July 8th, 2018 | Posted in Data & Insights, Real Estate, Rent vs Buy

San Francisco: the birthplace of denim jeans and the fortune cookie. The home of high-end toast, techno-optimism, and… expensive homes. Today, we’ll take a shot at answering a common concern: is it is a better financial decision to rent or buy in San Francisco?

In the face of soaring real estate prices and sensational media reports, it can be hard to take a calm look at things. Here, I’ve tried to take a data-driven and unbiased survey of the market. I’ve also laid out the steps taken and the assumptions made to arrive at the final answers.

Let’s jump in.

The Methodology

In order for us to assess whether it is more financially desirable to rent or buy in San Francisco, I’ve assembled a group of 16 homes for which we have a recent data point on the price to rent and the price to buy each of the homes.

I started with a group of several hundred homes that were listed for rent on the real estate portals Zillow and Trulia (in late June / early July 2018).

I then cross-referenced this list with home sale price data from the website Redfin.

In many cases, no data was available on the historical sale prices of the home. For others, the data was too old to be useful. I found several homes which were purchased for tens-of-thousands of dollars in the 70’s or 80’s. If only I had a time machine…

By doing this, the initial group of several hundred homes was whittled down to 16 homes that were sold in the past 10 months. The final list is a group of homes for which we have renting and buying prices that are as comparable as possible.

The Homes

Ranging from 2 to 5 bedrooms, 596 to 2,217 square feet, and an original build year of 1900 to 2016, we’ve got quite the diverse group.

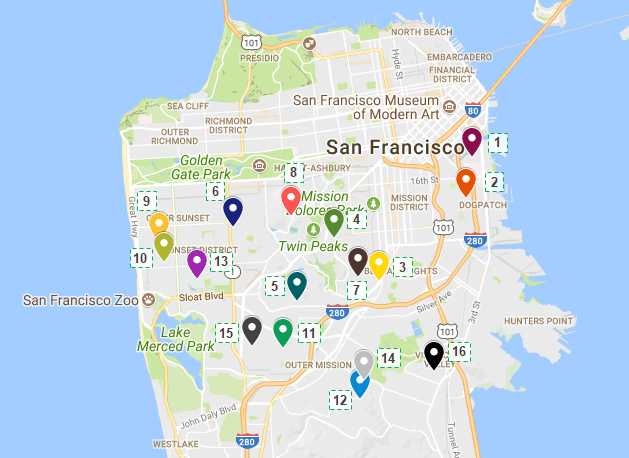

The selected homes are spaced throughout the city. Locations are shown on the map below. The labels 1 through 16 have been ordered by the price of buying the home (#1 being the most expensive).

Let’s get down to it. How much does one of these suckers cost?

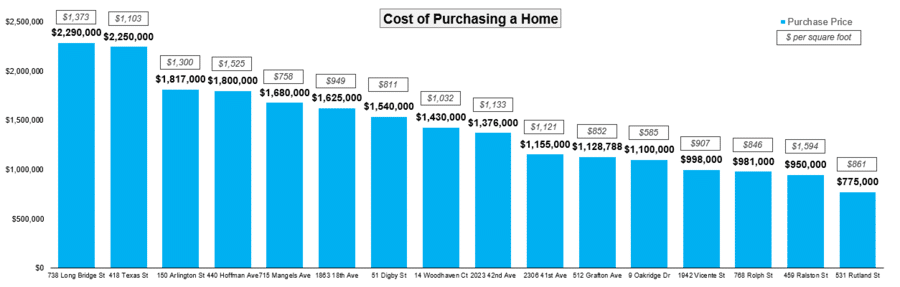

Buying One of These Homes

The homes range in purchase price from $775,000 to $2,290,000 (median value of ~$1.4M). On a $ per square foot basis, we’ve got a price range of $585 per square foot to $1,594 per square foot (median value of $990 per square foot).

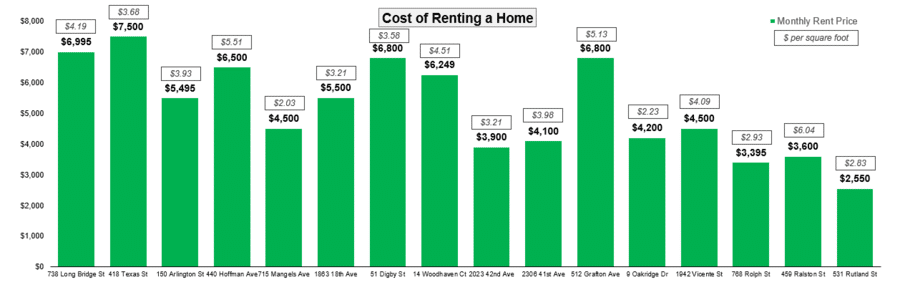

Renting One of These Homes

To rent one of these homes, the price ranges from $2,550 per month to $7,500 per month (median value of $4,998 per month). On a $ per square foot basis, the range goes from $2.03 per square foot to $6.04 per square foot (median value of $3.80 per square foot).

The homes in the chart below are shown in the same order as for the “cost of purchasing a home” chart above.

Price-to-Rent Ratios

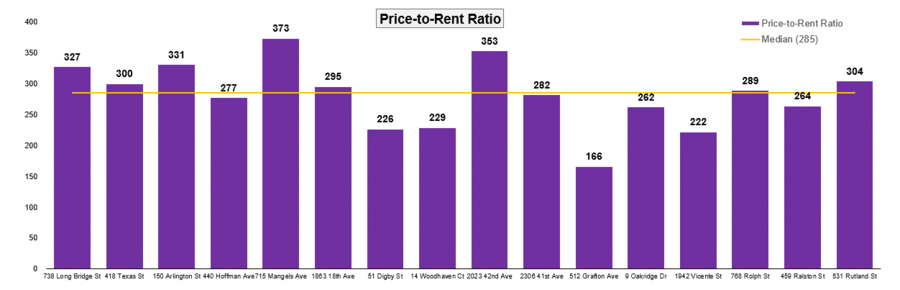

From a price-to-rent ratio perspective, these homes range from 166x to 373x (home price divided by monthly rent), with a median value of 285x.

This means that on average, the price to purchase one of these homes is equivalent to 285 monthly rent payments.

Rent vs Buy Calculations

Time to run the math on renting vs buying.

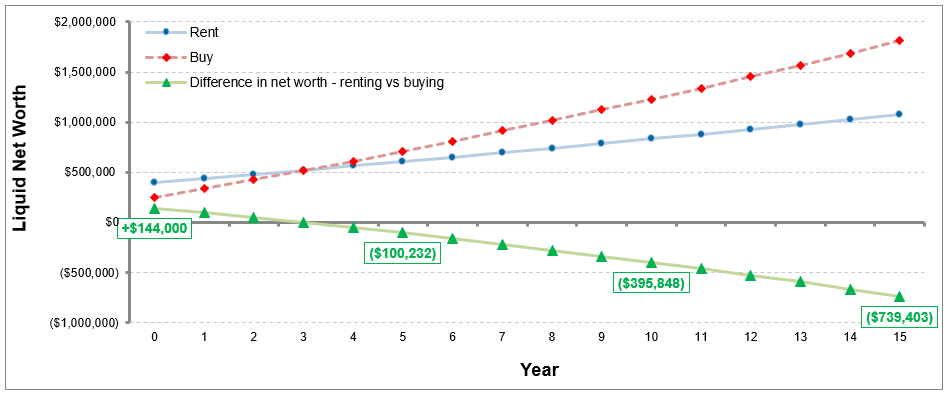

For illustration purposes, we’ll use the example of 440 Hoffman Avenue. The home has 2 bedrooms & 1 bathroom, has a living space of 1,180 square feet, and is situated in the posh Noe Valley neighbourhood.

The home is currently listed for rent at $6,500 per month, and was most recently sold for $1,800,000 in February 2018. This implies a price-to-rent ratio of ~277x.

A few months back, I built a rent versus buy calculator in excel. I’ve used this calculator to crunch the rent vs buy math for this home.

The chart below shows the ‘liquid net worth’ of the rent / buy scenarios at the end of each year, and the difference between the two scenarios. If you buy, your liquid net worth is the money you’d have if you sold your home and paid off the remaining mortgage balance. If you rent, your liquid net worth is the money you’d have if you invested your down payment and closing costs into the market instead.

In this example, during the first 3 years it would be a better financial decision to rent the home. At the ~3 year mark, the rent/buy scenarios are equal from a net worth perspective. After that, the buying scenario is better. After 15 years, the buying scenario would be better than the renting scenario by ~$739k.

Since there are transaction costs to buy a home (legal fees, home inspection, land transfer fees, etc.) and costs involved in selling a home (broker / agent fees, staging, etc.), renting is a better financial decision compared to buying if you live in the home for a short period of time.

As time goes on, those one-time transaction costs are spread out over a longer time period. In most cases, this allows the buying scenario to catch up to the renting scenario at some point. This is mainly due to the rising costs of rent, and the benefits of leverage.

After that break-even point is reached, in most cases the buying scenario remains superior to the renting scenario.

Rent versus Buy Assumptions

The calculator relies on a multitude of assumptions, aside from just the price of buying the home / the price of renting the home.

Key assumptions:

- Home price growth: 3% per year

- Cost of rent growth: 3% per year

- Mortgage interest rate: 4% per year

- Return on investment portfolio (to assess the opportunity cost of the down payment): 5% per year

Other assumptions:

- Down payment: 20% of home price

- Mortgage amortization period: 25 years

- Home purchase transaction costs: 2% of home value

- Home sale transaction costs: 6% of home value

- Marginal tax rate: 40%; assumes joint tax filing

- Property tax cost: 0.7% of home value per year

- Home maintenance cost: 0.5% of home value per year (I’ve often seen a general rule-of-thumb of 1% per year, but feel that this isn’t realistic in a market like San Francisco where home prices are so high relative to home square footage)

- Utilities: $300 per month in both the buying and renting scenarios

- HOA fees: as per the real estate listing from Redfin

- Homeowner’s insurance cost: 0.2% of home value per year

- Renter’s insurance cost: $50 per month

- Inflation rate: 2% per year

The calculator also takes into account the Tax Cuts and Jobs Act of 2017. These new rules limit the mortgage interest deduction to the first $750,000 of mortgage principal, and limit the property tax deduction to $10,000 per year.

The calculator allows you to tweak any of these assumptions and see how the final answers change.

When Is Buying Better than Renting?

Similar to what we saw above, I ran the rent vs buy math for all 16 homes.

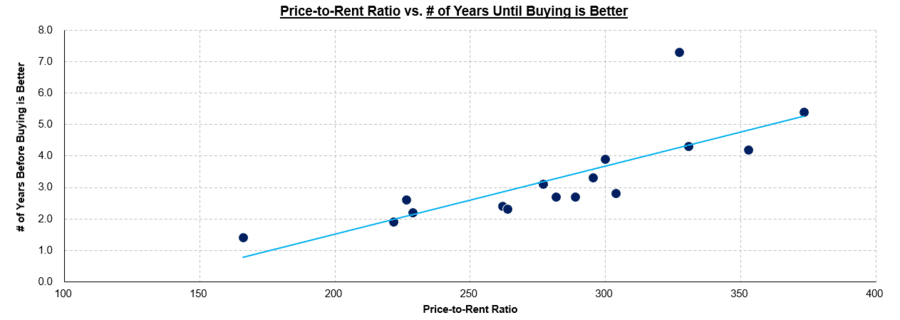

Below, you’ll see the number of years until buying is better shown for each of the homes (each dot in the chart represents one home). The range goes from 1.4 years to 7.3 years (median value of 2.8 years).

I’ve also included the linear trend line implied by these data points. This trend line indicates that a home with a price-to-rent ratio of 200 would break-even at ~1.5 years, whereas a home with a price-to-rent ratio of 300 would break-even at ~3.8 years.

If you sell your home before the break-even time threshold is reached, you would have been financially better off by renting the home, instead of buying. If you continue to own your home past this threshold, buying the home was a better decision.

You’ll notice that as the price-to-rent ratio of a home increases, the ‘number of years until buying is better’ also tends to increase.

While this is not a surprising result, it is important to keep in mind that the price-to-rent ratio is a key factor in determining whether it is better to rent or buy in San Francisco (or anywhere else).

It’s also important to keep in mind that the final answers can change significantly based on small tweaks to the assumptions.

Again, the results above assume that home prices would increase at 3% per year, and rent prices would also increase at 3% per year.

Scenario Analysis

What if we use different assumptions?

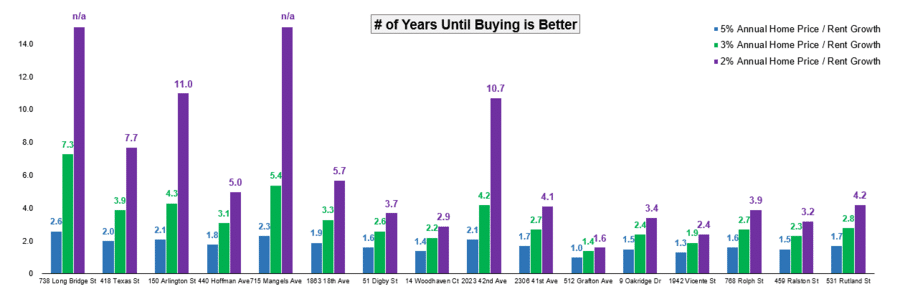

The chart above shows how the number of years until buying is better would change based on an assumption of 5% for home price / rent growth (the blue bars), and also for an assumption of 2% for both home price / rent growth (the purple bars).

If you think that home prices and rents will increase at 5% per year instead of 3%, buying becomes favourable to renting more quickly. It would only take 1 year to 2.6 years before buying is better.

Using a 2% assumption for home price / rent growth, it takes a significantly longer period of time before buying is better than renting. For two of the homes, buying would never become a better financial decision compared to renting (marked by the n/a label in the chart above).

It bears repeating – if home prices do not increase at a fast enough rate, it is possible that buying your home will remain an inferior financial decision compared to renting, even if you stay for 20, 30, or 50 years!

To Rent or Buy in San Francisco?

While the absolute prices of the homes in San Francisco are undoubtedly very high, the price of renting a comparable home is also very high.

So… should you rent or buy in San Francisco?

For most of the homes, my analysis indicates that it would require owning a home for roughly 2 to 4 years before buying would be better than renting. If you’re confident that you’ll continue living in your home for longer than this, it would be reasonable to consider buying.

When I started this analysis, I was expecting that it would take much longer for buying to be a better decision. After double and triple-checking the results, I’ll be honest – I’m still surprised!

I would stress that before making your decision, you should run the numbers on your own.

You will (most likely!) not buy one of the 16 homes profiled here, and you may have a significantly different view than me on the future of the real estate market in San Francisco.

Running the Numbers on Your Scenario

To crunch the numbers on your own scenario, feel free to use my Rent versus Buy Calculator to do so. I’d recommend trying out multiple scenarios to see how the answers change, before landing on something that you feel comfortable with.

It’s also important to keep in mind that the decision to rent or buy your home is mainly a lifestyle decision. In some scenarios, it is the better financial decision to rent. In other scenarios, it’s better to buy.

A Note for Canadian Readers

As an aside, it’s interesting to note that the U.S. tax laws around home ownership are significantly better for homeowners compared to the Canadian rules. Applying Canadian tax rules to these homes would increase the median number of years until buying is better from 2.8 years to 4.9 years.

In the U.S., mortgage interest on up to $750,000 of mortgage principal and property taxes up to $10,000 per year are deductible for income tax purposes. Neither of these expenses are tax-deductible in Canada. One offsetting factor is that Canadians do not pay any capital gains on their primary residences, whereas U.S. taxpayers are only able to shield up to $500,000 of capital gains if filing a joint return, or up to $250,000 of capital gains for an individual return.

All things considered, being a homeowner in the U.S. has big financial benefits compared to being a Canadian homeowner.

Final Thoughts

If you’d like to see the underlying data for the 16 homes used in this analysis and my rent versus buy calculations, you can download the data here.

If you have any questions, please let me know in the comments below or at themeasureofaplan@gmail.com.

What are your experiences with the decision to rent or buy in San Francisco? Too expensive / too crazy of a market to ever consider buying into? Rent prices increase way too fast, making it a no-brainer to buy? Let me know!

For the non-San Franciscans: would you like to see a similar analysis done for the real estate market in your city?

—

Photo credit: Yellow Brick Home

[…] Should you rent or buy in San Francisco? 16 case studies […]