June 29th, 2019 | Posted in Tools

A goal without a plan is just a wish, and a plan without a goal is an exercise in bureaucracy.

To assist you in setting financial goals and designing realistic plans to get there, I’ve built a simple Savings Goal Solver. It’s an interactive tool that gives quick answers to questions like…

- How much do I need to save each month to afford a home downpayment in 5 years?

- What investment return will I need over the next 20 years to reach my retirement savings target?

- If I save $200 per month and earn an investment return of 5% per year, how long will it take for me to reach my savings goal of $25,000?

An Algebraic Aside

Let’s take a quick hop, skip, and jump through the mathematics of how this works. This is just for your context — you don’t actually need to understand how the tool works in order to use it effectively.

The no-math-required web tool will follow in the next section.

In general, when you’re working towards any financial goal, the final value of your savings depends on: how much money you have today, the rate of return that you earn on your money, the length of time that you save for, and the amount of your regular contributions.

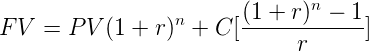

Translating this into math speak…

Where…

Where…

- FV is the final value (or future value) of your savings

- PV is the current value (or present value) of your savings

- r is the rate of return on your savings

- n is the time period over which you will be saving for

- C is the amount of money that you’ll contribute during each period

Now, some of you may be backing away slowly from the screen at the sight of that formula. If so, please bear with me for a few moments longer.

The point of showing the mathematical mechanics is just to demonstrate that there are 5 variables at play when you’re trying to reach a financial goal.

And through the mystical magic of math, we can re-arrange the formula above to solve for any of the variables, as long as we’ve supplied assumptions (inputs) for the other 4 variables.

For instance, if you’re trying to figure how how much you need to contribute each month, this will depend on the 4 other variables: your final savings goal, how much money you have today, your rate of return, and how long you save for.

If it floats your boat, feel free to ‘algebra it out’ and solve for the other variables.

For the mere mortals among us, the Savings Goal Solver below will let you easily solve for any variable, with precisely zero/zilch/zip math required.

The Savings Goal Solver

- Step 1: use the drop-down box to select the variable that you’d like to solve for

- Step 2: plug in your assumptions for the other variables

- Step 3: voila! time to get acquainted with the result 🙂

Variable to solve for:

| Your Assumptions | ||

|---|---|---|

| Initial Savings | $ | |

| Monthly Contribution | $ | |

| Time to Reach Goal | Years | |

| Months | ||

| Investment Return (Annual Rate) | % | |

| Implied Final Savings |

| Your Assumptions | ||

|---|---|---|

| Initial Savings | $ | |

| Final Savings | $ | |

| Time to Reach Goal | Years | |

| Months | ||

| Investment Return (Annual Rate) | % | |

| Implied Monthly Contribution | |

| Implied Annual Contribution |

| Your Assumptions | ||

|---|---|---|

| Initial Savings | $ | |

| Final Savings | $ | |

| Monthly Contribution | $ | |

| Investment Return (Annual Rate) | % | |

| Implied Time to Reach Goal |

| Your Assumptions | ||

|---|---|---|

| Initial Savings | $ | |

| Final Savings | $ | |

| Monthly Contribution | $ | |

| Time to Reach Goal | Years | |

| Months | ||

| Implied Investment Return (Annual Rate) |

| Your Assumptions | ||

|---|---|---|

| Final Savings | $ | |

| Monthly Contribution | $ | |

| Time to Reach Goal | Years | |

| Months | ||

| Investment Return (Annual Rate) | % | |

| Implied Initial Savings |

A note on inflation: I’d recommend that users input their assumptions in today’s dollars. This means that your final savings value would be in today’s dollars, and your rate of return assumption would be a real return (i.e., inflation-adjusted return).

Final Thoughts

Please keep in mind that when the tool calculates the final answer, it’s assumed that the input variables stay constant year after year. This is a simplification of how things usually turn out.

The amount that you save each month can bounce up or down as life takes its twists and turns. Investments can and do lose money, especially over short time periods.

With that in mind, I’d recommend tweaking the numbers up and down to get a sense for how the answers change when different inputs are used. Looking at it from multiple angles (solving for the monthly contribution vs. time to reach your goal vs. your final savings balance) is another great way to get a grasp on how realistic your financial goal is, and what’s required to get there.

All in all, it would be wise to take these answers as directional estimates, and it would be prudent to try running a “worst case” scenario with conservative assumptions.

—

One last thing for my fellow spreadsheeters: in the course of building out this tool, I created a quick and dirty version of this tool in excel. It doesn’t have all the bells and whistles included in the web tool, but the basic calculations are shown.

—

Header image credit: Andrea de Santis

Comment Section

Be the first to write a comment.