June 12th, 2018 | Posted in Tools

Get the Cost of Raising a Child calculator as an Excel file or as a Google Sheets file.

“If one feels the need of something grand, something infinite, something that makes one feel aware of God, one need not go far to find it. I think that I see something deeper, more infinite, more eternal than the ocean in the expression of the eyes of a little baby when it wakes in the morning and coos or laughs because it sees the sun shining on its cradle.”

-Vincent Van Gogh

I am neither as talented nor as eloquent as Mr. Van Gogh. As a testament to that, today I’d like to discuss the not-so-romantic topic of the cost of raising a child.

If you’ve decided to take the plunge into parenthood, taking the time to calculate the expected costs will ensure that you aren’t blindsided by the upcoming changes to your finances.

Hopefully you’ll find that the “something grand and something infinite” isn’t the bill created by those precious little footsteps…

How Much Does it Cost to Raise a Child?

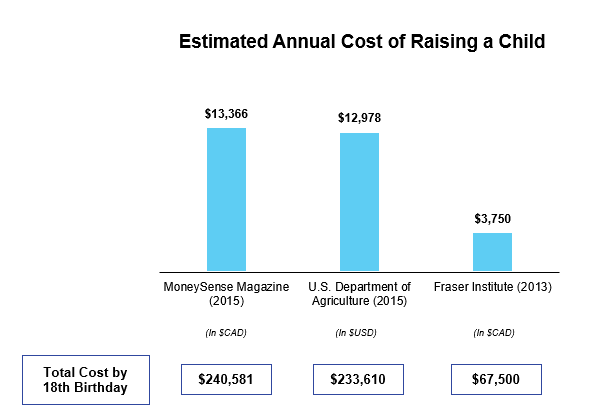

Many economists and policy groups have crunched the numbers on the “average” cost of raising a child. A few of the often-quoted figures are shown below:

MoneySense magazine estimates a cost of CAD$13,366 per year (a total of over $240k up until the child’s 18th birthday).

The U.S. Department of Agriculture has estimated a cost of USD$12,978 per year for families with mid-income ($59,200 to $107,400 in pre-tax household income). For families with low-income (<$59,200 income), the estimate drops to $9,705 per year. For families with high income (>$107,400 income), the estimate rises to $20,678 per year.

The Fraser Institute has estimated a cost of $3,750 per year (mid-point of their $3,000 to $4,500 range).

It is very important to keep in mind that the Fraser Institute did not include housing, transportation, and childcare costs in their estimates (!?). Their reasoning is that these expenses are either lifestyle choices by the parents, or are optional expenses (highly debatable assumptions, but I digress).

None of these estimates take into consideration the cost of saving up for a university / college education, and the lost income that may result from one (or both) parents staying at home to provide childcare.

The Flaw of Averages

Each and every family will have their own unique situation and unique preferences.

What one family absolutely “needs”, may be an unimaginable luxury for others. While some families will send their children to Montessori and study-abroad trips in Europe, other families will send their children to public school and spend summers at home.

With this in mind, the “average” cost figure is essentially meaningless.

The cost of raising your child will depend on a great number of variables:

- Do you have enough space / enough bedrooms in your home, or will you need to move somewhere bigger?

- Will you need to move to another neighbourhood to be closer to schools?

- Do you need to buy a car or upgrade to a newer / safer car?

- How will you be providing childcare? Will one parent stay home, or will you opt for daycare / babysitting?

- Are you planning on buying clothing and toys secondhand, or will you be buying new?

- Will you be starting a university / college fund for your child?

- Will you use cloth diapers or disposable diapers?

And on, and on, and on…

Depending on the answers to these questions, the cost to raise your child may be significantly higher or lower than what an overall average would indicate.

To get a remotely accurate estimate of the cost of raising your child, some time and effort is required. Only after going line-by-line through each expense category can we get a clearer sense of the cost you should expect to raise your child.

To help with this task, I’ve built a tool to serve as a guide and checklist for you in figuring out how much raising your child will cost.

Using the Cost of Raising a Child Calculator

If you haven’t done so already, please open up the Cost of Raising a Child calculator (either as an Excel file or as a Google Sheets file).

First things first, go to the “Recurring Costs” tab. For each category of expense (e.g. housing, food, transportation, clothing, health care, childcare, etc.) you’ll be able to input your assumptions.

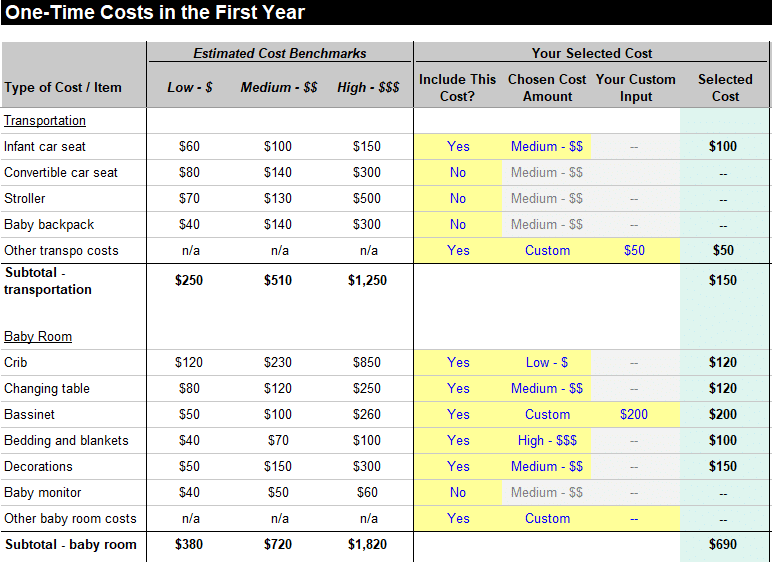

I’ve included ‘estimated cost benchmarks’ (low – $, medium – $$, high – $$$) to give you a rough sense for how much you can expect to spend in each of these categories.

These are only illustrative estimates, please use your best judgement in deciding what the right cost is for your family. Also note that these estimates are in US dollars (since I was only able to find detailed online sources from the US).

You also have the flexibility to choose whether to exclude certain costs, which cost benchmark to choose, and whether you’d like to enter a custom value. You can also specify a start and end date of the cost. For example, you’d be able to specify that childcare expenses will start at age 3 and end at age 10.

The only cells that you need to modify are those highlighted in yellow.

Follow the same steps to fill out the “One-Time Costs” tab. Here, you will enter the one-time costs that you’d have in the first year of child’s life. Strollers, car seats, baby proofing supplies, and the like.

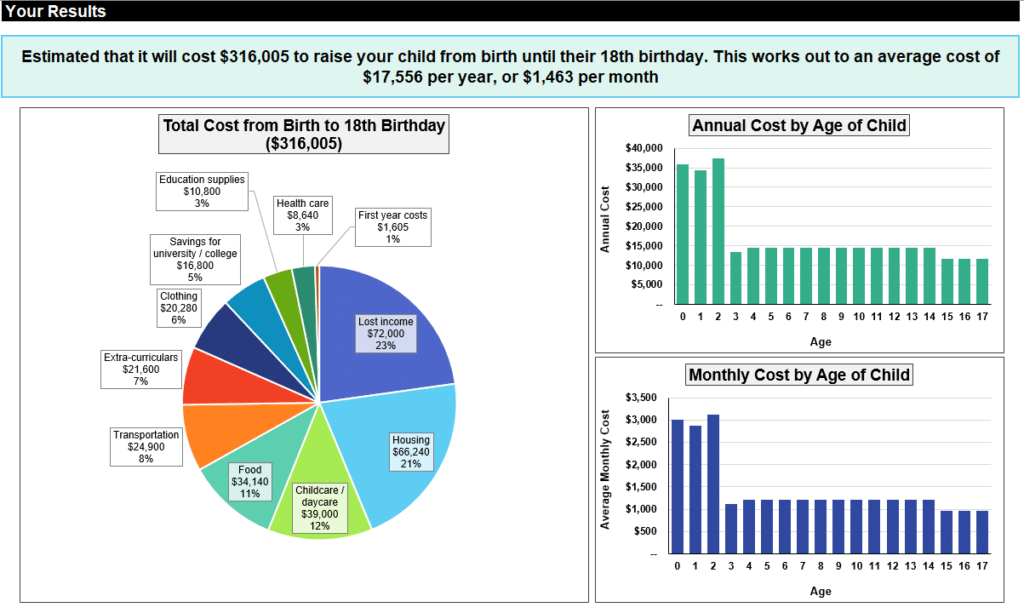

Your Results

Once you’ve done that, the hard work is over!

Flip to the “Results” tab to see the final answer. The total cost of raising your child from birth to their 18th birthday is shown here, together with a breakdown into each cost category.

You’ll also find the cost summarized on an annual and monthly basis for each year.

If you’d like to have full control of the expenses to raise your child in each year, you can use the “Fully Custom Scenario” tab. You’ll be able to input expenses at each age, and see the results of that custom scenario (starting on row 74). If you don’t want all this detail, feel free to disregard.

Can I Afford to Have a Child?

Now that you have a good sense of how much it’ll cost you to raise your child, the next question becomes – can I afford this?

It’s time to take a long and hard look at your budget. By tracking how much money you make and how much you spend, you can see if you’ll be able to take on the extra costs of parenthood based on your current spending and saving habits. If not, you may need to find ways to cut back on your expenses, or put off having kids until you have a higher income.

Please keep in mind that this calculator does not take into consideration the changes in your lifestyle that might result from having kids. If you end up taking fewer vacations or going out to bars less because you now have kids at home, part of the cost of having children would be offset by decreased expenses in other parts of your life.

You should also make note of the government benefit programs that may be available to you. Whether it is the Canada Child Benefit and GST / HST credit , or the U.S. Child Tax Credit, you may be eligible to receive assistance from the government to offset some of your costs.

Putting this all together, you can assess how much slack you currently have in your budget, the cost of raising your child, and the benefits you’d receive from the government.

Final Thoughts

The cost of raising a child depends on many factors, and can be wildly different from family to family.

Estimating your cost by individual category is hard work, but really is the only way to get to a reasonable figure.

I hope that you find the Cost of Raising a Child calculator that I’ve built to be a useful checklist and guide for figuring this out.

If you have any questions or suggestions for improvements, please let me know in the comments below, or by email at themeasureofaplan@gmail.com.

—

Header image credit: The Mirror

“The cost of raising a child depends on many factors, and can be wildly different from family to family.”

this is how i feel. sometimes when i see the costs next to an expense in posts or articles like this, i always say, I can get that expense lower than what’s listed. There are so many factors to consider, but one thing is for sure regardless of what the expense is, raising a child IS freaking expensive.

Hey Valerie,

Totally agreed. Raising a child is very expensive, so it’s definitely something that should be well planned for.

It’s hard work to go expense-by-expense to get to a reasonable total, but I think the exercise is well worth the time invested.

[…] issues that Canadian financial planning website The Measure of Plan set out to resolve with a new child costs calculator that went live on […]

[…] issues that Canadian financial planning website The Measure of Plan set out to resolve with a new child costs calculator that went live on […]

This is amazing thank you so much for this!! It was really helpful seeing everything broken down like this. I’ve seen some of those overall total figures and was quite scared by them…

I won’t need to move to a new home when I have a child, which helps to keep the costs down significantly.

Thanks again 🙂

Sarah, I’m really glad to hear that.

Definitely a good idea to consider the costs on a line-by-line basis rather than focus on the intimidating headline number.

Cheers and good luck!

[…] varies throughout the country, as does each individual family’s circumstance (check out The Measure of a Plan’s cost of raising a child calculator here to determine a realistic expectation for your […]

[…] you want a more personalized estimate, check out the excellent “Cost of Raising a Child Calculator” from The Measure of a Plan. Yikes! It looks like our youngest is still going cost us $206,000 […]

This is incredible work. EXACTLY what I was looking for.

Thanks for letting me know Chris, much appreciated!

[…] can access a Cost of Raising a Child calculator, which will help you look at spending patterns for families similar to […]

Thanks for sharing such an informative blog.

[…] how much it will cost you to raise a child? Check out this calculator to find […]

[…] is estimated that it currently takes a whopping quarter of a million dollars to raise a child from zero to eighteen years old. And that is just for the basics! Make a list of what you are spending your money on currently. […]

[…] can find a “Cost of Raising a Child” tool that will calculate these expenses based on demographics and […]

[…] can find a “Cost of Raising a Child” tool that will calculate these expenses based on demographics and […]