If you want to accelerate your progress towards your financial goals, reducing your expenses is the best place to start. The amount that you spend is fully within your control. Implement a change in your lifestyle and you’ll see the results immediately.

I think it’s well worth it for everyone to make an honest assessment of their spending habits. I’d wager that most people are spending money on things that don’t improve their quality of life.

Cutting back on your expenses (even just for a few months) can bring about some major benefits:

- You’ll be able to find out what things and experiences are truly important to you. You might find that you don’t even notice it when you cut something out of your life

- When you find out what things really are important to you, you’ll have a greater appreciation for those things when you start to spend on them again. It’s awfully easy to settle into a rhythm and start to take things for granted

- By making a shift to live more frugally for a period of time, you’ll reset your habits and defaults. This can have a long term impact on your spending habits

Down below, we’ll look at the major expense categories for most people (home, transportation, food) and discuss how you can reduce those expenses.

Downsize Your Home

Ask yourself: does the home that I live in right now really need to be this big?

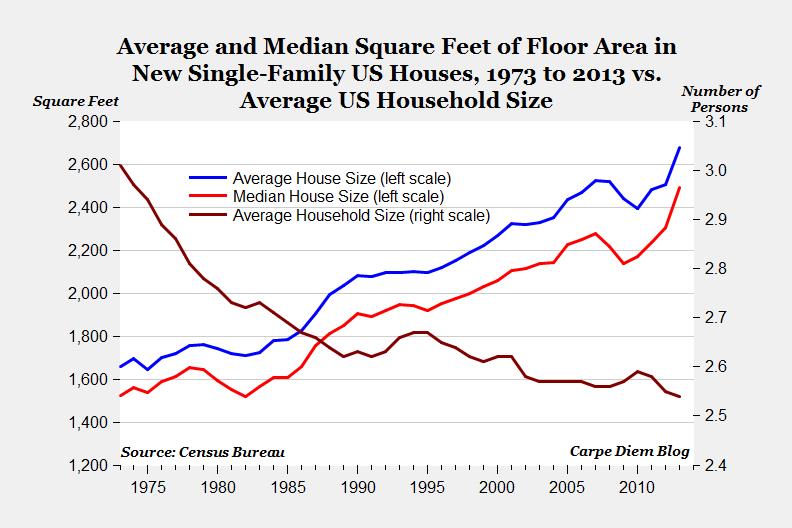

Society’s perception of a “normal” house size has shifted considerably in the past few decades. From 1973 to 2013, the average size of a new single-family house in the US has increased from ~1,600 square feet to ~2,600 square feet.

This huge increase has come at the same time as the average number of people in each household has decreased from ~3 to ~2.5 per home.

If you choose to live in a large home, just remember that you’ve made a deliberate choice to live in such a way, and that your choice has a price tag on it.

Lose the Car

Cut back to one car, or no cars if possible. If you can manage it, biking to work is great way to reduce expenses, stay fit, and protect the environment — all in one stroke.

Taking public transit is another great option. Bring your favourite music and/or podcast along for the ride, and forget the stress of having to navigate through rush hour traffic.

Use a trial period to see if you’re willing to make this lifestyle change. Switch out your car commute for a bike / public transit commute for a few weeks, and see how you feel.

At worst, you’ll save on gas costs for a bit, and you’ll have given the alternatives a fair shake.

Meal prepping

Meal prepping (making a large batch of food in one sitting) is a great way to reduce your spending on eating out at restaurants.

It took some time getting used to it, but it’s now part of my regular routine to make 6-10 meal portions on Sunday night. It’s become extremely rare for me to buy lunch at work. A couple of great resources for meal prepping:

- Budget Bytes: Delicious recipes at low cost. Each recipe includes cost per serving estimate. My personal favourite is the rosemary garlic beef stew recipe @ $1.41 per serving

- Reddit Meal Prep Sunday community: A seemingly limitless supply of meal recipes that are easy to cook in large batches (and tasty!). A great intro to the world of “meal prepping”

Before You Make a Big Purchase

Before you make a big purchase (new TV, car, couch, clothing, etc.), force yourself to wait for 2 or 3 days before you go ahead and actually buy it. You might be really excited in the moment at the store, but find that you don’t actually want that thing once you’ve had the chance to sleep on it.

This will help to limit impulse purchases that you’ll regret down the road. Take some time to think about if that thing will make you happy, if a cheaper option would also tick the boxes you’re looking for, and if you think you’ll get good use of that thing.

Then ask yourself: do I actually want to buy this, or am I tempted to do so because everyone else is doing it (friends, colleagues, family, etc.)?

Remember that most people are terrible with their money. The average person lives paycheck to paycheck, doesn’t have an emergency fund, is entirely reliant on their job, and doesn’t have any real plan to meet their future financial goals. Don’t spend like everyone else.

Finally, is there any way of buying this second hand? If you do some searching around online (Craigslist, Kijiji, Facebook Marketplace) and in your local thrift store you can often find some great secondhand deals on:

- Home goods (tables, chairs, lamps, dressers)

- Clothing (lots of like-new clothing, high quality vintage items, or expensive brands at cheap prices)

- Stereos and sound systems

- Used bikes (lightly used at less than 50% of the price of a new bike)

- Books and records

- Lots and lots more

Hobbies, Activities, & Entertainment

Finding a hobby that you look forward to doing everyday is something I’d encourage everyone to do. Carve out some time during the week or weekend to try new things, pick up new skills, or learn about something that interests you. You just might find a passion that you can carry forward for the rest of your life.

What follows is an entirely non-exhaustive list of activities that are fun and frugal…

It is free to:

- Take out books, music, and even DVDs from the local library. Free access to limitless sources of knowledge, and/or just a great way to pass the time. It is well worth it to be acquainted with your local library branch

- Visit a nearby park. Stroll around, take a few deep breaths of fresh air, and soak up the sounds of nature

- Attend events hosted by your city. Most cities put on free activities such as festivals, concerts, walking tours, yoga in the park, etc.

With low start-up and ongoing costs, you can:

- Learn piano, guitar, or your instrument of choice. It’s hard to match the rewarding feeling of improving each and every day on your own accord. Lots of fun to be had in performing for others as well

- Purchase a used bike, and embark on adventures exploring your own city and thereabouts

- Pick up a chess board and a few beginner’s books. Chess is a personal favourite hobby of mine. You can spend decades learning and honing your skills, and still get beat by a 12 year old Russian kid 🙂

- Learn to cook tasty, healthy, and affordable meals. It may seem daunting at first, but cooking can become a really fun activity that is rewarding and frugal. Hosting your friends for meals & potlucks is another upside

—

Source for average house size data: AEI.org

Comment Section

Be the first to write a comment.