The Magic of Compound Interest

Fact: money grows on trees. Well, not quite, but new money does grow on other money.

In this lesson I’ll introduce the marvelous concept of compound interest.

Say we have $1 today, and we’re able to invest our money at annual return of 10% per year. After one year, we’d have $1.10 (+10 cents). After two years, we’d have $1.21 (+11 cents). Notice that in the second year we’d earn 11 cents as opposed to 10. This is due to compound interest — our 10% return is applied to the new total at the end of each year.

This means that our money will grow exponentially. In year 3, we’d earn 12 cents, 13 cents the next, and 15 cents the year after that.

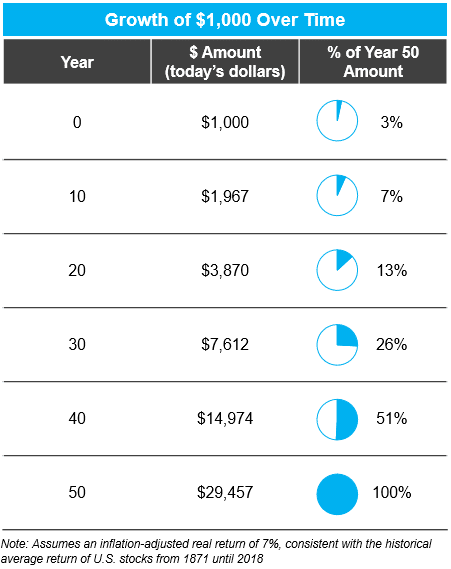

If you look back at the overall U.S. stock market from 1871 to 2018, you’ll find that stocks have generated a real return of roughly 7% per year through that entire time period (real return means that it is adjusted for inflation).

Even with the great depression, the dot-com bubble, and the financial crisis factored into that time period, the trend of the overall stock market has been up and up, growing exponentially.

Returns in any single year can be incredibly volatile — losing 40% of your money or gaining 50%. However, over long enough time periods, stocks have always continued to increase in value.

In the graphic below, you can see how an initial investment of $1,000 would grow over time, using that average 7% return per year.

After 50 years, the initial $1,000 would have become nearly $30,000!

Also notice that the amount of money we have roughly doubles every 10 years. This shows the massive power of compound interest.

Going from a net worth of $1,000 to $2,000 (doubling your money) takes 10 years of compounding.

Going from $500,000 to a million dollars (doubling your money) also takes 10 years.

In the first case, that 10 years of growth buys you a new iPhone. In the second case, you could have fully funded your retirement.

As a side note, you can do quick mental math using the “rule of 72”: if you divide 72 by the annual return rate, that will give you the number of years it would take for your money to double. A 4% annual return doubles every ~18 years, a 6% return doubles in 12 years, and an 8% returns doubles in 9 years.

Build Your Own Money Printing Press

Once you start saving money — even very small amounts, your savings start to create new money through the compounding process.

Then, your new money starts to create new-new money.

And what does that new-new money do? You got it: new-new-new money.

Once you get the ball rolling, you’ll have built your own money printing press.

This goes on and on into infinity.

While you sleep, while you browse the Internet, or while you sip on an umbrella drink on the beach — your money will be working away.

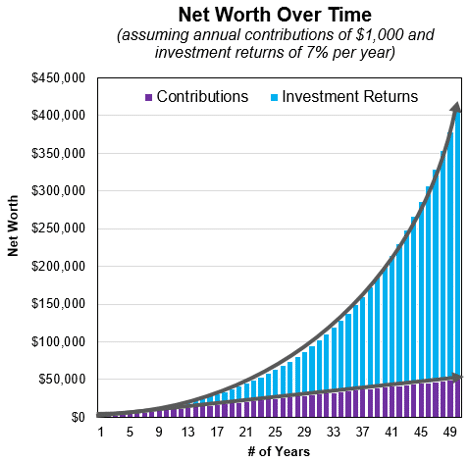

Let’s take an example: Instead of looking at how an initial investment of $1,000 would grow over time, let’s assume that you’re able to save $1,000 each year.

If you can keep that up that for 50 years, and earn a real return of 7% per year on your investments , you’d have a total of over $400,000 at the end of the 50 years.

In the chart above, the purple bars represent your “contributions” — amounts that you yourself saved and added to your investments. Notice how those purple bars grow in a straight line pattern; each year you are adding an additional $1,000 to the pot.

The blue bars show your “investment returns” — the new money that was created from your contributions, thanks to the power of compound interest. Here you can see an exponential growth curve.

By the end of the 50 years, the vast majority of your total net worth comes from investment returns, as opposed to money that you contributed.

After 50 years, you’d have a total net worth of ~$406k. $50k of that money came from you contributions ($1k saved per year for 50 years), while the remaining $356k comes from investment returns. 88% of your net worth has been generated from investment returns!

The Early Bird Gets the Worm

Time heals everything. If you can get time on your side by starting the compounding process early, you can breeze through to your financial goals.

To illustrate how powerful starting early can be, let’s take the example of the Early Bird versus the Late Starter:

- The Early Bird starts to save at age 22 as soon as they graduate from university, and saves $5k per year

- The Late Starter only gets going with saving at age 35, but makes up for lost time by saving $12.5k per year

- Both would like to retire at age 60. By the time they get there, the Early Bird has contributed a total of $190k (38 years x $5k) to their savings, while the Late Starter has contributed $312.5k (25 years x $12.5k)

- Even though the Late Starter has made significantly higher contributions ($122.5k more), they end up with the same net worth as the Early Bird at retirement age (~$680k), assuming returns of 6% per year (inflation-adjusted)

The Early Bird managed to kick off the compound interest process early in their life. As a result, while they contributed much less than the Late Starter throughout their career, they ended up with the same amount of money in the end.

Click here to visualize the Early Bird vs Late Starter example. Try using this interactive tool to sketch out your own projections on how your net worth would grow over time.

Starting earlier means that your money will work harder for you. Starting earlier compensates against having a lower salary or a lower annual savings amount.

What are you waiting for?

Up Next

In the next two lessons we’ll get down into the nitty gritty on exactly how you can start investing your money so that it can work for you while you sleep.

Comment Section

Be the first to write a comment.