While a journey of a thousand miles begins with a single step, the path to wealth begins with a budget.

Your budget will serve as the foundation for the rest of your financial plan — reducing debt, saving money, and investing to build wealth.

Before we get too far, what exactly is a budget? While there are many ways of looking at it, I define a budget as a document that shows:

- How much you earn and how much you spend

- What you spend your money on (rent, groceries, eating out, entertainment, transportation, etc.)

- How your current earning and spending habits compare against your targeted goals

Having a budget doesn’t mean that you need to penny-pinch, cut back on all of your expenses, or stop buying coffee in the morning. It just means that you know your current financial trajectory, and whether that trajectory will lead you to where you’d like to be in the future.

Everyone needs a budget. Those living paycheck-to-paycheck can use a budget to identify places where spending can be cut back. Those who already manage to save money each month can use a budget to plan for goals such as buying a house, saving for a child’s education, or retirement.

Before we decide on where we want to go and how to get there, we need to know where we’re standing first.

Pause for a moment here and try to estimate how much money you spent last month.

If you don’t track your budget regularly, this question is probably quite difficult to answer without relying on a wild guess.

Most people have a good idea of how much they spend on recurring bills (rent, utilities, gym, internet, etc.) but are surprised when they see the actual numbers on their total, all-inclusive spending. It adds up fast — the lunches out, weekend trips, drinks with friends, small purchases here and there…

I find that most people (myself included) tend to have “recurring one-time expenses” (which may seem like an oxymoron). The new shirts you bought last month or the weekend trip you took the month before might be “one-time” expenses that won’t come up again for a while, but for most people a new type of “one-time” expense seems to always pop up to take its place (celebratory dinner? replacing your laptop? a new couch?).

If you want to have an accurate view of your typical spending habits, it’s important that you track your spending in detail on a regular basis.

All that to say: to make progress in your financial life, you need to have a strong grasp on your cash inflows and your cash outflows.

Let’s stop beating around the bush. How do you actually go about creating a budget?

A Tool for Tracking Your Budget

I’ve built a spreadsheet which allows you to record your earning & spending data, set future budgeting goals, and visualize your cash inflows / outflows in a dashboard. Grab a copy of that budgeting spreadsheet here, and read through the post for a tutorial on how to use the tool.

Step 1 – Download Your Historical Data

It’s time to go back in your personal history so that you can piece together a picture of your earning and spending habits.

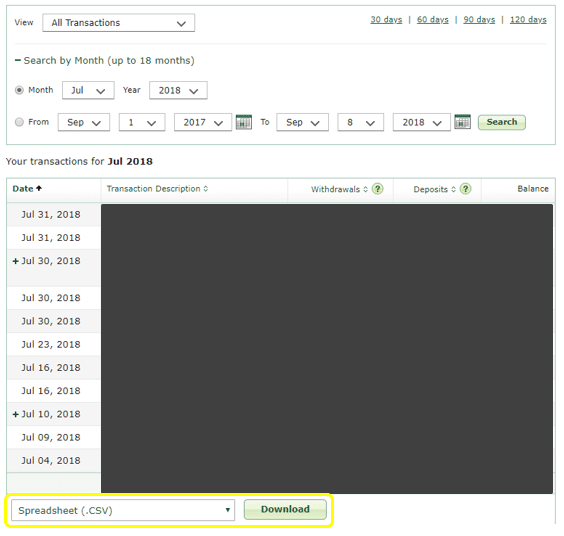

Log in to each of your bank accounts / credit card accounts, and export your transaction data into spreadsheet form. Every bank is different, but they’ll all offer some kind of excel, spreadsheet, or “CSV” download option (CSV stands for “Comma Separated Values”, and these files can be opened in any spreadsheet program).

As an example, my checking account at TD bank allows me to export my transactions in “CSV” format.

I recommend going back in time by at least 3 months. 6 months would be better, and 12+ months would be best. The goal is to cover a time period that will reflect your normal spending habits.

Once you have everything downloaded, put these transactions into the “expenses” and “income” tabs of the budget tracking spreadsheet linked above, as appropriate.

Afterwards, you’ll need to add a category label (e.g., groceries, rent, utilities, public transportation, etc.) beside each of your transactions.

Although this can be a time consuming exercise (especially when you’re just starting out and entering in multiple months), putting in the effort to understand your current financial habits will pay off again and again. I can’t stress how important this is to do — grab your drink of choice, settle in, and make it happen!

Personally, I update my spreadsheet once every couple of months, and it takes me 20-30 minutes each time — including the time spent reviewing (geeking out over) the outputs.

Step 2 – Review Your Results

Switch over to the “Dashboard” tab of the spreadsheet. You’ll see your results visualized in a few different ways: total income / spending / saving over the entire time period, your numbers broken down by individual category, and your monthly results over time.

Ask yourself these questions:

- What was my total income, spending, and savings over the time period that I’ve entered in?

- Are my habits pretty constant over time, or are there big month-to-month swings?

- What are my main spending categories? Do any of these numbers come as a surprise?

- Am I comfortable with the amount of money I’m spending on “discretionary” items such as eating out at restaurants, new clothing, travel, etc.?

Take your time to get acquainted with the results. Maybe some of this is unexpected. If so, just keep in mind that being aware of your habits has already put you in a much stronger position to deal with this in the future.

You’ve just taken a huge step towards being conscious and in control of your money.

Step 3 – Set Your Future Budget Targets

Now that you know what your current trajectory looks like, you can set goals for the future.

Navigate to the “Budget Targets” tab of the spreadsheet. Here, you can enter in targeted goals for each of your income and expense categories. If you’re comfortable with where you’re at, feel free to set your targets at a similar level to where you are today. If you’d like to cut back on some spending categories, you’ll be able to set those goals here.

There are many different budgeting styles, and as time goes on you’ll likely settle into a preferred setup.

Some people use an “envelope” budgeting method. To do this, you set aside specific dollars for each spending category (e.g., $300 for groceries, $100 for eating out, $50 for clothing), and you commit to spending no more than that amount of money for each category. If you run out of money mid-month, you stop spending on that category — no ifs, ands, or buts. This method is quite strict, but can be helpful for those who have trouble controlling their spending. Check out Dave Ramsey’s guide to the envelope method.

Others are much more flexible with their budgeting system, and allow themselves to spend on anything they want, as long as they meet an overall savings goal. Let’s say your take-home pay is $3,000 per month, and your goal is to save 15% of your salary — $450 per month. This means that you can spend at most $2,550 during the month. How you spend that $2,550 is totally up to you.

It’s entirely up to you how you go about it. Choose the envelope method, choose the overall savings goal method, or go with something in between. As long as you have a goal to work towards, you’re good to go.

Make it a Routine

Once you have your budget goals worked out, make sure that you stick with the process by making budgeting a part of your routine. Your budget should be a living document that you update and re-visit on a regular basis.

By committing to a regular budgeting routine, you’ll motivate yourself to make improvements and meet your goals. It will also force you to face up to your bad habits — the data won’t lie.

Decide on the frequency at which you’ll update and review your budget. I suggest that you do it once a month (or more frequently) until you get a hang of it.

Each time you sit down to budget, just follow those same steps listed above:

- Download your historical data, and input that data into your budget tracking tool

- Review your results — did your spending go up or down versus last month (and why)? Are you comfortable with what you’re spending your money on? Did you meet you savings goal for the month? What changes can you make next month?

- Set your future budget targets (feel free to leave these unchanged from month to month, or to make tweaks as you go along)

Budget once, budget twice, budget ’till your money’s nice. Then budget once more…

Tagging – so you mean tagging as in Excel tagging or simply manually entering each amount and categorizing it? I found this a bit confusing

Hi Maddy,

When I say “remember to tag each of your transactions with a category label”, I mean manually entering a category in the Category column of the spreadsheet.

For example:

$40; restaurant

$30; groceries

$50; clothing

etc.

Sorry for the ambiguity, I will clarify in the post.

It’s so hard to find someone who genuinely wants to help others in this day and age and I am so glad I stumbled upon your website! Your posts are so straight forward and easy to understand, especially for beginners in personal finance. Thank you for creating this!

I find that the Mint app is very useful for getting a categorized overview of your income and expenses, and you can also create a budget through Mint for those who may find this method too complicated or time-consuming.

Thank you Emily for your kind comment! Mint is a great solution for budgeting as well.

The end goal is to stay on top of the money that’s coming in and out each month, and apps like Mint make it easy to do so if you’d prefer to stay away from spreadsheets.

Cheers!

Very true Emily, I am so amazed and definitely so much appreciative of this site. Thank you so much The Measure of a Plan!!

Hi.

I love your spreadsheet tool, but I am having difficulties with it updating in real time. Am I missing something? I want the budget targets tab to update when I put in an expense or when I make a change in column G of the tab.

Thank you for your help,

Jenny

Hi Jenny,

That’s strange! The spreadsheet should update automatically whenever new data is added.

Are you using the excel version? Can you make sure that your calculation option is set to “Automatic”?

https://www.howtogeek.com/162219/how-to-change-the-automatic-calculation-and-multi-threading-features-in-excel-2013/

Hello,

Im entering my data but i have ni idea if im doing it right. Is there any visual reference i can see sothat i know im doing it correctly?

Hi Liam,

You can find instructions for using the spreadsheet here: https://themeasureofaplan.com/budget-tracking-tool/

A reader also created a youtube video about the spreadsheet which could be a helpful visual guide: https://www.youtube.com/watch?v=1jZ1EIoomDA&feature=youtu.be

Hi!

The way I’m doing my budget is: total income-total invariable expenses(immediate obligations: bills, debts, subscriptions, etc).

From this result, 40% goes to savings, 40% for free-spending, always sharing the same ceiling. Leaving me with 20% extra.

This twenty, if I want to spend it, I’ll share the same amount with my savings.

E.g.:I have $100 extra, I want to spend $30, I have to add first $30 to my savings.

If I still have extra money at the end of the month, I will cash out 50% of it to a pot that will never be accounted for (for psychological porpuses, not considering that cash in my accounting, cutting with any comfortability that I might have with my numbers, leaving my error margin positive). Other 50% stays to start the month always positive.

While the spending is controlled as well divided by the days left until the next salary.

What do you think? Would you consider this a budget plan? Is there any red flags you might find? Any suggestion?

Thank you for your time and I hope this doesn’t sound confusing.

Hi Francisco,

Your plan sounds OK, but a little complicated!

I’d suggest you look at something which is a bit simpler, such as the “50/30/20 budget”: https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

Of course this is just a rough guide, so feel free to adjust the percentages to fit your own situation.

Oh no, I entered all of my expenses and it will not calculate. What could I have done wrong? Thanks.

Hi Jack,

Please see this page, and read through the tips in the FAQ and Troubleshooting sections.

https://themeasureofaplan.com/budget-tracking-tool/

Hi,

First let me thank you for such a great informative website you got. Thank you so much for providing it for free.

I have a quick question, is the assumption to have all year long transactions/expenses in same tab and file? I mean won’t that make the file prone to crashes or slowness? can a yearly expense tab be added for each year and the green ones can take that into account?

Regards,

Michel

Thanks for this great tool! I’m curious, does investing money should be traced in this tool? I currently have a line in income (putting money in a new REER) and expense (transferring money to this REER). Should I remove these two lines, or keep only one? Maybe this is a personnal thing and I should decide what I prefer, but I’m curious of what is the typical way to handle these situations.

Hi Frédéric, when I do my own personal tracking, I don’t include transfers to investment accounts.

I am using a separate spreadsheet to track the investments I make and their performance over time: https://themeasureofaplan.com/investment-portfolio-tracker/

You’re right that it’s a personal decision though, so feel free to track how you’d like. Cheers!

Great tool and resources on your website, love it! Question though, the budget dashboard caps out at Jan 24, is there a way to extend this? Right now it is hard to see anything relevant as the dates are a few months in past.

Hi Nick,

Once you add transactions for the latest month (April 2024, May 2024, etc…), the Dashboard will automatically update and allow you to see this latest information. Please try toggling the date range shown at the top of the Dashboard tab.

If the error is still appearing, I’d be happy to take a look at your sheet to see if I can identify what’s causing the issue. Please add me as an editor to your sheet (click the share button in the top right corner) and then send me the link to your sheet by email. I can investigate after.