trades for stocks are not free, only ETFs.

Hi David,

Great question — thanks for your comment. I’ve started some research into this, perhaps for a future article.

Some good background info:

https://www.gbm.scotiabank.com/content/dam/gbm/market-insights/etf/october/2019-10-02-Free-Trading.pdf

https://help.wealthsimple.com/hc/en-ca/articles/360056581134-Is-it-really-0-commission-How-does-Wealthsimple-Trade-make-money-

https://help.wealthsimple.com/hc/en-ca/articles/360058452713-How-does-Wealthsimple-Trade-NOT-make-money

https://www.questrade.com/pricing/self-directed-commissions-plans-fees/transaction

My initial findings:

The practice of “payment for order flow” is currently banned in Canada (see first link above).

Canadian brokers make money from interest on cash sitting in accounts (i.e., they invest your excess cash and keep the returns), and currency exchange fees (applying a mark-up on the exchange rate).

Wealthsimple Trade mentions that they are looking to offer “premium offerings that will carry fees to access” in the future.

Questrade does charge commissions when you buy/sell individual stocks, and also when you sell ETFs ($5 to $10). In addition, Questrade charges ECN fees when you submit an order that removes liquidity from the market (such as a market order, or a limit order that fills immediately).

I’ve got more to learn on this front as well. I hope this helps!

[…] How Robinhood Misled the Poor and Rewarded the Rich […]

[…] https://themeasureofaplan.com/robinhood/ […]