Before jumping into discussions about budgeting, saving, and investing, I want to spend some time to make sure that you know how to read your paycheck. After all, we can only save and invest money that we’ve earned in the first place.

In this lesson, we’ll dig into these key concepts:

- Gross salary

- Taxes

- Deductions

- Net salary (also known as take-home pay)

Gross Salary

When people talk about their annual salary (e.g., $40,000 per year) or hourly salary ($20 per hour), they are almost always talking about “gross salary”. This is the headline number that appears on your employment contract.

This figure is only a starting point.

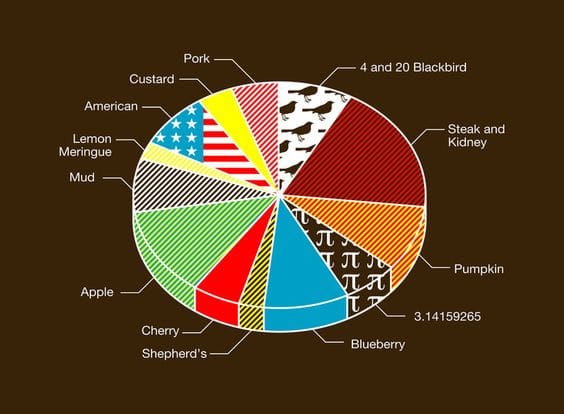

Unfortunately, the money that appears in our bank account after each pay day is lower than what our gross salary would suggest. Think of your gross salary as the entire pie. After taking off slices for taxes and deductions (discussed below), the remainder is of the pie is what actually gets deposited into our bank account.

Taxes

It’s morbid but true: ’Tis impossible to be sure of any thing but death and taxes.

When you earn money from your job, your employer will automatically subtract taxes off of your gross salary (boo). Your employer sends this money to the government on your behalf.

The main form of tax taken off from your paycheck is income tax. The amount of income taxes you pay are based on the concept of “tax brackets”. As your income gets higher, the percentage of your income that you pay in tax increases.

Here’s an overview of income tax brackets for Canadians and for Americans.

Side note #1: It’s a common misconception that you should try to stay below certain income levels, since shifting into a new tax bracket would reduce your overall take-home pay (i.e., higher salary but lower money coming into your bank account at the end of the day). This is absolutely NOT true.

When you move into a higher tax bracket, it’s only the money earned within that new bracket which is taxed a the higher rate, not your entire salary.

Side note #2: The taxes taken off your paycheck are a “withholding” tax, meaning that they are just an estimate of the amount that you should owe. At the end of the year, the actual amount of taxes that you should have paid will be calculated on your tax return. The resulting difference between what you paid and what you should have paid will be settled at that point (either through a tax refund or additional taxes owed).

Keep this in mind if you see something odd happen with your taxes on your paycheck (for example, when you receive a bonus). You will always get “trued-up” at the end of the year.

The bottom line: the higher your income, the more tax you pay. However, making a higher income will always increase the pay that hits your bank account.

Deductions

Depending on what company you work for, you may have other deductions that are taken off of your paycheck. These could include contributions to an employer stock option plan, an employer pension / retirement savings plan, or an employer health plan.

When you were first hired, HR may have given you forms to sign up for an employer retirement savings plan (often known as a “Group RRSP” account in Canada, or a “401k” account in the US). If you signed up, you’d be contributing a portion of your paycheck towards these savings plans (e.g., contributing 2% of each paycheck towards that account).

These amounts are deducted directly from your paycheck. As such, this money never arrives in your bank account. Instead, it’s held separately in a different account.

If this all sounds like mumbo-jumbo, we’ll talk about this in a future lesson on employer matching.

Net Salary (Take-Home Pay)

Gross salary is the full pie that we start with. After taking off a slice for taxes, and another slice for deductions, the amount of the pie remaining is what’s known as net pay or take-home pay. This is the amount of money that actually gets deposited into your bank account.

Your take-home pay is the most important number for you to know, since ultimately this is the money that you have control over. This is the money that pays the bills or gets saved for the future.

Knowing the amount of money that you take home each month will serve as a key input for the financial plan that you’ll build throughout this course.

An Illustrative Example

Let’s take an example from a hypothetical Canadian paycheck:

- For these two weeks, John earned a gross salary of $1,140 (regular pay plus overtime pay)

- John paid total taxes of $239.97. This consisted of income tax, employment insurance (EI), and Canada Pension Plan (CPP) payments

- John also had deductions of $104 for health insurance, registered pension plan, union dues, and Canada savings bonds

- As a result, John had take-home pay of $796.03 for these two weeks ($1,140 minus taxes of $239.97 and minus deductions of $104)

- John’s average tax rate was 21% for this paycheck (total taxes of $239.97 divided by gross pay of $1,140)

Note: The American version of CPP is known as Social Security.

Your Assignment

- Open up your latest paycheck (these may be mailed to you, or available for download from your company’s internal website)

- Similar to the example above, calculate your gross pay, taxes, deductions, and take-home pay (remember: take-home pay is equal to gross pay minus taxes and minus deductions)

- Calculate your average tax rate (also known as effective tax rate). To do this, divide the amount of taxes you paid into your gross pay amount

Resources

To get a quick and dirty estimate of what your take-home pay would be at different gross salary levels, try out these tools below. These can come in handy for estimating what your take-home pay would be after a raise, when moving to a new job, or just to perform what-if analyses.

I’m curious what you mean by your taxes get “trued up” at the end of year from receiving a bonus? I’ve noticed that any bonuses I receive generally get taxed at the highest possible rate.

Hi Daniel,

When taxes are deducted from your paycheck, this is known as a ‘withholding tax’. Basically, it’s an estimate of the income taxes that you owe.

When you actually file your taxes at the end of the year, you calculate the actual amounts of taxes that you should have paid. This actual amount that you owe is compared to the estimated amount (what was withheld from your paycheck).

If you paid MORE taxes throughout the year than you actually should have, you receive a refund. If you paid less taxes than you should have, you owe money to the government.

Now, when you receive a bonus from your employer, this usually results in getting taxed at a very high bracket. This is because the government estimates your taxes owed assuming that the amount you made in bonuses that period is what your normal pay rate is.

Let’s take an example…

– Let’s assume that you normally get paid $4K per month and receive a bonus of $5K at the end of the year

– This means your total salary is $53K ($4K per month * 12 months + year-end bonus of $5K).

– However, in the month that you receive your bonus, the income taxes withheld from your paycheck will be very high

– This is because it is assumed that you make $9K PER MONTH (or $108K per year), instead of the truth that you actually make $53K per year

– When you file your taxes at the end of the year, you compute the actual taxes that you should have paid vs what you did pay in withholding taxes

– At this time, you’ll find that you paid more than you should have. As such, you receive a refund

This is what I mean by getting “trued up” at the end of the year.

Hope this explanation makes sense to you!

“Side note #1: It’s a common misconception that you should try to stay below certain income levels, since shifting into a new tax bracket would reduce your overall take-home pay (i.e., higher salary but lower money coming into your bank account at the end of the day). This is absolutely NOT true.”

There’s one exception to this, or at least was: Ontario’s surtax. This tax does (or did, or both – there have been changes recently) benefit from staying below certain tax brackets. You can actually end up with a situation where an extra dollar earned results in a tax bracket shift for this surtax into a bracket that reduces your take-home more than that extra dollar.

Hi Moka,

Thanks for your comment.

From the info I’ve seen, I don’t believe that’s really the case with the Ontario surtax.

If you look at this page, in the section on “Combined Federal & Ontario Tax Brackets and Tax Rates Including Surtaxes”:

https://www.taxtips.ca/taxrates/on.htm

You can see that even when you include the surtaxes, this doesn’t create a scenario where earning an extra dollar of income reduces your total after-tax pay.

This is because the surtax is on applied on Ontario taxes ABOVE a certain threshold amount, not on your entire Ontario tax bill.

If this scenario did happen, this would mean that your marginal tax rate would be above 100% at some income levels.

For some further details, I’ve built this Canadian Income Tax Calculator, which lets you visualize income tax impacts across all provinces:

https://themeasureofaplan.com/canadian-income-tax-calculator/

If you look at Analysis #3 on that page for Ontario, you can see that after-tax income always rises in Ontario as pre-tax income becomes higher. This implies that the marginal tax rate is never above 100%.

Hi there,

I was wondering how this tax deduction works if you work as an entrepeneur? I have my own store and pay taxes over the full turnover of the store each year… I am in a ‘general parnership’… Thank you! And also thank you so much for this whole website, the excel sheets, documents etcetc. It is incredibly kind of you to share everything for free with us!