November 12th, 2017 | Posted in Real Estate, Rent vs Buy, Tools

If you want to jump right in to the Rent versus Buy Calculator to test your own assumptions, please download the excel file here

[Mar. 2023 update: version 3.2 of the spreadsheet has been uploaded. Many thanks to Alexander K. and Keith H., kind readers of the site who pointed out the correct way to calculate the tax shield on US mortgage interest payments. The spreadsheet now reflects a comparison between the standard tax deduction and the itemized tax deduction in your scenario.]

The Rent Versus Buy Debate

It is often said that “buying is always better than renting” or that “renting is flushing money down the drain”.

The argument is as follows: When you rent, your rent payments help your landlord pay their mortgage, while making you none the richer. However, when you buy a home, your monthly payments go towards your own mortgage, which increases your net worth.

Seems simple, right? Not so fast.

There are several factors which make this decision more complicated to assess:

- Homeownership comes with many more costs than just your mortgage payment. You’ll also pay fees such as property taxes, home maintenance, and condo fees. It is important to compare the total annual costs to buy or rent a comparable home.

- Transaction fees to buy / sell a home. When you buy a home, you’ll pay for legal fees, home inspection fees, and land transfer taxes. When you sell your home, you’ll pay a real estate agent (typically 4-6% of the total sale price) to find buyers, and negotiate / close the deal. This can add up to tens of thousands of dollars.

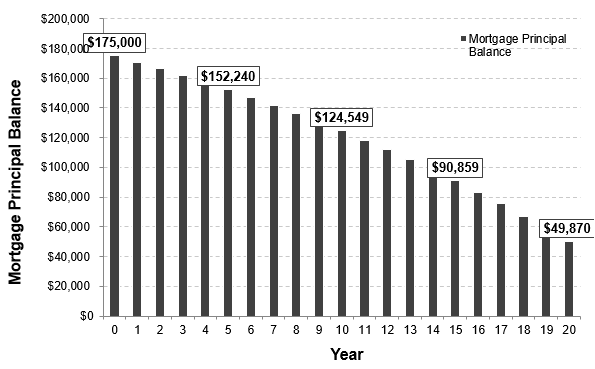

- A mortgage is essentially renting money from the bank. With every mortgage payment you make, a portion will go towards reducing the mortgage ‘principal’, and the remaining portion will go towards interest payments. Any dollar you spend on interest does not build your net worth. As an example, the total interest payments that you’d make on a $175,000 mortgage (over a 25 year term and a 4% interest rate) are over $100,000. This is $100,000 that you’ve paid to the bank to rent their money.

- Opportunity costs. If you choose to rent your home, the money that would have been used for a down payment, plus the money that you would have spent on buying transaction fees, can be invested. Furthermore, if the ongoing total costs of renting your home are lower than the ongoing total costs of buying a comparable home, each year you’ll generate additional savings that can be invested.

This is not to say that renting is always better than buying. All I’m saying is that in some situations, renting will be better from a financial standpoint, and in other situations, buying will be better.

To help you make this important financial decision, I’ve built a “Rent versus Buy Calculator”. This is a tool that takes in assumptions for the renting and buying scenarios, and then spits out answers and outputs (including your net worth over time, the total annual cost of each scenario, sensitivity and breakeven analyses, and more).

First things first, please download the rent versus buy calculator here (actually download the excel file as opposed to ‘opening in Google Sheets’).

How to Use the Rent Versus Buy Calculator

If you are not an expert at excel, don’t worry! I’ve tried to layout the spreadsheet so that you only need to look at one ‘tab’, and that once you enter a few of your own assumptions, the rest will automatically update for you.

- The only tab that you need to use in this spreadsheet is the “Dashboard” tab. All of the other tabs are for your information only, and don’t need to be looked at.

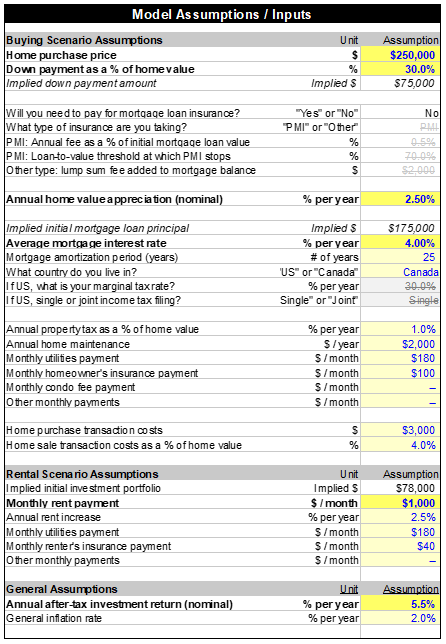

- On the dashboard tab, the only cells that you need to change are those highlighted in yellow. These cells contain the assumptions that the model will use to calculate the renting and buying scenarios. I’ve noted which assumptions are ‘major’, and which assumptions are ‘less important’. See screenshot below, showing the assumptions that you need to enter highlighted in yellow. In this example, I’ve used these major assumptions:

- For the buying scenario: you are considering buying a $250,000 home with a 30% down payment, the home will increase in value by 2.50% per year, and your mortgage interest rate will be 4.00%.

- For the renting scenario: a comparable home rents for $1,000 per month, and your investment portfolio will increase in value by 5.5% per year.

- Once you’ve entered your assumptions, please click the button “Recalculate Model“. This will ensure that all the calculations and outputs are taking into account the latest assumptions that you’ve entered.

- By using the drop down menu under the “Model Output” section of the tab, you can switch between looking at the various outputs (more discussion below on what these outputs are).

- By clicking the “Generate PDF Report” button, the model will generate a PDF report with full set of charts / outputs based on the assumptions you’ve made. This makes for easier reading, can be printed, and is an easy way to save your results (highly suggested!).

- If the model is running slowly or is generally not working, please try the following: (1) close any other excel spreadsheets that you have running, and (2) make sure you are in the “automatic except for data tables” calculation mode (in the excel toolbar: go to file > options > formulas > check the button “automatic except for data tables” in the “calculation options” section)

What Answers Will This Rent Versus Buy Calculator Give?

The rent versus buy calculator generates several charts / outputs based on your assumptions.

These outputs will help you to understand whether renting or buying is better over a specific time period, the total costs for you to either rent or buy your home, and how the answers change based on different assumptions.

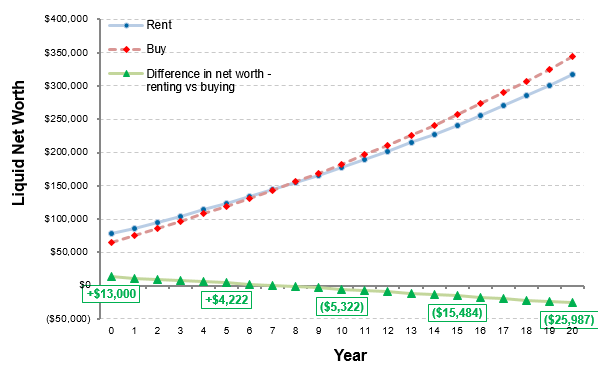

Chart #1: Liquid Net Worth Over Time

Shows how your net worth changes over time in both the renting and buying scenario.

In this example, renting is better than buying at the start, however, buying becomes better after approximately 7.3 years.

To be honest, it’s not necessary to look at any of the other charts.

From this chart you can see whether it is better to rent or buy after a given number of years.

The following charts will give you more detail on both the renting and buying options, and walk you through some “what if?” scenarios.

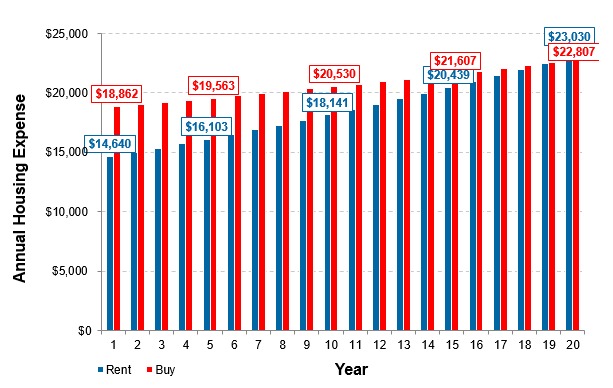

Chart #2: Annual Housing Expense

Shows the total costs of either renting or buying your home, in a given year.

The costs are further broken down in the following charts 3 and 4.

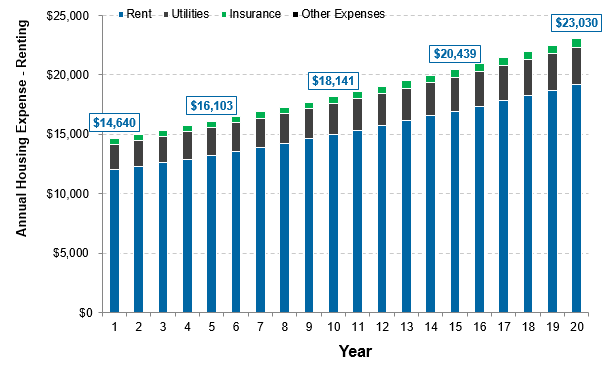

Chart #3: Annual Housing Expense (Renting)

Shows the costs to rent your home in a given year.

This is broken down by rent payment, utilities, insurance, and other expenses.

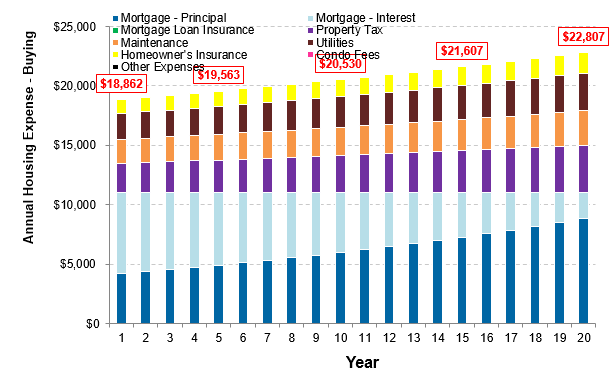

Chart #4: Annual Housing Expense (Buying)

Shows the costs of owning your home in a given year.

This is broken down by mortgage payments (principal and interest), mortgage loan insurance, property tax, maintenance, utilities, insurance, condo fees, and other expenses.

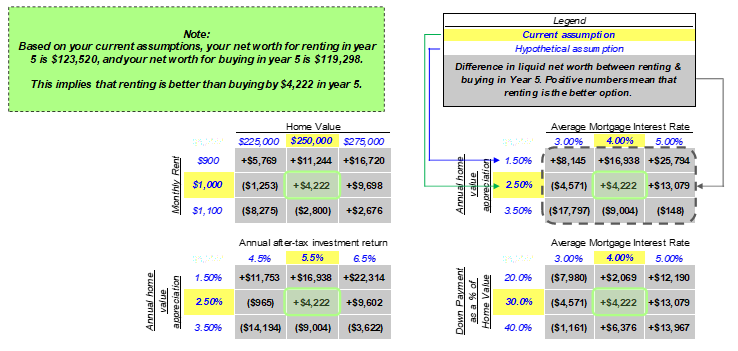

Chart #5: Sensitivity to Key Assumptions

Shows how the difference in net worth between the renting and buying scenario changes based on different assumptions.

In the current example, net worth in the renting scenario is higher by $4,222 relative to the buying scenario in year 5.

If you are able to buy your home for $225,000 instead of the current assumption of $250,000, the buying scenario would be better than the renting scenario by $1,253 in year 5.

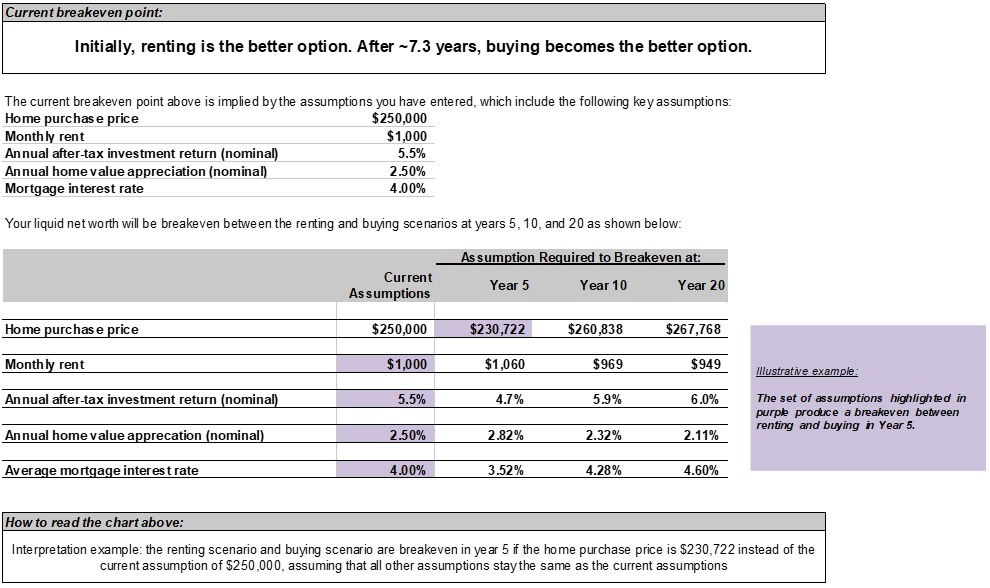

Chart #6: Breakeven Points

Calculates breakeven points between the renting and buying scenarios by changing one assumption at a time.

In the current example, the scenarios breakeven in 7.3 years. If you’d like to breakeven in 5 years instead, the following would have to change:

- The purchase price of your home would have to decrease from $250,000 to $230,722, or

- monthly rent payment would have to increase from $1,000 to $1,060, or

- annual investment return would have to decrease from 5.5% to 4.7%, or

- home value appreciation rate would have to increase from 2.50% to 2.82% per year instead of 2.50%, or

- mortgage interest rate would have to decrease from 4.00% to 3.52%

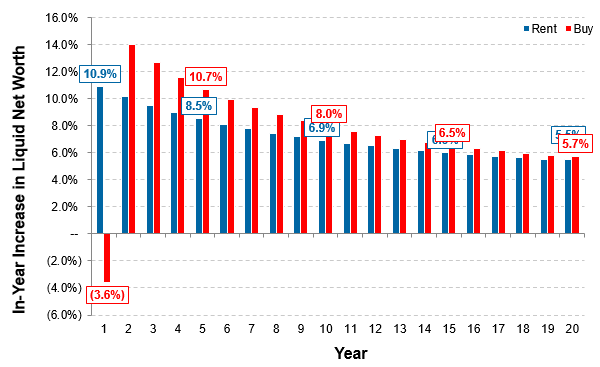

Chart #7: In-Year Increase in Liquid Net Worth

Shows how your net worth increases in each year, in percentage terms.

Note that the year 1 return for the buying scenario tends to be negative given that the one-time costs of buying / selling a home are typically larger than the increase in housing prices plus the mortgage principal paid down over 1 year.

If you sell your home further down the road, the one-time transaction costs are spread over a longer time period.

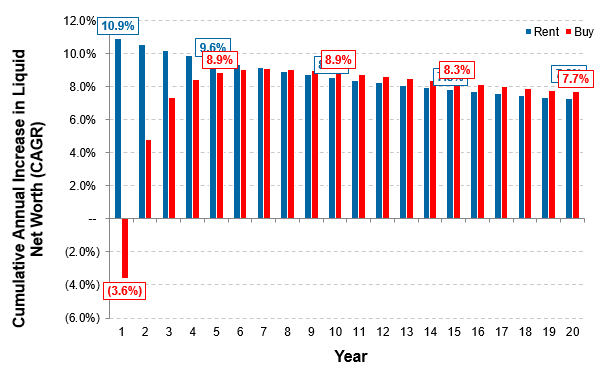

Chart #8: Cumulative Annual Increase in Liquid Net Worth

Shows the average annual increase in your net worth over a given time period (i.e., a Compounded Annual Growth Rate, or CAGR).

In the current example, the renting scenario has an average annual increase in net worth of 9.6% over the first 5 years, while the buying scenario will only have an average annual increase of 8.9%.

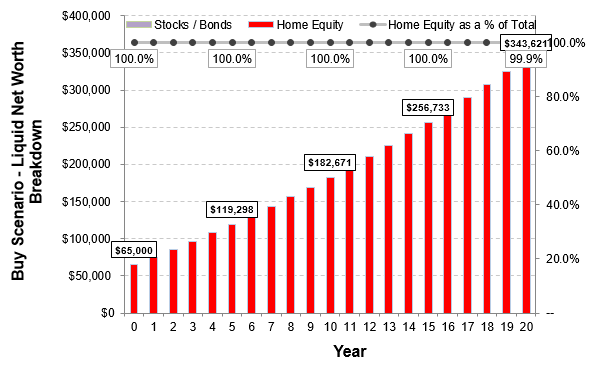

Chart #9: Buy Scenario – Liquid Net Worth Breakdown

Shows the breakdown of your net worth in the buying scenario into two parts: (i) home equity, and (ii) stocks / bonds.

The buying scenario is assumed to accumulate a portfolio of stocks / bonds once the annual costs for buying are lower than the costs to rent.

Try playing around with the model assumptions to make the cost of buying lower (smaller home purchase price, lower mortgage rate, etc.) or the cost of renting higher (higher rent payment, etc.), and you’ll see that the buying scenario begins to accumulate a portfolio of stocks / bonds.

Chart #10: Buy Scenario – Mortgage Principal Balance

Shows how much you owe on your mortgage at the end of any given year.

What’s Next?

Once you’ve acquainted yourself with how the rent versus buy calculator works, and what answers it can give, you can trying playing around with different scenarios and assumptions to see whether renting or buying is a better financial decision for you.

A few things to keep in mind:

- Compare similar homes in the renting and buying scenarios. Try to make sure that you are comparing homes of similar overall quality (location, square footage, age, etc.). You don’t need an excel model to tell you that it would be financially favourable to rent a studio apartment in the suburbs compared to buying a 3-bedroom detached home in a posh neighbourhood.

- This model only accounts for the financial aspects of your decision. There are many non-financial factors that might influence the decision to rent or buy your home. More often than not, there are significant ‘lifestyle’ differences between renting and buying that are not taken into account if we just look at the numbers.

- Test out a range of assumptions before making your decision. The answers that you’ll get from this model will change significantly even with small changes to certain assumptions. In particular, the assumptions that you make for annual investment return and annual home value appreciation will cause the answers to swing quite a bit. With that in mind, I’d suggest trying out a range of assumptions in the model before making your mind up.

And that’s a wrap!

Thank you for taking the time to check out my rent versus buy calculator. I hope that this comes in handy for when you make the decision to either rent or buy your home.

Please let me know if you have any feedback on how to improve this rent versus buy calculator (either through the comments below or by email at themeasureofaplan@gmail.com). My goal is to make updates to this model as time goes on to make sure that it is as easy to use and is as accurate as possible.

—

Header image photo credit: Gary Smith

Wow. Nice calculator. Will it remain online, or is there a way to download it?

Hi Carla,

Thank you! This will definitely remain online.

However, you can use the download links in the post to download your own copy of the calculator in excel. If you save it on your own computer you’ll be able to keep it as long as you’d like. This way, you’ll be able to save the scenarios that you’ve looked at.

[…] News leads the numbers through the online "rent versus purchase calculator" provided by The measure of a plan a Canadian financial planning site. If you assume that house […]

[…] News run the numbers through the online “rent vs. buy calculator” provided by The Measure of a Plan, a Canadian financial planning site. If you assume that home […]

[…] News run the numbers through the online “rent vs. buy calculator” provided by The Measure of a Plan, a Canadian financial planning site. If you assume that home […]

Hi,

The tool looks great! But, I can find the “Recalculate model” there. Could you please let me know where to find that?

Thanks,

Regards,

Gayeth

Hi Gayeth,

See screenshot here: https://imgur.com/a/6wjrAqG

The recalculate model button is in the Model Output section in the top middle, highlighted in yellow.

Thanks!

The issue was with the online version. I’ve downloaded the spreadsheet on my machine and opened it with MS Excel and that fixed the issue.

Thanks again!

Regards,

Gayeth

Great. Glad to hear it is working for you.

Great works and ton of useful information!

Thank you!

You are very welcome! 🙂

Thank you for the tool!!! It looks great!

If I decided that I should buy a house; Is there any similar to calculate if it is better to pay a 20% down-payment instead of a 5%?

Could be a difference between both scenarios? the mortgage rate? the insurance cost? the chance to invest the money saved in a smaller down-payment?

Hey epub,

Thanks for the comment. You can actually perform that analysis in this tool. Set your assumption at 5% down payment instead of 20%, and the tool will automatically calculate the opportunity cost of the money and the change in mortgage payments.

If you will have to pay mortgage insurance in the 5% scenario, there are assumption fields to enter in that cost (e.g., perhaps if you take mortgage insurance, you’ll need to add a lump sum cost of $5,000 to your mortgage). In Canada, the mortgage insurance is called CMHC. In the US, there is PMI and a couple of other insurance programs.

Good luck!

Another great calculator. One thing I would add is transportation. I live in a large city and one of the major differences is rent allows me to use public transit or walk to work (summer) instead of having to pay for a car or 2 if we were to move to the suburbs for a house.

Thanks Div Interest.

As it stands, you can model in these types of impacts in the assumption field for “other monthly payments” in either the rent scenario or the buy scenario. This can be used as a catch-all for anything that hasn’t already been considered.

For example, in the buying scenario you could add a monthly payment of $150 per month in extra transportation costs. This would make the renting scenario look better in comparison.

Hello – this spreadsheet is exactly what i was going to attempt to build. Emphasis on attempt! Love it and thanks for putting in the time. However – i can’t change any data in the highlighted input cells. Editing is enabled as are macros. I can’t even get to “options” it is the whole sheet is locked somehow. Any advice?

Hi Marshall,

Thanks for the comment, and sorry to hear that you’re having an issue.

I just tested it out by following the google drive link, downloading the spreadsheet, and opening in excel. It works OK for me. After clicking “enable editing” and “enable macros” at the top, I can edit all cells.

Which version of excel are you using? Are you on a PC or Mac?

Can you try one more time? If it doesn’t work, please send me an email at themeasureofaplan@gmail.com and perhaps I can try to send you the file directly.

This is a very great tool! Thanks so much! it really answers a whole lot of questions I had and I have a clearer picture.

P.S. Excel wise, your tool just educated me more. 🙂

Thanks Ayo! Happy to hear it, and you are very welcome.

I definitely learned a few new tricks in excel while building this as well.

Hi – Would the tax calculations change due to new 2019 tax laws?

My result is after 4.1 years, buying becomes the better option. However, my confusion is that cell G68 (Dashboard Tab) is still a positive number, indicating my net worth when renting is still higher at the end of year 4. I know it says “end of year” in row 60, but are they in fact the end or the beginning of the year? If I break even early in year 4, cell G68 should show a negative number (higher net worth in buying scenario)?

Love this and all the wonderful posts and resources on your site.

Wondering if you could make a Commercial real estate calculator for leasing VS buying? Much appreciated.

Hi Amy, thanks for the kind words!

I typically try to create tools that can be useful for a wide audience, so unfortunately I don’t think I’ll undertake the project of building a commercial real estate calculator.

Perhaps you could try to re-work / re-label this existing spreadsheet to fit your needs?

This spreadsheet is exactly what I needed. Thanks so much for putting it together.

Hey, Thanks for the amazing calculator and really all of the work you have done putting this whole website together! Just a couple of questions.

1. I’m not really sure where to find an accurate number for the annual home value appreciation (nominal) for where I live (Victoria, BC). Or even how to calculate this if I can pull together something like the average annual price of a comparable dwelling. Let me know your thoughts 🙂

2. Is the model sensitive to situations where either through gifts or incentive programs you are able to access additional money to put towards a downpayment that you would not have access to through normal saving and investing.

Cheers!

Thanks for the great Rent vs Buy spreadsheet. It is very helpful and insightful.

Have you considered also creating a Buy vs Buy spreadsheet? I think it could be very helpful to enable an individual to compare the value of buying one home versus another home. It could also just as easily compare the value of one high financing home purchase approach versus another lower financing + investing approach for the same home purchase.

[…] in the future, you can think through major financial plans or decisions — whether that’s renting versus buying your home, forecasting your retirement age, or just getting a general grip on where your net worth trajectory […]

Thank you very much for putting this together!! How would things change in the case where one takes out money from stock savings to buy a property as all cash and then invests every month the amount that would have been the rent payment back into stocks? Could one use the workbook for that case?

[…] Rent versus buy calculator — a spreadsheet to crunch the numbers on whether renting or buying is the better financial decision […]

Would be great if you could also include the option to select the type of payment for the mortgage. i.e. accelerated bi-weekly vs. bi-weekly vs. monthly etc.

Thanks Ray. I’ll try to add this in a future version of this tool. Cheers.