December 1st, 2017 | Posted in Real Estate, Rent vs Buy

Rent Versus Buy — Which to Choose?

Life isn’t all dollars and cents, and neither is the rent versus buy decision.

While I encourage you to crunch the numbers to find out whether renting or buying is better for you from a financial perspective, this decision is mostly a lifestyle choice.

There are many emotional, psychological, or other non-financial differences between renting and buying that may influence your choice, regardless of which path makes you richer.

The Advantages of Buying Your Home

- Changing your living space as you see fit: buying your home makes you the master of your domain. Want to paint the walls? Go for it. Want to re-do the tiles in the kitchen? Nothing’s stopping you. However, if you rent, you’ll need to ask for permission from the landlord, and won’t be able to benefit from these improvements in the long-term.

- Stability: if you buy, you have the guarantee that you can stay put for however long you’d like (as long as you pay your mortgage / property taxes). Your home becomes the stable rock around which you can build the rest of your life. If you rent, you’re beholden to the landlord, who might decide to find a new tenant, move in to your home themselves, or otherwise find a reason to force you to move elsewhere.

- Choice: when you buy your home, you’re able to choose from the full range of living space options, whether that’s a studio apartment, townhouse, detached home, or whatever else. When you rent, there are usually plenty of options for apartment style-living, but less so for large detached homes. If you want to have the full range of choice available to you, buying is the better option.

- Pride / status: in most societies, buying a home is seen as a major milestone in life. It symbolizes success, demonstrates responsibility, and can be seen as the last step in “becoming an adult”. For many people, homeownership is a source of pride; renting just doesn’t compare, regardless of what the financial analysis says.

The Advantages of Renting Your Home

- Flexibility: When you rent, you have the flexibility to move around easily. Life often throws curveballs at us: a great career opportunity in a new city, needing to move back to your hometown because of a family emergency, being forced to downsize because of a layoff, you name it. If you’re renting, you can pack your bags and go. If you’ve bought your home, this becomes much more complicated. Selling a home can often be a multi-month process, and can be very costly (~5%+ of the value of your home paid to your agent). Buying a home can become an anchor tying you down to a specific location, while renting avoids this burden.

- Fewer ongoing hassles: Buying your home means that it’s your job to maintain everything; the plumbing, electrical, roofing, flooring, exterior, so on and so forth. You’re in charge of doing it yourself, or hiring someone else to do it for you. Renting simplifies this immensely; if something goes wrong, call the landlord and let them deal with it! If your to-do list is spilling over as it is, you may prefer to rent.

- Simplicity: Renting your home can be as simple as finding a suitable place online, having a short visit, and then signing the papers. Buying your home involves many more steps in the process, including finding a buyer’s agent, meeting with banks to discuss mortgage options, hiring a notary to draft the legal agreement, and hiring a home inspector.

- Lower risk: Buying a home involves tying up a significant portion (if not all) of your net worth in one specific asset, in one specific location. Having your financial future being so dependent on the success of your local economy can be stressful, given that a downturn in your city could put your job at risk while decreasing the value of your home at the same time. In comparison, renting offers you the opportunity to diversify your wealth across a global portfolio of investments, limiting your exposure to the economic health of the city you’ve chosen to live in. If having diversification helps you to sleep at night, consider renting.

So What?

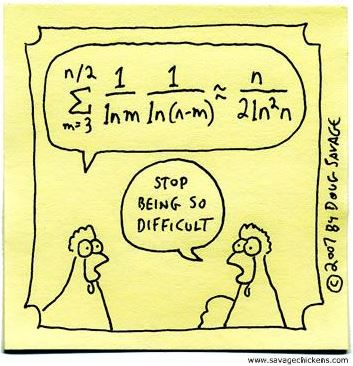

The math behind the rent vs buy equation is complex, and relies on educated guesses for stock market returns, home value appreciation, and more (not so easy for mere mortals). If the assumptions change slightly, the financial breakeven point between renting and buying can change significantly.

Looking purely at the math can leave us in “analysis paralysis”, stopping us from making the decision one way or another.

Unfortunately there is no quick and easy answer to the overall question. However, by taking stock of your gut feelings towards the soft / intangible factors discussed above, you might find that the path forward is clear.

—

Photo Credit: Doug Savage at Savage Chickens (highly recommended if you enjoy humour and/or chickens)

Comment Section

Be the first to write a comment.