November 3rd, 2018 | Posted in Tools

To Grad School or Not To Grad School? That is the Question…

It’s a familiar scene for many: after a few years on the job, you start to get an itch for a change.

Is this it? This is what I’ll do for the rest of my career? Shouldn’t I branch out and go after something new / more exciting / higher paying, etc?

If this rings a bell, the idea of going back to school has probably popped into your mind.

Heading back to school to study something new, or to level-up in your current field, is a tried and true path. Doing so can lead to promotions, a road to upper management, or access to opportunities that simply would’ve been out of your grasp otherwise.

However — between sky high (and rising) tuition costs, taking time off work, and interest owed on student loans, going back to school imposes quite the hefty financial burden.

So… will a master’s, PhD, or certification in an up-and-coming field pay off for you? More simply put, is grad school worth it? Well, to help you get to the bottom of it, this article covers:

- The financial upsides and downsides of the decision, and an interactive grad school calculator that’ll crunch the numbers for you

- A case study showcasing how the grad school calculator works, and the answers that it gives

- Discussion on the “intangible” aspects of the decision, and why you shouldn’t make your choice purely based on what the math shows

Onward.

The Puts and Takes

The financial upside of going back to school is straightforward — you’re banking that your salary after graduation will be higher than your current salary, and that in the long-run you’ll have boosted your earning power.

However, to make a sound decision, we need to keep in mind the financial downsides of going back to school as well. These downsides are a bit more nuanced:

- The direct costs of schooling — tuition costs and living expenses during school (rent, ramen, ramen…)

- Foregone income while you’re back in school; i.e., the money that you would’ve saved from your job if you hadn’t gone back to school

- Compound interest: if you borrow money to pay for school, you’ll pay interest on the debt; if you use your savings to pay for school, you’re losing out on the investment gains that you would have otherwise earned

Getting an accurate answer on the back-to-school-or-not question requires an analysis of all of these upside and downside factors.

The grad school calculator below will help you to crunch the numbers for your specific scenario. Rest easy — no trigonometry required on your part…

The Grad School Calculator

Start by filling in your assumptions in the fields below. Note that the fields highlighted in yellow don’t need to be filled in — these implied figures will be calculated automatically for you based on the assumptions that you input.

Then, scroll down further to see the results for your scenario visualized in a chart comparing your net worth in the baseline scenario versus the scenario where you go back to school.

Your net worth in the baseline scenario is driven by your current amount of savings, how much you save each year (after-tax income minus living expenses), and your expected investment return.

The back to school scenario takes into consideration all the same factors as above, but also layers on your student loan balance and the interest you’ll pay on the loan.

You can also click the “+ Advanced Options” button to create a more granular income forecast by modelling in future changes in your income.

You’ll find some guidance & tips on the assumptions in the next section.

| Income & Expense Assumptions | Baseline Scenario | Back to School Scenario (Post-Graduation) |

|---|---|---|

| After-tax income (monthly $) | ||

| Living expenses (monthly $) |

| Savings Assumptions | |

|---|---|

| Current amount of savings ($) | |

| Expected investment return (% per year, in real dollars) | |

| Cost of School Assumptions | |

|---|---|

| # of years of schooling | |

| Tuition cost (annual $) | |

| Living expenses during schooling (monthly $) | |

| Implied total cost of schooling: | |

| Schooling cost paid with savings ($) | |

| Implied student loan balance ($) | |

| Student loan interest rate (% per year) | |

| # of years to pay back student loan | |

| Implied loan payment (monthly $) | |

You can use the inputs below to generate a more realistic income forecast. Enter in up to 2 promotions for the baseline and/or back-to-school scenarios.

Any promotions where the “# of years” field is set to zero will be disregarded.

While these have been labelled as “promotions”, you can also make the assumption that your income decreases over time.

| Promotion Assumptions | Baseline Scenario | Back to School Scenario (Post-Graduation) |

|---|---|---|

| Promotion #1 | ||

| Years from today / years from graduation | ||

| New total after-tax income (monthly $) | ||

| Promotion #2 | ||

| Years from today / years from graduation | ||

| New total after-tax income (monthly $) | ||

Some Notes on Using the Grad School Calculator

A few things to keep in mind when using the grad school calculator above.

After-tax salary: You’re meant to input your after-tax salary into the calculator. To convert a pre-tax salary into an after-tax figure, you can use these tools to get a quick and easy estimate.

Most other grad school calculators out there focus only on the change in your income before taxes. If you ignore taxes, you will over-estimate the benefits of going back to school. If and when you get a raise, the government will come looking for their share — e.g., when you get a $5,000 raise, you don’t actually get an extra $5,000 in your pocket at the end of the year.

Cost of schooling: If your tuition costs / living costs during school will be partially paid for without using your own savings or without taking on student loans (for example: scholarships, working part-time during school, reimbursement from your employer, or your parents helping out), reduce your schooling cost assumptions accordingly.

Living expenses: I recommend that you use the same assumption for living expenses in the baseline scenario and in the back-to-school scenario after graduation. This will ensure an apples-to-apples comparison. However, the grad school calculator does allow you to input a different value for the two scenarios in case your new job would result in unavoidable changes to your lifestyle (e.g., moving to a new city, needing to get a car, having to spend more on clothing).

Expected investment returns: I’d recommend using an assumption in the 4% to 8% range, based on the historical long-term returns of the U.S. stock market.

Tuition tax credits: This calculator doesn’t take into account any tuition tax credits that you might get in the back-to-school scenario. If you want to model in an approximation of those tax credits, you could calculate the value of the credits, and then reduce the cost of schooling by that amount. Not a perfect solution, but decent enough.

A Case Study

Let’s walk through an example of how the grad school calculator works. Rather than just pulling all the figures from thin air, we’ll start with some data from Georgetown University’s study on the economic value of college majors.

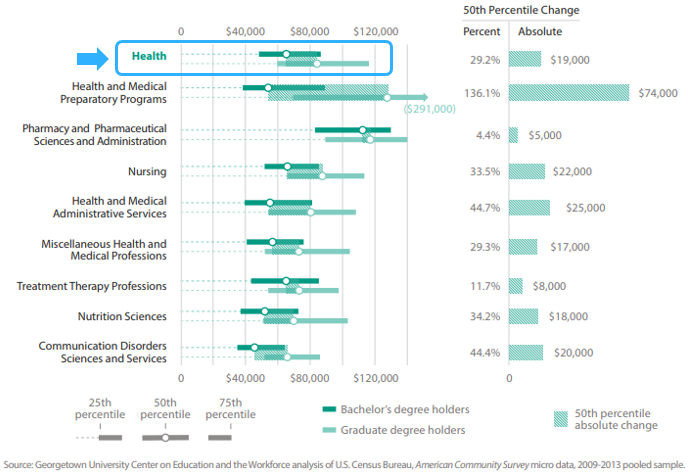

Starting on page 184, salary data is shown for people with bachelor’s degrees versus those with graduate degrees. There are pages breaking down the figures for broad job categories (healthcare, education, engineering, business, so on and so forth), and even micro categories within those big groups. Plenty of good data to geek out on…

Here, we’ll look at a healthcare sector employee who’s thinking through whether they should go to grad school or not.

The top two bars on this chart show the range in annual salary for people working in the health sector as a whole.

- The dark green bar shows people with bachelor’s degrees — the median salary is ~$64,000 per year

- Directly below that, the light green bar shows the income for those with graduate degrees — here, the median salary is ~$83,000 per year. This implies a difference of $19,000 per year (in pre-tax salary) for those with a graduate degree compared to those with only a bachelor’s degree

Using the Smart Asset paycheck calculator (same as linked above), I’ve calculated the net pay of these two scenarios based on pre-tax annual salaries of $64,000 and $83,000. In the baseline scenario, this gives $3,795 per month of net pay, versus $4,744 per month in the grad school scenario.

Time to run the math using the grad school calculator above.

I’ve also used the following assumptions:

- Living expenses of $2,500 per month for both scenarios

- 5% annual expected returns on savings

- 2 years of schooling

- Tuition of $20,000 per year, and living expenses of $2,500 per month during school — this implies a total cost of schooling of $100,000 combined over the two years of school

- The entire $100,000 cost of school is financed through student loans, at an interest rate of 6%; I assume that the student loan is paid back over 15 years

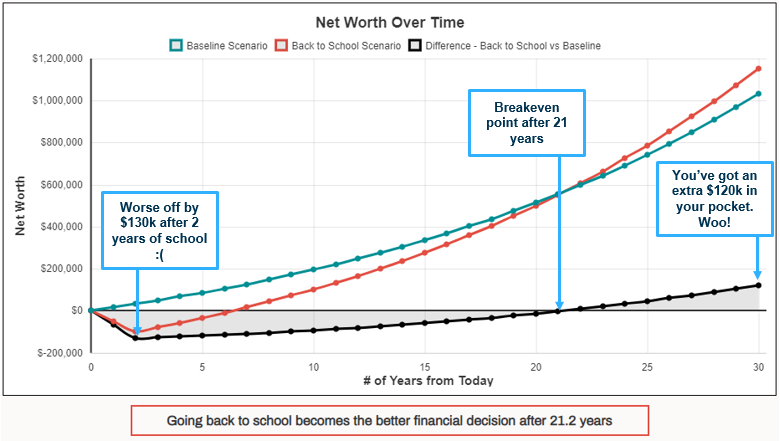

After inputting all of this, where do we end up?

- After 2 years, going back to school would mean that you’re worse off by ~$130k compared to the baseline scenario; this is because you’ve spent $100k to go to school for two years, and because you’ve taken two years off of work, meaning that you weren’t able to save up any extra money during that time

- At the 21 year mark, the two scenarios will break even. Your net worth in the baseline scenario would be equal to your net worth in the back-to-school scenario. Your increased salary has allowed you to build up enough savings to catch up with the baseline scenario

- 30 years down the road, the back-to-school scenario will be better off by ~$120k compared to the baseline scenario

All things considered, not an overly fantastic result.

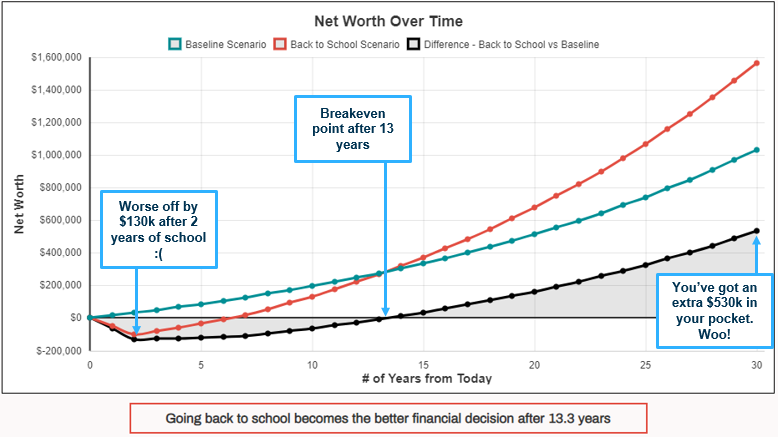

Let’s tweak this a bit. What if you think that going back to school will not only bump up your initial salary, but that it’ll also help you get a promotion that you wouldn’t otherwise receive?

By opening up the “Advanced Options” button, we can model that out.

Let’s assume that going back to school means that you’ll be able to get a pay bump from $83k to $100k per year after 5 years of working ($5,574 per month after taxes).

So… what now?

The results look much better!

- You’ll breakeven in ~13 years (instead of ~21 years without the promotion)

- At the end of 30 years, you’d be better off by ~$530k in the back to school scenario compared to the baseline scenario (versus ~$120k without the promotion)

If you’d like to see / tweak the scenarios described above, you can use these links which have the assumptions pre-filled for the simple first example, and also for the more detailed second example including the future pay bump. Just scroll back down to the grad school calculator section of the page.

All that being said, your scenario is unique and you’ll need to run the numbers with assumptions fit for your specific case.

Take a look around on sites like Glassdoor or Payscale, or in the Georgetown University report linked above to get a sense of how your salary might increase after going to grad school. Find out how much your target school’s tuition will set you back. Do some research on student loan interest rates. Get smart on the assumptions.

I’d recommend toying around with different scenarios in the tool to get a sense of how the answer changes based on different assumptions. How much of an income increase would you need to break even in 5, 10, or 15 years? If you go to a cheaper school or get a scholarship to offset some of the cost, how does this impact the outcome?

The Intangibles

While it’s all fine and dandy to crunch the numbers to see whether going to grad school will make you wealthier in the long-run, dollars and cents don’t tell the whole story.

To get the full picture, you’ll also need to take into consideration the “intangibles” of this decision (a.k.a. everything that can’t be quantified).

Let’s assume that you’ve run the numbers and the result comes back that you’d break even after 10 years. This means that after 10 years, you’d be in exactly the same financial position regardless of whether you chose to continue working at your current job, or to go back to school.

Ask yourself:

- Which scenario maximizes my happiness? 10 years is a long time — would I be more engaged on a day to day basis in one of these paths?

- What are the other trade-offs that I’d be making? Does a change in my career mean working longer hours, moving to a new city (which could be a positive or negative), or impact my life in some other way?

What the math says is one thing. How this decision affects your overall lifestyle is another question entirely.

Perhaps going to grad school won’t give you much of a pay raise. However, would it increase your quality of life by letting you work in a job that fits with your personal values? If so, you may want to make the switch anyways.

Maybe by going back to school and switching careers, you’ll become far wealthier in the long-run. But, if this change also imposes negative side effects on the rest of your life (added stress, less time to spend with family and friends), perhaps this isn’t a trade you want to make.

Do the math, but keep the human side of the equation in mind too.

Conclusion

Going back to school is a big decision which will impact your career path, financial health, and overall lifestyle.

Before diving in, you should pick your head up and survey the pros and cons:

- What kind of salary increase can I reasonably expect to get?

- How much will it cost to go back to school (tuition, foregone income, opportunity costs, interest on student loans)?

- Run the numbers — how many years will it take for this to pay off?

- Aside from what the grad school calculator math tells you, what other lifestyle trade-offs does this decision come with?

Whether you decide to stick with the status quo, or to head back to campus with your mind open and your pencil sharp, you’ll be confident that you’ve made the choice that maximizes your long-term wealth and happiness.

Now, I’d love to hear from you: are you considering taking time off work to go back to school (or did you already make the jump)? What do the numbers say — will you be better off after 5, 10, 15+ years? What lifestyle considerations or other trade-offs did you consider? Let me know in the comment section below.

P.S. — For my fellow excel junkies, follow this link to grab a copy of the grad school calculator as an excel spreadsheet. Right click on the file, then click download. Don’t open it in Google sheets as the functionality and formatting will be slightly off.

This is very interesting interactive article. I really appreciate your effort for making this post. Thank you!

Hi Chris,

Much appreciated, thanks for letting me know!

How would you implement an option to do a part-time graduate program? Say, you keep your current salary and are working (full time or some % of 40 hr work week), and taking the required classes on a per-credit tuition, perhaps 1 or 2 classes at a time spread out over 2-3 years.

This is a real-life scenario I’m considering, as it would seem to ease cash-flow during the schooling period but still provide the salary (and fulfillment) boost from the degree.

Any thoughts on implementing this in a calculator?

I did this for myself and put in my actual income and expenses over the last few years. I’d say you’re pretty spot on with estimates. Great work as always.

Cheers, thanks Codcom!

Would it be possible to do a staying in the military vs going to grad school calculator?

With military our pay is foretasted with time in service promotions. But how would you calculate healthcare/retirement/ and other intangibles.

Currently 10 years in and considering leaving to attend business school.

I was pulling my hair out and knew someone else must have already figured it all out. It was you. 🙂 Thank you for sharing this tool with those of us buying graph paper and trying to remember linear functions. You really have made a big difference in my decision making. Thank you.

[…] This calculator by Measure of a Plan, which gives you outputs based on your estimates. […]

The purpose of this plan is for a sponsored back to school plan by smart asset of my own ? I appreciate this proposal but my different views on the increased intangible values that I “earned” from real life obstacles and challenges as application with persuasive solutions may have different projection from yours.

I am not against smart asset as a rewarding investment however as macroeconomic issues are concerned , this new asset requires a system tuning to become more responsible asset.

As shared in many posts earlier, easy money with shared wealth scheme means increase of value without productive activity, hence things get more expensive because excessive trading currency in the market in both centralized and decentralized supply chain that exhausts the product with faster consumption hence price increases.

Now you need to solve this issue, with my free findings already supplied with my own resources.

Good luck 🙂

Smart asset is part of innovation which should deserve opportunity and environment to test, any adjustment is normal for new things, I acknowledge that you have been trying to improve CTR of the Ad tech performance to justify the reasonable consumption of marketing and advertisement for greater return to advertisers

And it’s also a fact that shared technology gives many people ability to make similar products with similar function but only different brands, and compete via advertising and pricing for market share penetration. Healthy competition is good but this practice has forced a price sensitive environment under perfect economic model. The cost of marketing and advertisement will eventually absorbed by consumers in order to meet shareholder expectations

For company goes for slim profit margin as earning, insufficient budget allocation for R&D , employee training and other “highly skilled value add” expense

So what’s missing from your smart asset design ? That eases all mentioned issues above?

Think please, me is not the answer …

Welcome those higher educated talent to join this , I am just a normal degree holder in hospitality industry, so it’s also a good survey for me to evaluate the gain if I choose to advance my education:)

One of the nonfinancial costs of going to grad school are missed opportunities. It took me 8 years to finish a MS/PHD in physics. My fellow Bs degree holders did the following:

1) had babies while they were still fertile

2) started companies

3) worked their way up the job ladder and segued to new companies/new career paths.