January 12th, 2019 | Posted in Tools

Robo-advisors have burst onto the investment scene with plenty of glitz and glamour. Armed with an online-first focus, the robos have quickly become the option of choice for younger investors.

However, when it comes to the topic of fees, there’s much left to be desired. While robo-advisor fees are lower than what a typical mutual fund would charge, they’ll still chomp up a big chunk of your savings.

Over the course of your working career, these robo-advisor fees will pile up into a tidy sum — certainly in the tens of thousands of dollars, if not more than a hundred thousand dollars.

In other words, using a robo-advisor could mean delaying your retirement by several years.

For anyone using a robo-advisor or for anyone sitting on the fence, I want to make sure that you know exactly how much money you’ll lose from paying these robo-advisor fees.

With that goal in mind, this article will feature:

- An illustration of why a seemingly small fee ends up snowballing into a big problem (a.k.a, how you can pay $37.50 of fees in year 1 and end up losing $80,000)

- An interactive calculator that will give you a custom estimate of how much money you’re giving up by going with a robo-advisor instead of using a DIY index investing strategy

- Resources to help you get started with DIY investing (i.e., a simple way to put in place the same investing strategy that robo-advisors use while saving on fees)

The Lowdown on Robos

In the span of a few short years, robo-advisors have made the transition from ‘new kid on the block’ to being a central piece of the investment ecosystem.

For those who haven’t yet seen a slickly-produced marketing pitch from one of these companies, a robo-advisor is commonly defined as: an online service which invests your money using an automated software program, without the need for human intervention.

The largest of the robo-advisors — a company called Betterment, currently manages $15 billion of investments for 375,000 customers, and has raised over $250 million of financing to expand their business (as of 2018, and growing fast). Nothing to sneeze at.

There are several dozens of robo-advisors out there. Among the biggest of the bunch are the aforementioned Betterment, together with Wealthfront, Personal Capital, Acorns, Wealthsimple, and WealthBar.

Almost all robo-advisors offer the following:

- A short “investor questionnaire” that gauges your investment horizon & risk appetite, and provides a recommended asset allocation (i.e., where to invest your money and in what proportion)

- An online platform that will automatically invest your money on your behalf, using an investment strategy “based on Nobel prize research” (a.k.a. passive investing / index investing / couch potato investing)

- An easy to use and beautifully designed website (featuring a trendy colour palette and millennial-friendly speak)

So far, so good.

But there’s one major piece of the puzzle that’s been left out — and therein lies the catch.

Robo-Advisor Fees

Robo-advisors are big profit-seeking companies that have hired scores of web developers, graphic designers, investment managers & researchers. To make their profits, these robo-advisors charge fees — typically ranging from 0.25% to 0.4% of the total value of your portfolio, charged each and every year.

At first glance, this may not sound like much. As these companies are fond of pointing out, if you have $10,000 invested with them, a fee of 0.25% comes out to only $25. Viewed from this angle, these robo-advisor fees seem like a rounding error that can be ignored.

However, keep in mind that this fee is charged every year, and that the fee grows as your investment portfolio grows.

With a portfolio of $100,000, the fee becomes $250 per year. For a portfolio of $1,000,000, you’re staring down a fee of $2,500 per year.

These persistent and pesky fees will stick with you through every twist and turn, chipping away at the value of your portfolio.

As we’ll see next, these fees accumulate into a major problem over time. Ignore them at your own peril.

The Impact of Paying Investment Fees

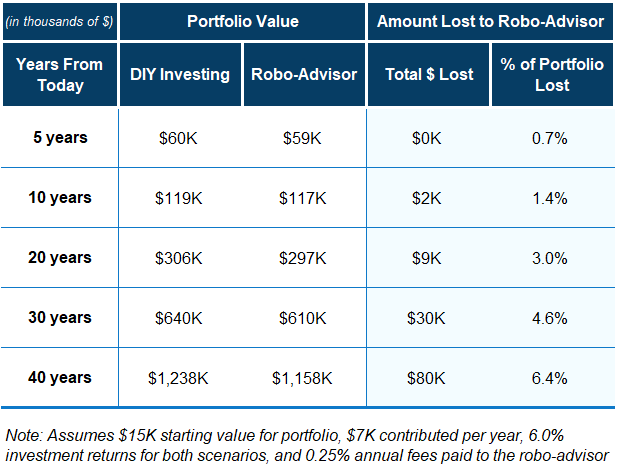

For argument’s sake, let’s take the example of Alex — a 25 year old who’s decided to invest her savings with a robo-advisor. She’s got $15,000 saved up, and expects to save an additional $7,000 per year going forward.

We’ll also assume an investment growth rate of 6% per year (after inflation), and assume robo-advisor fees of 0.25% per year — the standard rate for the large U.S. providers (Canadian robo-advisors usually charge a heavier fee of 0.4%).

Here’s what the picture would look like after 40 years — when Alex is 65:

- If Alex manages her own portfolio, she’d have ~$1.24 million

- If Alex uses a robo-advisor instead, she’d end up with ~$1.16 million

- By using a robo-advisor, Alex has lost $80,000 (or 6.4% of her entire investment portfolio)

In the first year, Alex will pay a pretty innocent-looking fee of $37.50 ($15,000 x 0.25%). Seems like a fair deal. But as the fees accumulate over time, what seemed quite reasonable at first ends up snowballing into an $80,000 problem.

If Alex needs to make up this gap at the end of her career, this could mean delaying her retirement by a few years, or reducing her standard of living in retirement (skipping out on vacations, a cheaper living space, etc). Put another way, entire years of Alex’s efforts to save up money have been eaten up by the robo-advisor fees that she pays.

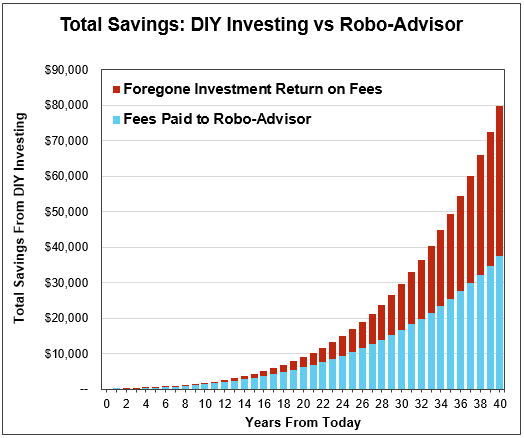

The $80,000 that Alex loses is broken up into two main pieces: the fees paid directly to the robo-advisor, and the foregone investment returns on those fees.

The direct fees are straightforward. Alex pays a fee of 0.25% of her total portfolio value each year.

However, the foregone investment returns are a little bit more nuanced. Since Alex has paid fees to the robo-advisor, her portfolio is smaller. With a smaller portfolio, the investment returns that she’ll earn each year will also be smaller.

Take a look at the chart below. Over time, you can see that these two impacts have nearly equal importance. Alex will pay roughly $38,000 in fees to her robo-advisor. And because she wasn’t able to invest the money that she paid in fees, she’ll lose out on $42,000 of investment returns.

Again, keep in mind that Alex only paid $37.50 of fees in the first year. If you only look at the short-term, using a robo-advisor might seem like a great option. However, the long-term costs can be shocking and tough to justify.

To sum up:

- While robo-advisor fees might look pretty insignificant on the surface, they’ll rack up into a hefty amount over time. These fees are big enough to delay your retirement by a few years

- When you’re calculating the amount that you’d lose by using a robo-advisor, you can’t just look at the direct fees paid each year. You also need to take into consideration the money you’d make over time if those fees had been invested in the market as well

What Does This Mean For Me?

In the example above, we saw that Alex loses out on $80,000 by using a robo-advisor. However, note that the answer changes significantly based on what assumptions we use.

If Alex saves $10,000 per year going forward (instead of $7,000), she’d lose $108,000 over her working career.

If Alex lives in Canada instead of the U.S. — where the standard robo-advisor fees are 0.4% instead of 0.25%, she’d lose $125,000 in total.

Now you’re up. Time for you to jump in to see how your own financial situation would be impacted by paying robo-advisor fees.

By using the tool below (inputting your assumptions / dragging the sliders), you’ll be able to see exactly how much you’d lose by investing with a robo-advisor instead of using a DIY index investing strategy.

Robo-Advisor Fees – Interactive Calculator

| Assumptions | |

|---|---|

| Current savings ($) | |

| Annual savings ($) | |

| Annual return (%) |

|

| Annual robo-advisor fee (%) |

|

| Hours spent per year on DIY investing |

|

| # of years to look ahead |

|

DIY Investing 101

If you’re looking for a path forward that doesn’t involve paying big fees to a robo-advisor, check out the (free) resources below for a simple guide to Do-It-Yourself investing:

- Two of my previous articles: (1) A Blueprint for Building Wealth, and (2) How to Trade Online

- A comprehensive series of articles on DIY investing and market psychology: JL Collins’ stock series

Robo-advisors use an investing strategy known as passive investing (or index investing). Put simply, this strategy relies on purchasing “index funds” that track the performance of a broad range of investments. Instead of betting on only a handful of stocks, you buy every stock that’s out there.

Perhaps surprisingly, it’s quite easy for the average person to replicate the same investment strategy.

By following a Do-It-Yourself index investing strategy, you can earn the same investment returns that you’d earn by using a robo-advisor, while saving the 0.25% – 0.4% fee that the robo-advisor would charge you.

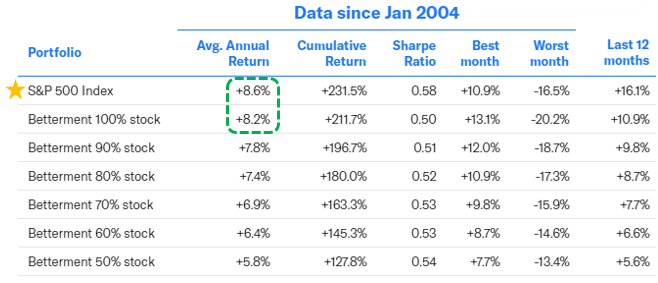

Just take a look at the chart below, which has been pulled directly from (leading robo-advisor) Betterment’s website. This shows the returns from Betterment’s portfolios versus the S&P 500 index (the 500 largest traded U.S. companies) — from Jan. 2004 to July 2018.

While the S&P 500 index delivered an average return of 8.6% per year, the Betterment 100% stock portfolio only delivered 8.2% after the fees were deducted.

Cutting out the middleman (or perhaps more accurately, middle robot) will let you build wealth and reach your financial goals more quickly.

And while the thought of doing it yourself might seem intimidating, it truly isn’t.

If you’ve got 10 hours to spare each year, you can be a DIY investor. And don’t worry — you don’t need to have an education in finance or have any particular talent with numbers.

A technical note: when you follow a DIY strategy you actually do pay some fees (typically around ~0.1% per year) to the company managing the index fund. However, you would pay that same fee to the robo-advisor on top of the 0.25% – 0.4% fee that they already charge. i.e., the all-in fee for using a robo-advisor is actually 0.35% to 0.5% (but the incremental fee vs DIY investing is 0.25% to 0.4% as discussed above).

DIY Investing for Busy Humans

As the name would imply, Do-It-Yourself investing does involve some amount of work on your part. However, if you follow the guides above, managing your own portfolio becomes a surprisingly easy task.

If you’re new to the concept, it’ll take a couple hours of reading to get a hang of the basics.

Once you’re up and running, you’ll then need to spend a few hours every year on the mechanics of it all — making trades and re-balancing occasionally.

My own DIY investing routine consists of:

- Taking 30 minutes per month to make trades in my brokerage account and to keep records in my investment portfolio tracker

- At the end of the year, I take an hour or two to review my results. And since I’ve got everything neat and tidy in a spreadsheet, tax time becomes very easy as well

- All in all, it takes me about 8 hours a year to keep my investments chugging along

That’s about it. I don’t read quarterly financial reports from Apple and Walmart. I don’t look for “hot stocks”. I don’t try to jump in-and-out of the market when my crystal ball looks particularly shiny that morning.

Re-visiting our example from earlier, Alex would save $80,000 in total by using a DIY strategy and would likely spend something like 400 hours on managing her portfolio (10 hours a year x 40 years).

This works out to savings of $200 per hour (!!).

Your hourly savings figure might be higher or lower (the calculator above will give you the answer), but it’s very likely that the return on learning how to do DIY investing will be better than nearly anything else you can spend your time on.

DIY Investing for Mere Mortals

The financial industry has done a tremendous job of convincing the general public that they simply aren’t equipped to manage their own money.

Investing is too complicated, too time-consuming, and best left in the hands of people with fancy degrees and even fancier watches.

This couldn’t be further from the truth.

You absolutely do not need to be a stock market guru to be a good DIY investor. You don’t need to spend hours digging into press releases and financial results to find good stock picks — in fact, you don’t need to pick stocks at all. And you certainly don’t need to be the next Warren Buffett or Gordon Gekko.

Spend a few hours learning the basics of do-it-yourself investing. Give it a fair shake, and see how you feel afterwards.

If DIY investing still seems too challenging, and you’re aware of how much money you’re giving up by going with a robo-advisor, then so be it. You have the facts in front of you and can be confident in your decision to stick with a robo-advisor.

The Good, The Bad, The Ugly, (and the Worst)

Let’s take a big step back. From the tone of this article I think it’s evident that I don’t have the highest opinion of robo-advisors.

However, I do want to make it clear that robo-advisors are not all bad.

These companies have done great work in educating the general public — and young people in particular, of the benefits of passive investing and starting to save at an early age.

They’ve also provided consumers with a cheaper investment option compared to actively-managed mutual funds.

These are all fantastic achievements that deserve praise.

It’s just that when you take stock of the puts and takes, robo-advisors are better than some alternatives, but are far from the ideal solution.

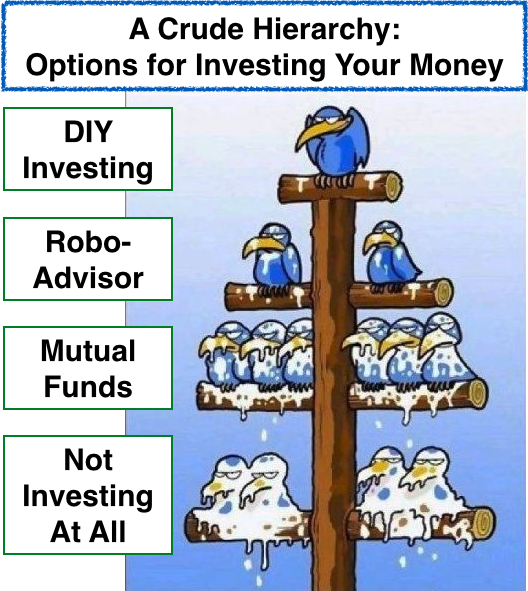

When it comes to options for investing your money, my view is that it stacks up like this:

The good: DIY investing.

The bad: investing your money with a robo-advisor — get the same returns as DIY investing, but pay fees of 0.25% – 0.4% per year.

The ugly: investing your money in an actively-managed mutual fund — get the same returns, but pay fees of 1% – 2% per year.

The worst: not investing at all — earning zero returns on your money.

Terminate Your Robo-Advisor; Pad Your Wallet

Robo-advisors have been wildly successful and appear to have many years of strong growth ahead of them.

They’ve done a great job in offering an alternative to actively-managed mutual funds, and have helped people to start investing with a consumer-first focus and easy to use platforms.

That being said, using a robo-advisor will cost you tens of thousands of dollars (at a minimum) in the long run. I don’t know about you, but I’d rather keep that money in my pocket and make my exit from the rat race many years sooner.

If you’re up for it, DIY investing will get you the same returns, without the fees. It’ll take a few hours of work each year, but you’ll end up wiser and richer.

Say “hasta la vista, baby” to robo-advsior fees, once and for all.

—

Header image credit: Keni Thomas

Loved this article. Great read!

Thank you Cindy, glad you enjoyed it!

I think it’s also important to consider the impact of taxes on your portfolio, especially considering the benefits some robo-advisors offer in helping create tax-coordinated portfolios. Chances are a DIY investor will not be well-versed in the best strategies to reduce taxes, which can have significant impacts on potential returns as well. Betterment, for example, offers tax-loss harvesting as a part of its fee structure, and while I don’t know how effective their strategy is in protecting an investor from unnecessary taxes, it is something most DIY investors would not have access to.

I enjoyed this article. Definitely important to consider the higher fees of robo-advisors.

Thanks Daniel. Good point about tax-loss harvesting. It will be interesting to see if robos like Betterment can actually generate better post-tax returns for you through these strategies. Time will tell.

Also, DIY investors can make the effort to do tax-loss harvesting themselves. See the whitepaper contained here:

https://canadiancouchpotato.com/2013/10/21/tax-loss-selling-with-canadian-etfs/

do you care to share your spreadsheet for this?

Here you go!

https://drive.google.com/drive/u/0/folders/1XKofK0H3WkpGHI-ySm1YC12Qfc14wbxs

great site with exactly the info and tools that I m looking for as someone new to Canada

Happy to hear it! Thanks for letting me know Johnny.

Great article! I am a DIY Investor and tried doing Tax Loss Harvesting (TLH). To be fair to Robo advisors, the time needed to do TLH (assuming done twice a year) will add about 4 more hours of efforts per year (to make sure you don’t run into Superficial loss you will need to look across all of your accounts and your spouse/partner’s account, take bid/ask spread into consideration, etc.) so return on efforts won’t be 200 $/hour but 142.98 $/hour, still not bad.

Also, note that TLH is not a magic wand that helps reduce/eliminate taxes on Capital gains, it is a tax deferral strategy so eventually you do pay taxes, hopefully in retirement when your marginal tax rate would be much lower.

Roboaviors claim to be able to do TLH throughout the year, whenever the opportunity arises as it is automated using the software. Not sure how much it adds to the portfolio over a long time due to tax deferral. Would love to see some studies being published.

In the end, I decided not to do TLH due to the efforts needed. Looking for a tool that can help with it taking into points I have mentioned above regarding bid/ask spread, avoid running into superficial loss, etc.)

Hi PPan,

Thanks for your comment. Indeed, tax loss harvesting is not for the faint of heart! I will admit that I don’t do any tax loss harvesting in my own portfolio. Agreed with you that it would be great to read through some studies about the net value created by TLH for the average buy and hold investor.

At some point I’ll try to educate myself on the intricacies of it… if I do, I’ll try to create such a tool!

Hi! Great article Indeed. I’m quite new yo every single concept. Do DIY and robo investments apply only for Canada or is it possible to invest from south america aswel?

Could you bring some light about it or even provide some articles? Btw i’m from Bolivia

Thanks!!

Hi Gustavo,

Unfortunately I don’t know much about investing from South America or Bolivia in particular.

You could try looking into opening an account with a brokerage such as Interactive Brokers. If you’re able to do that, you should be able to do DIY investing on their platform — i.e., buying passive index funds / ETFs that track broad market indexes like the S&P 500.

Good luck!

Thanks for the reply! I’ll look into it.

Do you have any write up on DIY TLH? Just came across your blog and love it!

Hi Juniper,

Unfortunately I haven’t written about Tax Loss Harvesting, but I’m sure you can find some good guides on that elsewhere 🙂